Question: This is part of a case study two part question After interviewing your client. Matilda, and completing a know your client form, you have determined

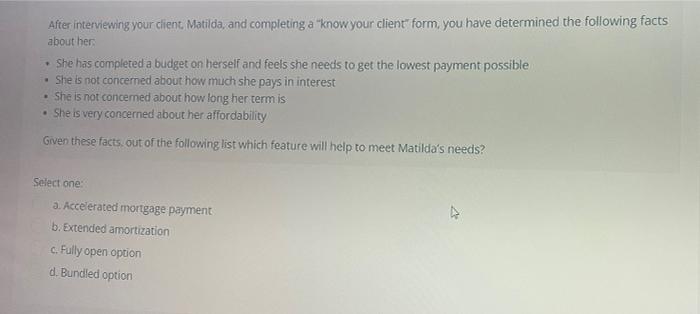

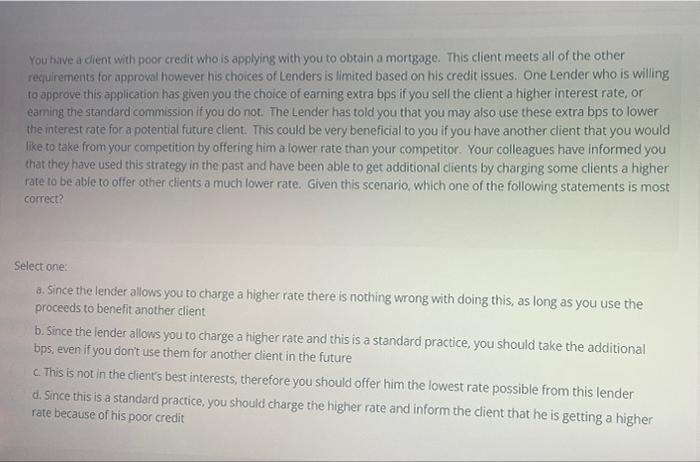

After interviewing your client. Matilda, and completing a "know your client" form, you have determined the following facts about her . She has completed a budget on herself and feels she needs to get the lowest payment possible . She is not concerned about how much she pays in interest . She is not concemed about how long her term is She is very concerned about her affordability Given these facts out of the following list which feature will help to meet Matilda's needs? Select one: 3. Accelerated mortgage payment b. Extended amortization c. Fully open option d. Bundled option You have a client with poor credit who is applying with you to obtain a mortgage. This client meets all of the other requirements for approval however his choices of Lenders is limited based on his credit issues. One Lender who is willing to approve this application has given you the choice of earning extra bps if you sell the client a higher interest rate, or earning the standard commission if you do not. The Lender has told you that you may also use these extra bps to lower the interest rate for a potential future client. This could be very beneficial to you if you have another client that you would like to take from your competition by offering him a lower rate than your competitor. Your colleagues have informed you that they have used this strategy in the past and have been able to get additional clients by charging some clients a higher rate to be able to offer other clients a much lower rate. Given this scenario, which one of the following statements is most correct? Select one: a. Since the lender allows you to charge a higher rate there is nothing wrong with doing this, as long as you use the proceeds to benefit another client b. Since the lender allows you to charge a higher rate and this is a standard practice, you should take the additional bps, even if you don't use them for another client in the future C. This is not in the client's best interests, therefore you should offer him the lowest rate possible from this lender d. Since this is a standard practice, you should charge the higher rate and inform the client that he is getting a higher rate because of his poor credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts