Question: this is the answer key but where are they getting -240? Sample Problem 4 . . Assume that we have the following information for two

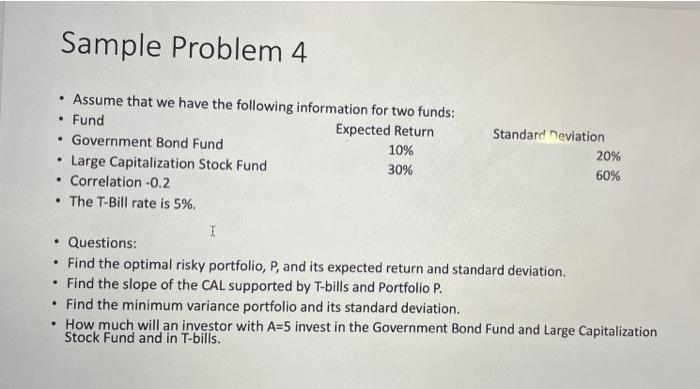

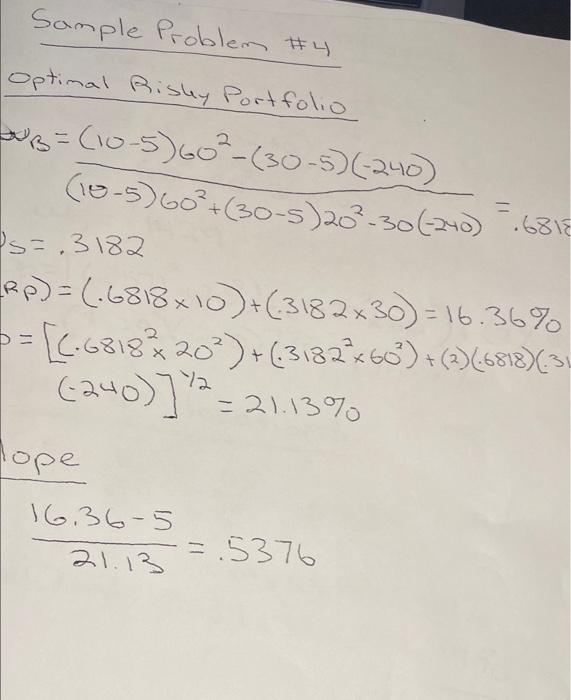

Sample Problem 4 . . Assume that we have the following information for two funds: Fund Expected Return Standard Deviation . Government Bond Fund 10% 20% Large Capitalization Stock Fund 30% 60% Correlation-0.2 The T-Bill rate is 5%. I Questions: Find the optimal risky portfolio, P, and its expected return and standard deviation. Find the slope of the CAL supported by T-bills and Portfolio P. Find the minimum variance portfolio and its standard deviation. How much will an investor with A=5 invest in the Government Bond Fund and Large Capitalization Stock Fund and in T-bills. . 2 Sample Problem #4 Optimal Risky Portfolio B=(10-5) 60-(30.5) (240) (18-5) 603+(30-5)202-30(240):681 Us=.3182 [Rp) = (.6818+10)+(.318230) = 16.36% = [[.68183202) +63137x60) +(2)(6818)(34 (240)]' = 21.13% ) = lope 16.36-5 =5376 x + 72 21.13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts