Question: This is the assignment using R Studio Using the data below, please perform the following calculations. The SP500 column is the annual return on the

This is the assignment using R Studio

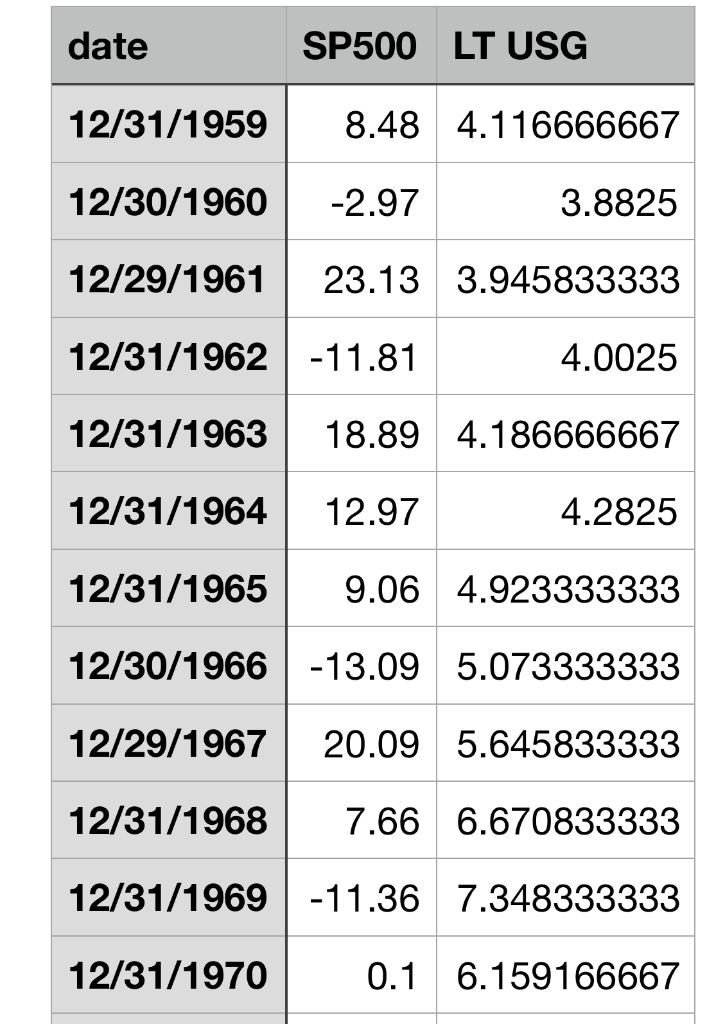

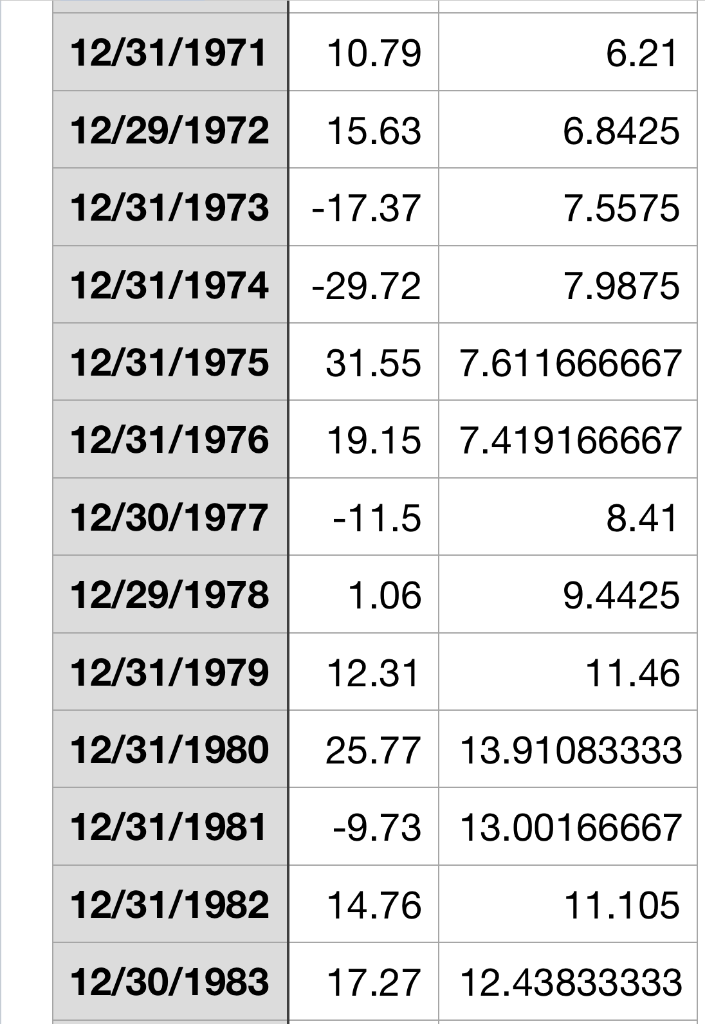

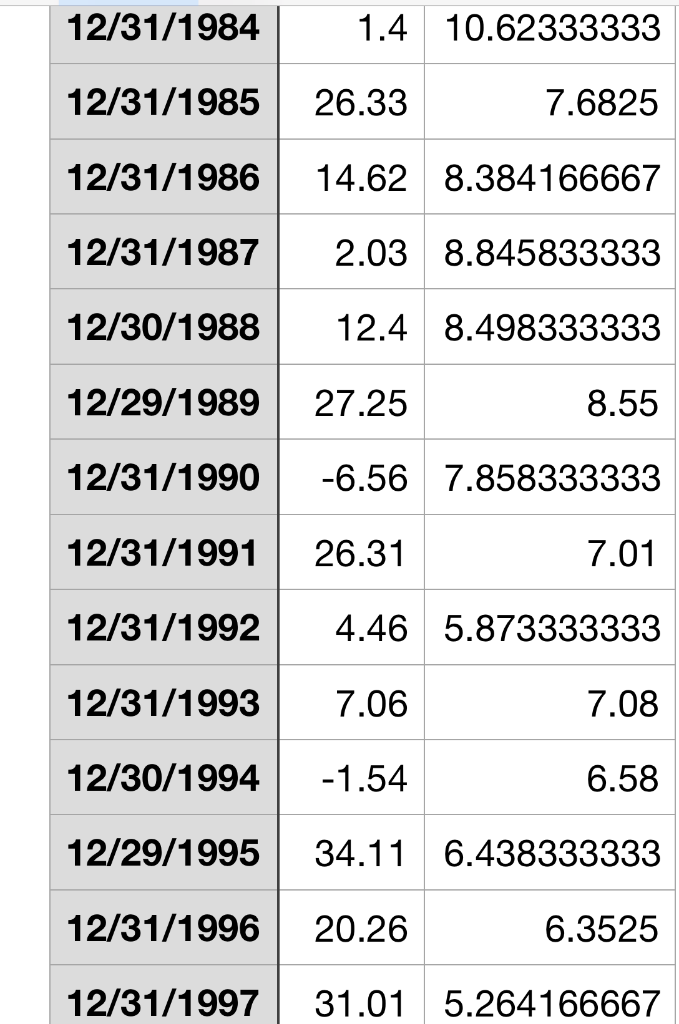

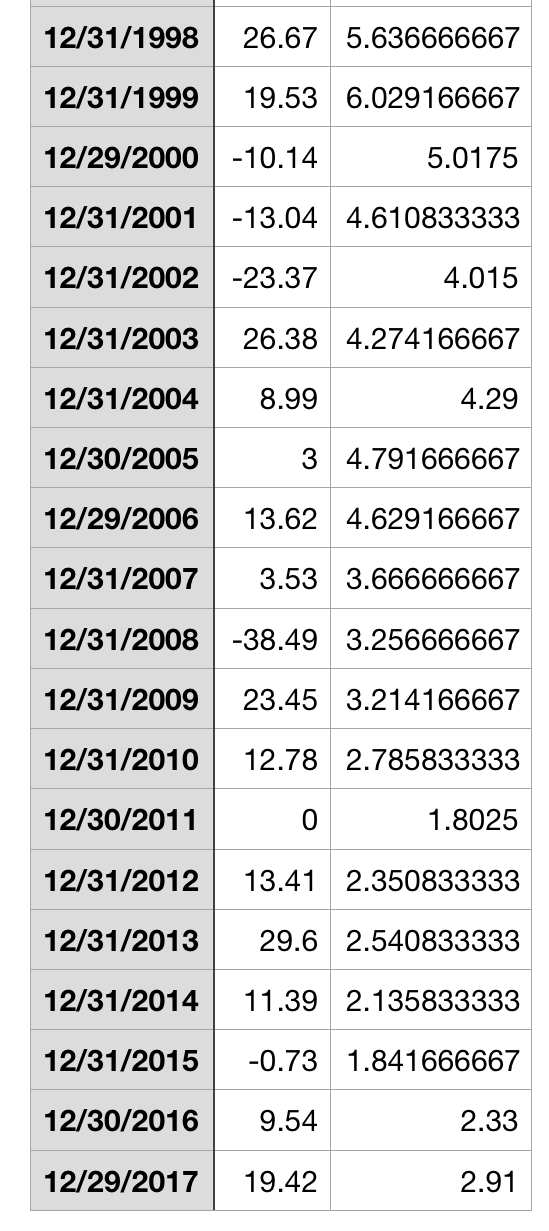

Using the data below, please perform the following calculations. The SP500 column is the annual return on the S&P 500 for the year ending on the date in the date column, and the LT.USG is the contemporaneous interest rate on long term US government debt.

Please submit both the R code you used to compute your answers, and the answers to the following questions. 1. Calculate the arithmetic and geometric mean return. 2. Calculate the arithmetic mean excess return. Use this mean for all future calculations. 3. Calculate the variance and standard deviation of the excess returns 4. Calculate the skew and kurtosis of the excess returns 5. Plot a histogram of the excess returns 6. Calculate the Sharpe Ratio

\begin{tabular}{|l|r|r|} \hline date & SP500 & LT USG \\ \hline 12/31/1959 & 8.48 & 4.116666667 \\ \hline 12/30/1960 & 2.97 & 3.8825 \\ \hline 12/29/1961 & 23.13 & 3.945833333 \\ \hline 12/31/1962 & 11.81 & 4.0025 \\ \hline 12/31/1963 & 18.89 & 4.186666667 \\ \hline 12/31/1964 & 12.97 & 4.2825 \\ \hline 12/31/1965 & 9.06 & 4.923333333 \\ \hline 12/30/1966 & 13.09 & 5.073333333 \\ \hline 12/29/1967 & 20.09 & 5.645833333 \\ \hline 12/31/1968 & 7.66 & 6.670833333 \\ \hline 12/31/1969 & 11.36 & 7.348333333 \\ \hline 12/31/1970 & 0.1 & 6.159166667 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 12/31/1971 & 10.79 & 6.21 \\ \hline 12/29/1972 & 15.63 & 6.8425 \\ \hline 12/31/1973 & 17.37 & 7.5575 \\ \hline 12/31/1974 & 29.72 & 7.9875 \\ \hline 12/31/1975 & 31.55 & 7.611666667 \\ \hline 12/31/1976 & 19.15 & 7.419166667 \\ \hline 12/30/1977 & 11.5 & 8.41 \\ \hline 12/29/1978 & 1.06 & 9.4425 \\ \hline 12/31/1979 & 12.31 & 11.46 \\ \hline 12/31/1980 & 25.77 & 13.91083333 \\ \hline 12/31/1981 & 9.73 & 13.00166667 \\ \hline 12/31/1982 & 14.76 & 11.105 \\ \hline 12/30/1983 & 17.27 & 12.43833333 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 12/31/1984 & 1.4 & 10.62333333 \\ \hline 12/31/1985 & 26.33 & 7.6825 \\ \hline 12/31/1986 & 14.62 & 8.384166667 \\ \hline 12/31/1987 & 2.03 & 8.845833333 \\ \hline 12/30/1988 & 12.4 & 8.498333333 \\ \hline 12/29/1989 & 27.25 & 8.55 \\ \hline 12/31/1990 & 6.56 & 7.858333333 \\ \hline 12/31/1991 & 26.31 & 7.01 \\ \hline 12/31/1992 & 4.46 & 5.873333333 \\ \hline 12/31/1993 & 7.06 & 7.08 \\ \hline 12/30/1994 & 1.54 & 6.58 \\ \hline 12/29/1995 & 34.11 & 6.438333333 \\ \hline 12/31/1996 & 20.26 & 6.3525 \\ \hline 12/31/1997 & 31.01 & 5.264166667 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline 12/31/1998 & 26.67 & 5.636666667 \\ \hline 12/31/1999 & 19.53 & 6.029166667 \\ \hline 12/29/2000 & 10.14 & 5.0175 \\ \hline 12/31/2001 & 13.04 & 4.610833333 \\ \hline 12/31/2002 & 23.37 & 4.015 \\ \hline 12/31/2003 & 26.38 & 4.274166667 \\ \hline 12/31/2004 & 8.99 & 4.29 \\ \hline 12/30/2005 & 3 & 4.791666667 \\ \hline 12/29/2006 & 13.62 & 4.629166667 \\ \hline 12/31/2007 & 3.53 & 3.666666667 \\ \hline 12/31/2008 & 38.49 & 3.256666667 \\ \hline 12/31/2009 & 23.45 & 3.214166667 \\ \hline 12/31/2010 & 12.78 & 2.785833333 \\ \hline 12/30/2011 & 0 & 1.8025 \\ \hline 12/31/2012 & 13.41 & 2.350833333 \\ \hline 12/31/2013 & 29.6 & 2.540833333 \\ \hline 12/31/2014 & 11.39 & 2.135833333 \\ \hline 12/31/2015 & 0.73 & 1.841666667 \\ \hline 12/30/2016 & 9.54 & 2.33 \\ \hline 12/29/2017 & 19.42 & 2.91 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts