Question: THIS IS THE COMPLETE QUESTION. Please follow the format in Figure 5.1 (on page 154 of the text) in answering the following questions reated to

THIS IS THE COMPLETE QUESTION.

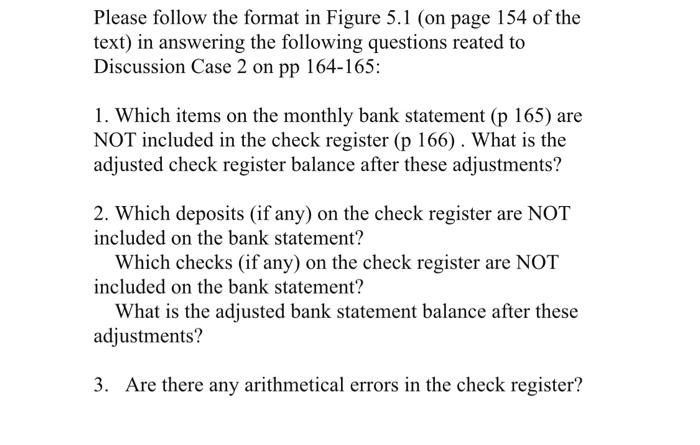

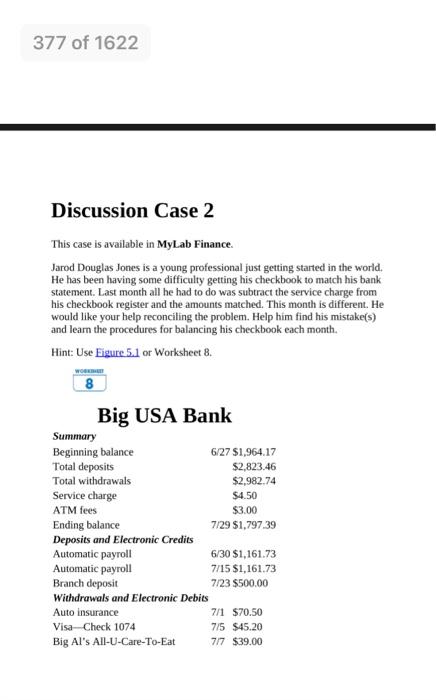

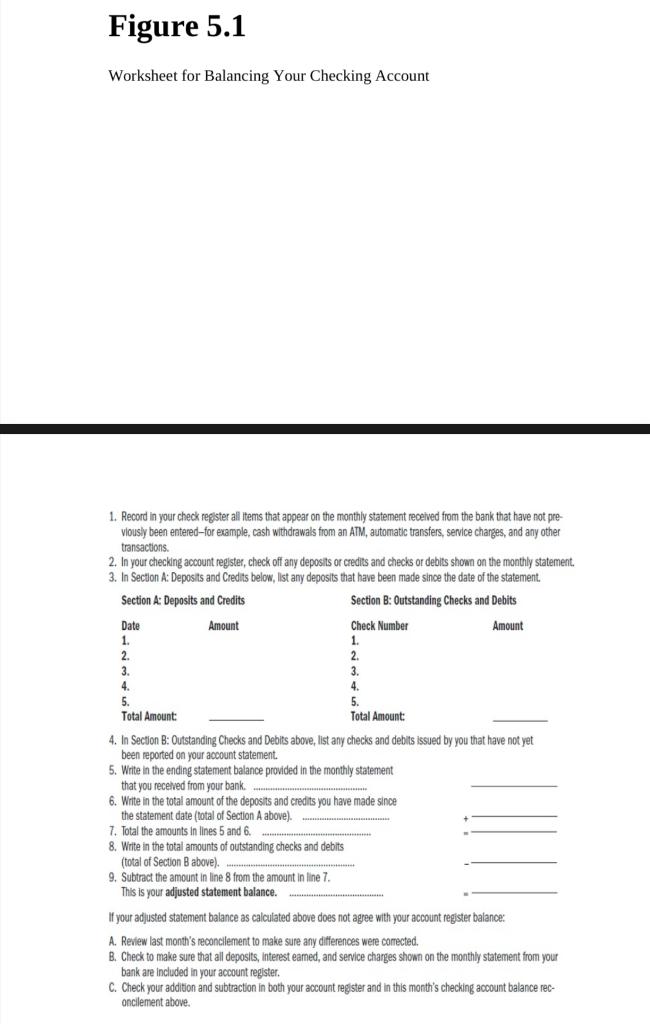

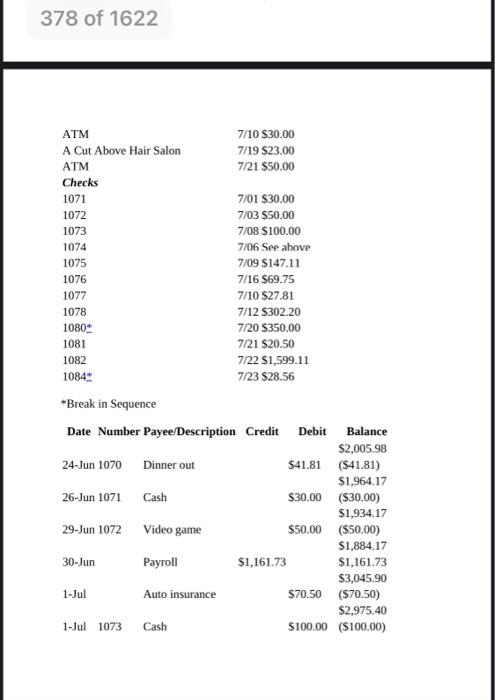

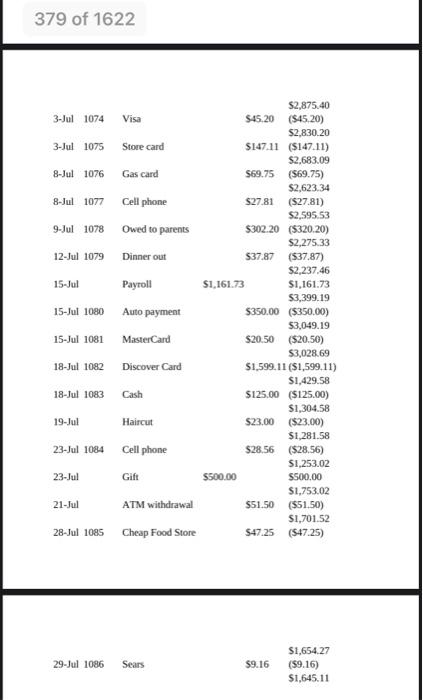

Please follow the format in Figure 5.1 (on page 154 of the text) in answering the following questions reated to Discussion Case 2 on pp 164-165: 1. Which items on the monthly bank statement (p 165) are NOT included in the check register (p 166). What is the adjusted check register balance after these adjustments? 2. Which deposits (if any) on the check register are NOT included on the bank statement? Which checks (if any) on the check register are NOT included on the bank statement? What is the adjusted bank statement balance after these adjustments? 3. Are there any arithmetical errors in the check register? 377 of 1622 Discussion Case 2 This case is available in MyLab Finance. Jarod Douglas Jones is a young professional just getting started in the world, He has been having some difficulty getting his checkbook to match his bank statement. Last month all he had to do was subtract the service charge from his checkbook register and the amounts matched. This month is different. He would like your help reconciling the problem. Help him find his mistake(s) and learn the procedures for balancing his checkbook each month. Hint: Use Figure 5.1 or Worksheet 8. WO 8 Big USA Bank Summary Beginning balance 6/27 $1,964.17 Total deposits $2,823.46 Total withdrawals $2.982.74 Service charge $4.50 ATM fees $3.00 Ending balance 7/29 $1,797.39 Deposits and Electronic Credits Automatic payroll 6/30 $1,161.73 Automatic payroll 7/15 $1,161.73 Branch deposit 7/23 $500.00 Withdrawals and Electronic Debits Auto insurance 7/1 570.50 Visa-Check 1074 7/5 $45.20 Big Al's All-U-Care-To-Eat 717 $39.00 Figure 5.1 Worksheet for Balancing Your Checking Account 1. Record in your check register all items that appear on the monthly statement received from the bank that have not pre viously been entered-for example, cash withdrawals from an ATM, automatic transfers, service charges, and any other transactions. 2. In your checking account register, check off any deposits or credits and checks or debits shown on the monthly statement. 3. In Section A: Deposits and Credits below, list any deposits that have been made since the date of the statement. Section A: Deposits and Credits Section B: Outstanding Checks and Debits Date Amount Check Number Amount 1. 1. 2. 2 3. 3. 4. 5. 5. Total Amount: Total Amount: 4. In Section B: Outstanding Checks and Debits above, list any checks and debits issued by you that have not yet been reported on your account statement 5. Write in the ending statement balance provided in the monthly statement that you recelved from your bank. 6. Write in the total amount of the deposits and credits you have made since the statement date total of Section A above). 7. Total the amounts in lines 5 and 6. 8. Write in the total amounts of outstanding checks and debits (total of Section B above). 9. Subtract the amount in line 8 from the amount in line 7 This is your adjusted statement balance. If your adjusted statement balance as calculated above does not agree with your account register balance: A. Review last month's reconcilement to make sure any differences were comected, B. Check to make sure that all deposits, interest eamed, and service charges shown on the monthly statement from your bank are included in your account register. C. Check your addition and subtraction in both your account register and in this month's checking account balance rec- oncilement above. 378 of 1622 ATM 7/10 $30.00 A Cut Above Hair Salon 7/19 $23.00 ATM 7/21 $50.00 Checks 1071 7/01 $30.00 1072 7/03 $50.00 1073 7/08 $100.00 1074 7/06 See above 1075 7/09 S147.11 1076 7/16 $69.75 1077 7/10 $27.81 1078 7/12 $302.20 1080 7/20 S350.00 1081 7/21 $20.50 1082 7/22 $1,599.11 1084 7/23 $28.56 *Break in Sequence Date Number Payee Description Credit Debit Balance $2,005.98 24-Jun 1070 Dinner out $41.81 (541.81) $1,964.17 26 Jun 1071 Cash $30.00 ($30.00) $1,934.17 29-Jun 1072 Video game $50.00 ($50.00) $1,884.17 30-Jun Payroll $1,161.73 $1,161.73 $3,045.90 1-Jul Auto insurance $70.50 ($70.50) $2,975.40 1.Jul 1073 Cash $100.00 ($100.00) 379 of 1622 3-Jul 1074 Visa 3-Jul 1075 Store card 8-Jul 1076 Gas card 8-Jul 1077 Cellphone 9-Jul 1078 Owed to parents 12-Jul 1079 Dinner out 15 Jul Payroll 15-Jul 1080 Auto payment $2,875.40 $45.20 (545.20) $2,830.20 $147.11 ($147.11) $2,683.09 $69.75 (569.75) $2,623.34 $27.81 (527.81) $2,595.53 $302.20 (5320.20) $2,275.33 $37.87 (537.87) $2,237,46 S1,161.73 S1,161.73 $3,399.19 $350.00 ($350.00) $3,049.19 $20.50 (520.50) $3,028.69 $1,599.11 (51,599.11) $1,429.58 $125.00 ($125.00) $1,304.58 $23.00 ($23.00) $1,281.58 $28.56 ($28.56) S1,253.02 $500.00 S500.00 $1,753.02 $51.50 (551.50) $1,701.52 $47.25 (547.25) 15-Jul 1081 MasterCard Discover Card 18-Jul 1082 18-Jul 1083 Cash 19-Jul Haircut 23-Jul 1084 Cell phone 23-Jul Gift 21-Jul ATM withdrawal 28-Jul 1085 Cheap Food Store 29-Jul 1086 Sears $9.16 $1,654.27 (59.16) $1,645.11 380 of 1622 29-Jul 1086 Sears $1,654.27 $9.16 ($9.16) S1,645.11 Please follow the format in Figure 5.1 (on page 154 of the text) in answering the following questions reated to Discussion Case 2 on pp 164-165: 1. Which items on the monthly bank statement (p 165) are NOT included in the check register (p 166). What is the adjusted check register balance after these adjustments? 2. Which deposits (if any) on the check register are NOT included on the bank statement? Which checks (if any) on the check register are NOT included on the bank statement? What is the adjusted bank statement balance after these adjustments? 3. Are there any arithmetical errors in the check register? 377 of 1622 Discussion Case 2 This case is available in MyLab Finance. Jarod Douglas Jones is a young professional just getting started in the world, He has been having some difficulty getting his checkbook to match his bank statement. Last month all he had to do was subtract the service charge from his checkbook register and the amounts matched. This month is different. He would like your help reconciling the problem. Help him find his mistake(s) and learn the procedures for balancing his checkbook each month. Hint: Use Figure 5.1 or Worksheet 8. WO 8 Big USA Bank Summary Beginning balance 6/27 $1,964.17 Total deposits $2,823.46 Total withdrawals $2.982.74 Service charge $4.50 ATM fees $3.00 Ending balance 7/29 $1,797.39 Deposits and Electronic Credits Automatic payroll 6/30 $1,161.73 Automatic payroll 7/15 $1,161.73 Branch deposit 7/23 $500.00 Withdrawals and Electronic Debits Auto insurance 7/1 570.50 Visa-Check 1074 7/5 $45.20 Big Al's All-U-Care-To-Eat 717 $39.00 Figure 5.1 Worksheet for Balancing Your Checking Account 1. Record in your check register all items that appear on the monthly statement received from the bank that have not pre viously been entered-for example, cash withdrawals from an ATM, automatic transfers, service charges, and any other transactions. 2. In your checking account register, check off any deposits or credits and checks or debits shown on the monthly statement. 3. In Section A: Deposits and Credits below, list any deposits that have been made since the date of the statement. Section A: Deposits and Credits Section B: Outstanding Checks and Debits Date Amount Check Number Amount 1. 1. 2. 2 3. 3. 4. 5. 5. Total Amount: Total Amount: 4. In Section B: Outstanding Checks and Debits above, list any checks and debits issued by you that have not yet been reported on your account statement 5. Write in the ending statement balance provided in the monthly statement that you recelved from your bank. 6. Write in the total amount of the deposits and credits you have made since the statement date total of Section A above). 7. Total the amounts in lines 5 and 6. 8. Write in the total amounts of outstanding checks and debits (total of Section B above). 9. Subtract the amount in line 8 from the amount in line 7 This is your adjusted statement balance. If your adjusted statement balance as calculated above does not agree with your account register balance: A. Review last month's reconcilement to make sure any differences were comected, B. Check to make sure that all deposits, interest eamed, and service charges shown on the monthly statement from your bank are included in your account register. C. Check your addition and subtraction in both your account register and in this month's checking account balance rec- oncilement above. 378 of 1622 ATM 7/10 $30.00 A Cut Above Hair Salon 7/19 $23.00 ATM 7/21 $50.00 Checks 1071 7/01 $30.00 1072 7/03 $50.00 1073 7/08 $100.00 1074 7/06 See above 1075 7/09 S147.11 1076 7/16 $69.75 1077 7/10 $27.81 1078 7/12 $302.20 1080 7/20 S350.00 1081 7/21 $20.50 1082 7/22 $1,599.11 1084 7/23 $28.56 *Break in Sequence Date Number Payee Description Credit Debit Balance $2,005.98 24-Jun 1070 Dinner out $41.81 (541.81) $1,964.17 26 Jun 1071 Cash $30.00 ($30.00) $1,934.17 29-Jun 1072 Video game $50.00 ($50.00) $1,884.17 30-Jun Payroll $1,161.73 $1,161.73 $3,045.90 1-Jul Auto insurance $70.50 ($70.50) $2,975.40 1.Jul 1073 Cash $100.00 ($100.00) 379 of 1622 3-Jul 1074 Visa 3-Jul 1075 Store card 8-Jul 1076 Gas card 8-Jul 1077 Cellphone 9-Jul 1078 Owed to parents 12-Jul 1079 Dinner out 15 Jul Payroll 15-Jul 1080 Auto payment $2,875.40 $45.20 (545.20) $2,830.20 $147.11 ($147.11) $2,683.09 $69.75 (569.75) $2,623.34 $27.81 (527.81) $2,595.53 $302.20 (5320.20) $2,275.33 $37.87 (537.87) $2,237,46 S1,161.73 S1,161.73 $3,399.19 $350.00 ($350.00) $3,049.19 $20.50 (520.50) $3,028.69 $1,599.11 (51,599.11) $1,429.58 $125.00 ($125.00) $1,304.58 $23.00 ($23.00) $1,281.58 $28.56 ($28.56) S1,253.02 $500.00 S500.00 $1,753.02 $51.50 (551.50) $1,701.52 $47.25 (547.25) 15-Jul 1081 MasterCard Discover Card 18-Jul 1082 18-Jul 1083 Cash 19-Jul Haircut 23-Jul 1084 Cell phone 23-Jul Gift 21-Jul ATM withdrawal 28-Jul 1085 Cheap Food Store 29-Jul 1086 Sears $9.16 $1,654.27 (59.16) $1,645.11 380 of 1622 29-Jul 1086 Sears $1,654.27 $9.16 ($9.16) S1,645.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts