Question: this is part one and part two. I cannot post them seperately. please show me the formula also. I want to be able to solve

this is part one and part two. I cannot post them seperately. please show me the formula also. I want to be able to solve on my own

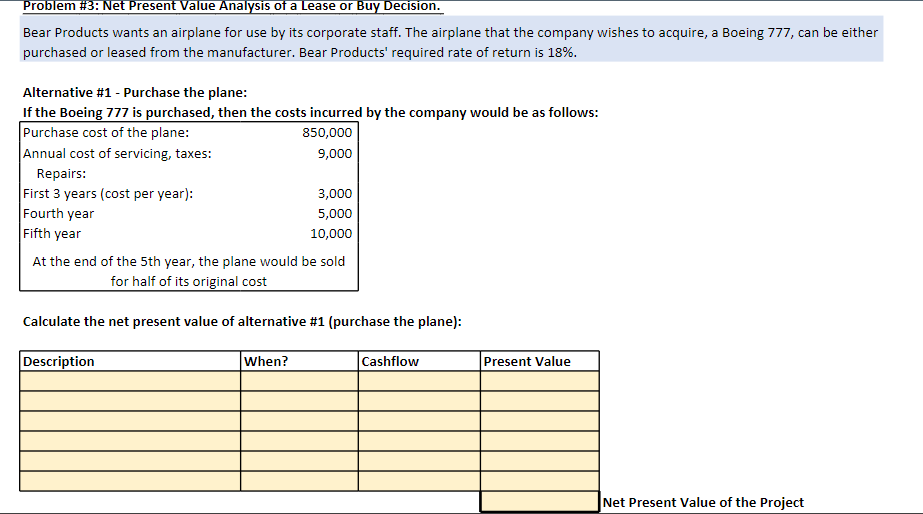

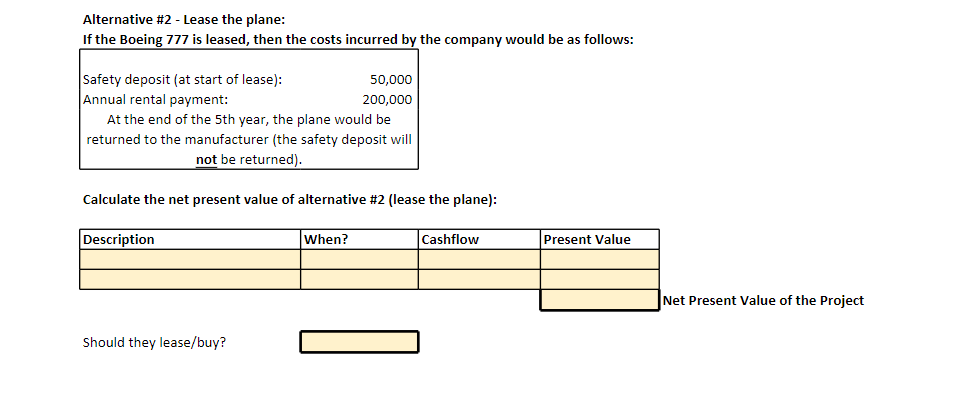

Bear Products wants an airplane for use by its corporate staff. The airplane that the company wishes to acquire, a Boeing 777 , can be either purchased or leased from the manufacturer. Bear Products' required rate of return is 18%. Alternative \#1 - Purchase the plane: If the Boeing 777 is purchased, then the costs incurred by the company would be as follows: Calculate the net present value of alternative \#1 (purchase the plane): Alternative \#2 - Lease the plane: If the Boeing 777 is leased, then the costs incurred by the company would be as follows: Calculate the net present value of alternative \#2 (lease the plane): Should they lease/buy? Bear Products wants an airplane for use by its corporate staff. The airplane that the company wishes to acquire, a Boeing 777 , can be either purchased or leased from the manufacturer. Bear Products' required rate of return is 18%. Alternative \#1 - Purchase the plane: If the Boeing 777 is purchased, then the costs incurred by the company would be as follows: Calculate the net present value of alternative \#1 (purchase the plane): Alternative \#2 - Lease the plane: If the Boeing 777 is leased, then the costs incurred by the company would be as follows: Calculate the net present value of alternative \#2 (lease the plane): Should they lease/buy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts