Question: this is the case I just need the second part, only the calculation part. thanks Your second quiz will focus on a maximum 3 page

this is the case

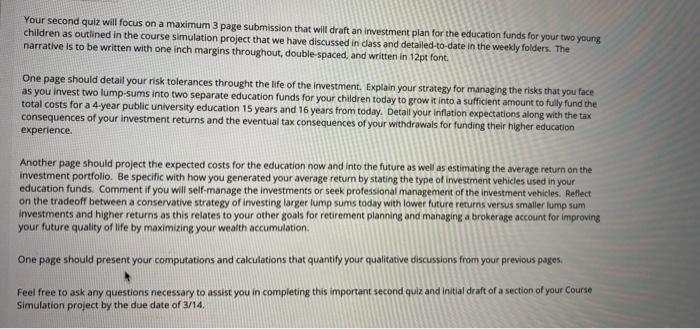

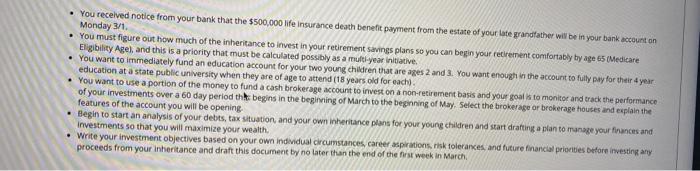

this is the case Your second quiz will focus on a maximum 3 page submission that will draft an investment plan for the education funds for your two young children as outlined in the course simulation project that we have discussed in class and detailed-to-date in the weekly folders. The narrative is to be written with one inch margins throughout double-spaced, and written in 12pt font. One page should detail your risk tolerances throught the life of the investment. Explain your strategy for managing the risks that you face as you invest two lump-sums into two separate education funds for your children today to grow it into a sufficient amount to fully fund the total costs for a 4-year public university education 15 years and 16 years from today. Detail your inflation expectations along with the tax consequences of your investment returns and the eventual tax consequences of your withdrawals for funding their higher education experience Another page should project the expected costs for the education now and into the future as well as estimating the average return on the investment portfolio. Be specific with how you generated your average return by stating the type of investment vehicles used in your education funds. Comment if you will self-manage the investments or seek professional management of the investment vehicles. Reflect on the tradeoff between a conservative strategy of investing larger lump sums today with lower future returns versus smaller lump sum investments and higher returns as this relates to your other goals for retirement planning and managing a brokerage account for improving your future quality of life by maximizing your wealth accumulation One page should present your computations and calculations that quantify your qualitative discussions from your previous pages. Feel free to ask any questions necessary to assist you in completing this important second quiz and initial draft of a section of your Course Simulation project by the due date of 3/14, You received notice from your bank that the $500,000 Me Insurance death benefit payment from the state of your late grandfather will be in your bank account on Monday 3/1, . You must figure out how much of the inheritance to invest in your retirement savings plans so you can begin your retirement comfortably by age 65 (Medicare Eligibility Age), and this is a priority that must be calculated possibly as a multi-year iniciative. You want to immediately fund an education account for your two young children that are ages 2 and 3. You want enough in the account to fully pay for their 4 year education at a state public university when they are of age to attend (18 years old for each You want to use a portion of the money to fund a cash brokerage account to invest on a non-retirement basis and your goal is to monitor and track the performance of your investments over a 60 day period the begins in the beginning of March to the beginning of May. Select the brokerage or brokerage houses and explain the features of the account you will be opening Begin to start an analysis of your debts, tax situation, and your own inheritance plans for your young children and start drafting a plan to manage your finances and investments so that you will maximize your wealth Write your investment objectives based on your own individual circumstances, career aspirations, risk tolerances and future financial priorites before investing any proceeds from your inheritance and draft this document by no later than the end of the first week in March Your second quiz will focus on a maximum 3 page submission that will draft an investment plan for the education funds for your two young children as outlined in the course simulation project that we have discussed in class and detailed-to-date in the weekly folders. The narrative is to be written with one inch margins throughout double-spaced, and written in 12pt font. One page should detail your risk tolerances throught the life of the investment. Explain your strategy for managing the risks that you face as you invest two lump-sums into two separate education funds for your children today to grow it into a sufficient amount to fully fund the total costs for a 4-year public university education 15 years and 16 years from today. Detail your inflation expectations along with the tax consequences of your investment returns and the eventual tax consequences of your withdrawals for funding their higher education experience Another page should project the expected costs for the education now and into the future as well as estimating the average return on the investment portfolio. Be specific with how you generated your average return by stating the type of investment vehicles used in your education funds. Comment if you will self-manage the investments or seek professional management of the investment vehicles. Reflect on the tradeoff between a conservative strategy of investing larger lump sums today with lower future returns versus smaller lump sum investments and higher returns as this relates to your other goals for retirement planning and managing a brokerage account for improving your future quality of life by maximizing your wealth accumulation One page should present your computations and calculations that quantify your qualitative discussions from your previous pages. Feel free to ask any questions necessary to assist you in completing this important second quiz and initial draft of a section of your Course Simulation project by the due date of 3/14, You received notice from your bank that the $500,000 Me Insurance death benefit payment from the state of your late grandfather will be in your bank account on Monday 3/1, . You must figure out how much of the inheritance to invest in your retirement savings plans so you can begin your retirement comfortably by age 65 (Medicare Eligibility Age), and this is a priority that must be calculated possibly as a multi-year iniciative. You want to immediately fund an education account for your two young children that are ages 2 and 3. You want enough in the account to fully pay for their 4 year education at a state public university when they are of age to attend (18 years old for each You want to use a portion of the money to fund a cash brokerage account to invest on a non-retirement basis and your goal is to monitor and track the performance of your investments over a 60 day period the begins in the beginning of March to the beginning of May. Select the brokerage or brokerage houses and explain the features of the account you will be opening Begin to start an analysis of your debts, tax situation, and your own inheritance plans for your young children and start drafting a plan to manage your finances and investments so that you will maximize your wealth Write your investment objectives based on your own individual circumstances, career aspirations, risk tolerances and future financial priorites before investing any proceeds from your inheritance and draft this document by no later than the end of the first week in March

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts