Question: THIS IS THE ADDITIONAL INFORMATION YOU WILL NEED TO COMPLETE WHAT I AM ASKING HELP WITH!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! THE PICTURE IS JUST ADDITIONAL INFORMATION!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! I NEED HELP

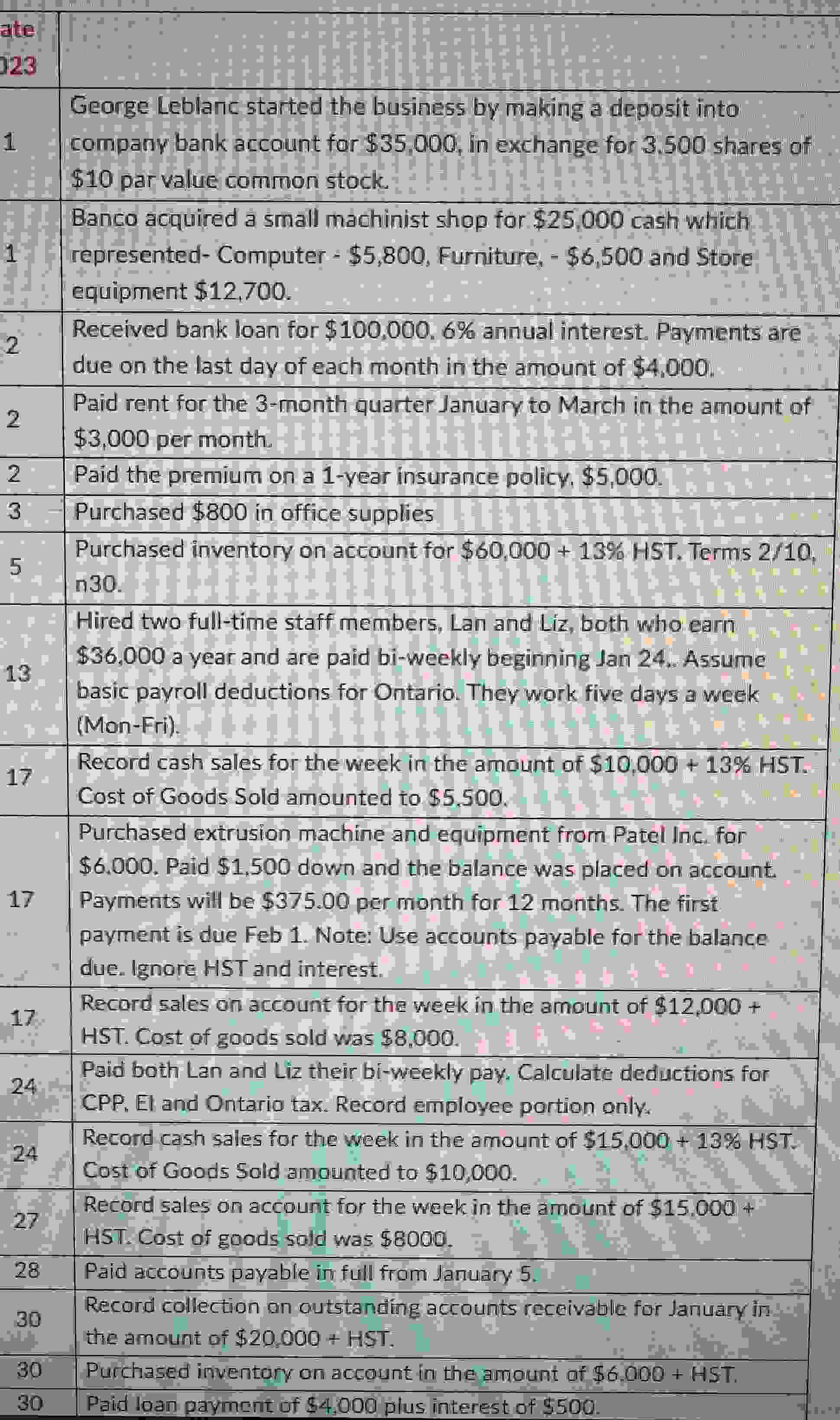

THIS IS THE ADDITIONAL INFORMATION YOU WILL NEED TO COMPLETE WHAT I AM ASKING HELP WITH!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! THE PICTURE IS JUST ADDITIONAL INFORMATION!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! I NEED HELP CREATING ADJUSTED JOURNAL ENTRIES, ADJUSTED GENERAL LEDGER AND ADJUSTED TRIAL BALANCE, INCOME STATEMENT, BALANCE SHEET AND STATEMENT OF RETAINED EARNINGS. HERE IS THE INFORMATION FOR THAT:Accrue wages payable to Lan and Liz as of Jan

The telephone bill for January was received on Feb th in the amount of $ HST

Office supplies on hand were counted as $ as of the end of the month.

The utility bill for Jan was received on Feb rd in the amount of $ignore HST

The company received a $ HST advertising bill on Feb th for work completed in Jan.

We estimate approximately of accounts receivable are uncollectible. Use the Allowance for Doubtful accounts AFDA method.

The company wants to record depreciation on a monthly basis using straightline depreciation.

Computer year useful life with no residual value

Furnitureyear useful life with $ residual value

Store equipment year useful life with $ residual value

Hint: You must review the Journal Entries tab and the Trial Balance tab for additional information for adjusting entries.

Also note, that you should accrue HST on expenses that are accrued. I have been struggling all day and no one has actually read my post to help me and i am getting so frustrated.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock