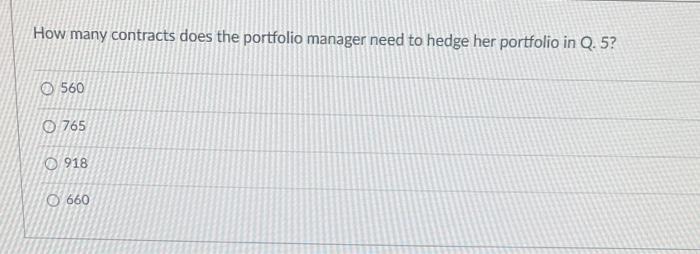

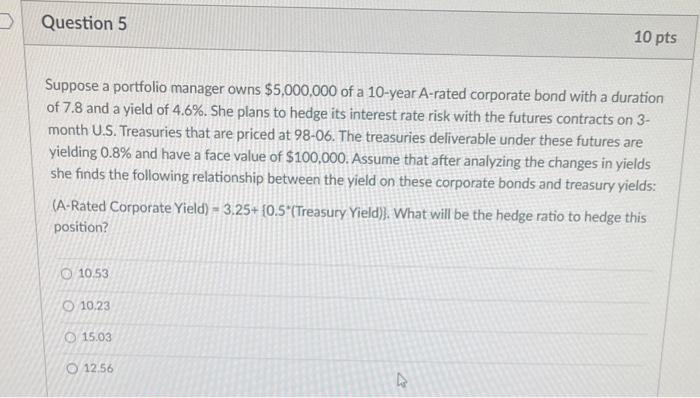

Question: This is Q5 How many contracts does the portfolio manager need to hedge her portfolio in Q.5? O 560 0765 918 660 Question 5 10

How many contracts does the portfolio manager need to hedge her portfolio in Q.5? O 560 0765 918 660 Question 5 10 pts Suppose a portfolio manager owns $5,000,000 of a 10-year A-rated corporate bond with a duration of 7.8 and a yield of 4.6%. She plans to hedge its interest rate risk with the futures contracts on 3- month U.S. Treasuries that are priced at 98-06. The treasuries deliverable under these futures are yielding 0.8% and have a face value of $100,000. Assume that after analyzing the changes in yields she finds the following relationship between the yield on these corporate bonds and treasury yields: (A-Rated Corporate Yield) = 3.25+ {0.5" (Treasury Yield)]. What will be the hedge ratio to hedge this position? O 10.53 10.23 0 15.03 1256 How many contracts does the portfolio manager need to hedge her portfolio in Q.5? O 560 0765 918 660 Question 5 10 pts Suppose a portfolio manager owns $5,000,000 of a 10-year A-rated corporate bond with a duration of 7.8 and a yield of 4.6%. She plans to hedge its interest rate risk with the futures contracts on 3- month U.S. Treasuries that are priced at 98-06. The treasuries deliverable under these futures are yielding 0.8% and have a face value of $100,000. Assume that after analyzing the changes in yields she finds the following relationship between the yield on these corporate bonds and treasury yields: (A-Rated Corporate Yield) = 3.25+ {0.5" (Treasury Yield)]. What will be the hedge ratio to hedge this position? O 10.53 10.23 0 15.03 1256

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts