Question: This is practice and im trying to double check my answers thanks Sample Questions: Chapters 1.2 1. A central bank's pursuit of policies that control

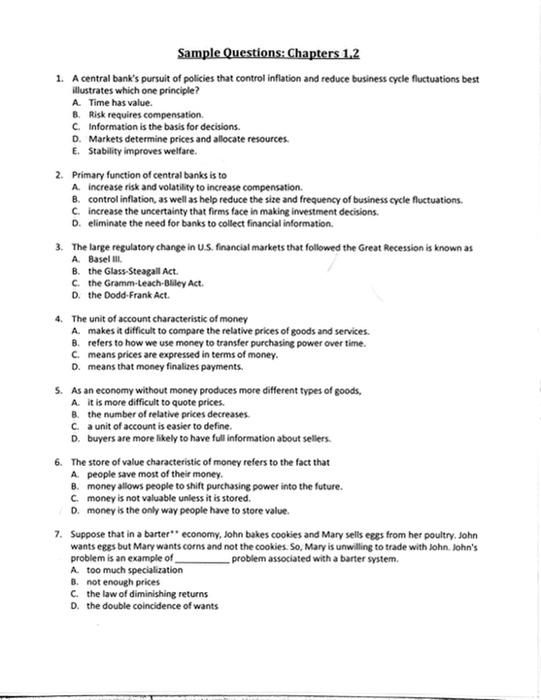

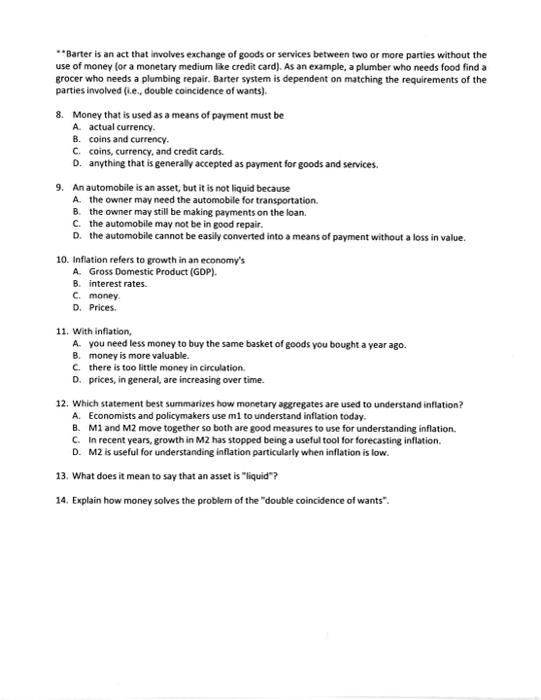

Sample Questions: Chapters 1.2 1. A central bank's pursuit of policies that control inflation and reduce business cycle fluctuations best illustrates which one principle? A. Time has value. B. Risk requires compensation C. Information is the basis for decisions. D. Markets determine prices and allocate resources E. Stability improves welfare. 2. Primary function of central banks is to A increase risk and volatility to increase compensation & control inflation, as well as help reduce the size and frequency of business cycle fluctuations. Cincrease the uncertainty that firms face in making investment decisions. D. eliminate the need for banks to collect financial information, 3. The large regulatory change in US financial markets that followed the Great Recession is known as A Basel III. B. the Glass-Steagall Act the Gramm-Leach-Blley Act. D. the Dodd-Frank Act. 4. The unit of account characteristic of money A makes it difficult to compare the relative prices of goods and services. B. refers to how we use money to transfer purchasing power over time. c means prices are expressed in terms of money. D. means that money finalizes payments. 5. As an economy without money produces more different types of goods, A it is more difficult to quote prices. B. the number of relative prices decreases c. a unit of account is easier to define. D. buyers are more likely to have full information about sellers. 6. The store of value characteristic of money refers to the fact that A. people save most of their money. B. money allows people to shift purchasing power into the future. c. money is not valuable unless it is stored. D. money is the only way people have to store value. 7. Suppose that in a barter" economy, John bakes cookies and Mary sells eggs from her poultry John wants eggs but Mary wants corns and not the cookies. So, Mary is unwilling to trade with John John's problem is an example of problem associated with a barter system. A too much specialization 8. not enough prices c. the law of diminishing returns D. the double coincidence of wants **Barter is an act that involves exchange of goods or services between two or more parties without the use of money for a monetary medium like credit card). As an example, a plumber who needs food find a grocer who needs a plumbing repair. Barter system is dependent on matching the requirements of the parties involved (ie, double coincidence of wants). 8. Money that is used as a means of payment must be A. actual currency B. coins and currency. C coins, currency, and credit cards. D. anything that is generally accepted as payment for goods and services. 9. An automobile is an asset, but it is not liquid because A. the owner may need the automobile for transportation B. the owner may still be making payments on the loan C. the automobile may not be in good repair. D. the automobile cannot be easily converted into a means of payment without a loss in value. 10. Inflation refers to growth in an economy's A. Gross Domestic Product (GDP). B. interest rates. C. money D. Prices 11. With inflation, A you need less money to buy the same basket of goods you bought a year ago B. money is more valuable. c. there is too little money in circulation. D. prices, in general, are increasing over time. 12. Which statement best summarizes how monetary aggregates are used to understand inflation? A. Economists and policymakers use mi to understand inflation today. B. Mi and M2 move together so both are good measures to use for understanding inflation C. In recent years, growth in M2 has stopped being a useful tool for forecasting inflation D. M2 is useful for understanding inflation particularly when inflation is low. 13. What does it mean to say that an asset is "liquid"? 14. Explain how money solves the problem of the double coincidence of wants". Sample Questions: Chapters 1.2 1. A central bank's pursuit of policies that control inflation and reduce business cycle fluctuations best illustrates which one principle? A. Time has value. B. Risk requires compensation C. Information is the basis for decisions. D. Markets determine prices and allocate resources E. Stability improves welfare. 2. Primary function of central banks is to A increase risk and volatility to increase compensation & control inflation, as well as help reduce the size and frequency of business cycle fluctuations. Cincrease the uncertainty that firms face in making investment decisions. D. eliminate the need for banks to collect financial information, 3. The large regulatory change in US financial markets that followed the Great Recession is known as A Basel III. B. the Glass-Steagall Act the Gramm-Leach-Blley Act. D. the Dodd-Frank Act. 4. The unit of account characteristic of money A makes it difficult to compare the relative prices of goods and services. B. refers to how we use money to transfer purchasing power over time. c means prices are expressed in terms of money. D. means that money finalizes payments. 5. As an economy without money produces more different types of goods, A it is more difficult to quote prices. B. the number of relative prices decreases c. a unit of account is easier to define. D. buyers are more likely to have full information about sellers. 6. The store of value characteristic of money refers to the fact that A. people save most of their money. B. money allows people to shift purchasing power into the future. c. money is not valuable unless it is stored. D. money is the only way people have to store value. 7. Suppose that in a barter" economy, John bakes cookies and Mary sells eggs from her poultry John wants eggs but Mary wants corns and not the cookies. So, Mary is unwilling to trade with John John's problem is an example of problem associated with a barter system. A too much specialization 8. not enough prices c. the law of diminishing returns D. the double coincidence of wants **Barter is an act that involves exchange of goods or services between two or more parties without the use of money for a monetary medium like credit card). As an example, a plumber who needs food find a grocer who needs a plumbing repair. Barter system is dependent on matching the requirements of the parties involved (ie, double coincidence of wants). 8. Money that is used as a means of payment must be A. actual currency B. coins and currency. C coins, currency, and credit cards. D. anything that is generally accepted as payment for goods and services. 9. An automobile is an asset, but it is not liquid because A. the owner may need the automobile for transportation B. the owner may still be making payments on the loan C. the automobile may not be in good repair. D. the automobile cannot be easily converted into a means of payment without a loss in value. 10. Inflation refers to growth in an economy's A. Gross Domestic Product (GDP). B. interest rates. C. money D. Prices 11. With inflation, A you need less money to buy the same basket of goods you bought a year ago B. money is more valuable. c. there is too little money in circulation. D. prices, in general, are increasing over time. 12. Which statement best summarizes how monetary aggregates are used to understand inflation? A. Economists and policymakers use mi to understand inflation today. B. Mi and M2 move together so both are good measures to use for understanding inflation C. In recent years, growth in M2 has stopped being a useful tool for forecasting inflation D. M2 is useful for understanding inflation particularly when inflation is low. 13. What does it mean to say that an asset is "liquid"? 14. Explain how money solves the problem of the double coincidence of wants

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts