Question: this is previous question 4. Use the information in the previous question to answer this question. If Debt/Equity ratio remains unchanged, a) Estimate the free

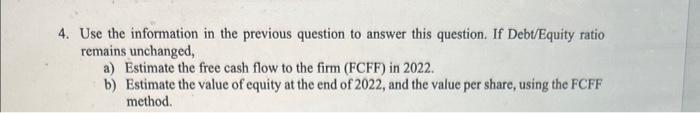

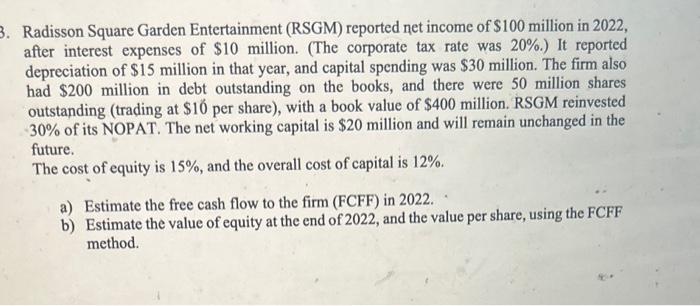

4. Use the information in the previous question to answer this question. If Debt/Equity ratio remains unchanged, a) Estimate the free cash flow to the firm (FCFF) in 2022. b) Estimate the value of equity at the end of 2022 , and the value per share, using the FCFF method. Radisson Square Garden Entertainment (RSGM) reported net income of $100 million in 2022 , after interest expenses of $10 million. (The corporate tax rate was 20%.) It reported depreciation of $15 million in that year, and capital spending was $30 million. The firm also had $200 million in debt outstanding on the books, and there were 50 million shares outstanding (trading at $10 per share), with a book value of $400 million. RSGM reinvested 30% of its NOPAT. The net working capital is $20 million and will remain unchanged in the future. The cost of equity is 15%, and the overall cost of capital is 12%. a) Estimate the free cash flow to the firm (FCFF) in 2022. b) Estimate the value of equity at the end of 2022 , and the value per share, using the FCFF method. 4. Use the information in the previous question to answer this question. If Debt/Equity ratio remains unchanged, a) Estimate the free cash flow to the firm (FCFF) in 2022. b) Estimate the value of equity at the end of 2022 , and the value per share, using the FCFF method. Radisson Square Garden Entertainment (RSGM) reported net income of $100 million in 2022 , after interest expenses of $10 million. (The corporate tax rate was 20%.) It reported depreciation of $15 million in that year, and capital spending was $30 million. The firm also had $200 million in debt outstanding on the books, and there were 50 million shares outstanding (trading at $10 per share), with a book value of $400 million. RSGM reinvested 30% of its NOPAT. The net working capital is $20 million and will remain unchanged in the future. The cost of equity is 15%, and the overall cost of capital is 12%. a) Estimate the free cash flow to the firm (FCFF) in 2022. b) Estimate the value of equity at the end of 2022 , and the value per share, using the FCFF method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts