Question: This is the complete information , Still if you find something is missing then you can take assumption , but please answer this L Mr.

This is the complete information , Still if you find something is missing then you can take assumption , but please answer this

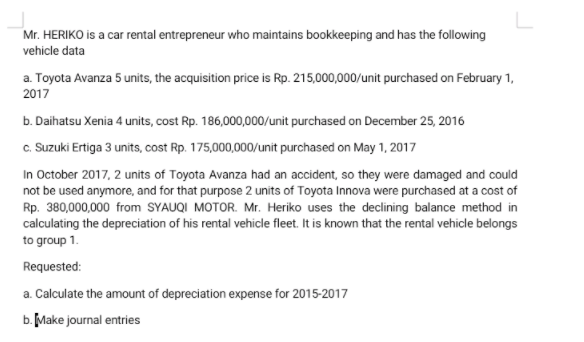

L Mr. HERIKO is a car rental entrepreneur who maintains bookkeeping and has the following vehicle data a. Toyota Avanza 5 units, the acquisition price is Rp. 215,000,000/unit purchased on February 1, 2017 b. Daihatsu Xenia 4 units, cost Rp. 186,000,000/unit purchased on December 25, 2016 c. Suzuki Ertiga 3 units, cost Rp. 175,000,000/unit purchased on May 1, 2017 In October 2017, 2 units of Toyota Avanza had an accident, so they were damaged and could not be used anymore, and for that purpose 2 units of Toyota Innova were purchased at a cost of Rp. 380,000,000 from SYAUQI MOTOR. Mr. Heriko uses the declining balance method in calculating the depreciation of his rental vehicle fleet. It is known that the rental vehicle belongs to group 1. Requested: a. Calculate the amount of depreciation expense for 2015-2017 b. Make journal entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts