Question: this is the answer to question 2 answer with excel please 3. (20 points) Unicorn Capital, and up and coming venture capital firm, is considering

this is the answer to question 2

this is the answer to question 2

answer with excel please

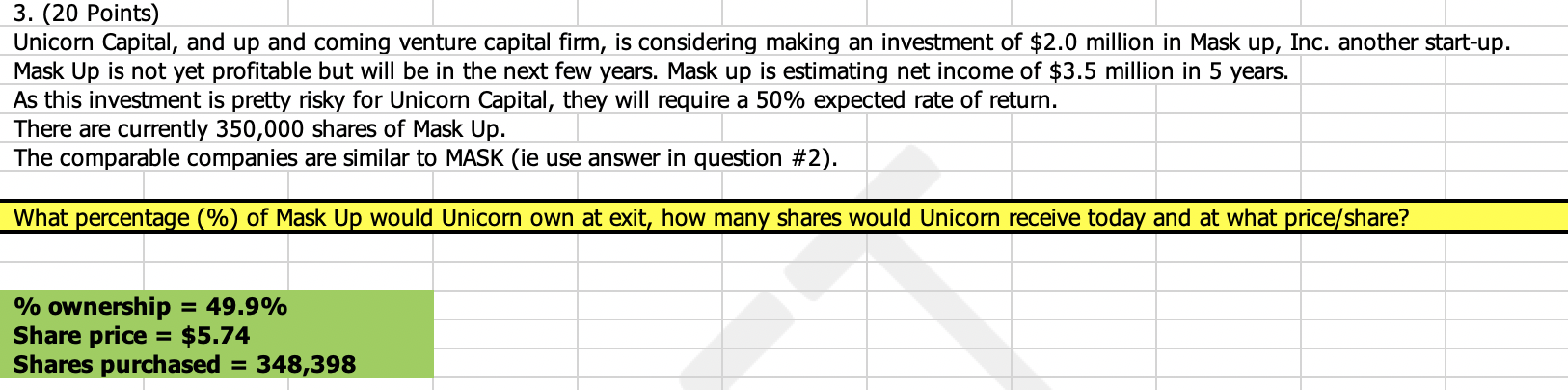

3. (20 points) Unicorn Capital, and up and coming venture capital firm, is considering making an investment of $2.0 million in Mask up, Inc. another start-up. Mask Up is not yet profitable but will be in the next few years. Mask up is estimating net income of $3.5 million in 5 years. As this investment is pretty risky for Unicorn Capital, they will require a 50% expected rate of return. There are currently 350,000 shares of Mask Up. The comparable companies are similar to MASK (ie use answer in question #2). What percentage (%) of Mask Up would Unicorn own at exit, how many shares would Unicorn receive today and at what price/share? % ownership = 49.9% Share price $5.74 Shares purchased = 348,398 = $15.54 + Qualitative - How companre to DCF in #1? 3. (20 points) Unicorn Capital, and up and coming venture capital firm, is considering making an investment of $2.0 million in Mask up, Inc. another start-up. Mask Up is not yet profitable but will be in the next few years. Mask up is estimating net income of $3.5 million in 5 years. As this investment is pretty risky for Unicorn Capital, they will require a 50% expected rate of return. There are currently 350,000 shares of Mask Up. The comparable companies are similar to MASK (ie use answer in question #2). What percentage (%) of Mask Up would Unicorn own at exit, how many shares would Unicorn receive today and at what price/share? % ownership = 49.9% Share price $5.74 Shares purchased = 348,398 = $15.54 + Qualitative - How companre to DCF in #1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts