Question: This is the complete question!! Thanks Use your work from 1 &2 to caleulate your answer for 3 1. A firm has a ROE of

This is the complete question!! Thanks

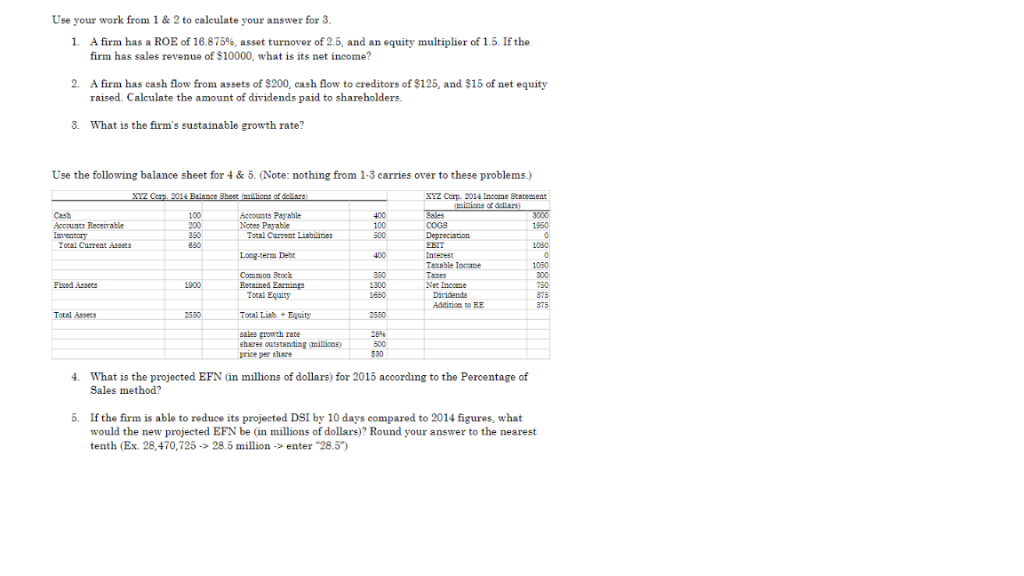

Use your work from 1 &2 to caleulate your answer for 3 1. A firm has a ROE of 16.875%, asset turnover of 2.5, and an equity multiplier of 1.5 If the firm has sales revenue of $10000, what is its net income? 2.A firm has cash flow from assets of $200, cash flow to creditors of $125, and $15 of net equity raised. Calculate the amount of dividends paid to shareholders 3. What is the firm's sustainable growth rate? Use the following balance sheet for 4 & 5. (Note: nothing from 1-3 carries over to these problems.) Z Carp. 2014 Income Statement 100 Accounts Parable Notes Payable Accounts Recerrable 100 COGS Toral Current Liabilites otal Current Aaser BIT Long-term Deb Common Stock Retained Eamin Tocal Equity Taxable Income Tanes Net Income 300 Fixed Atsets 1900 1300 1650 375 Addition to RE Liab+ ealee growth rate shares outstanting milions) price per share 500 What is the projected EFN (in millions of dollars) for 2015 according to the Percentage of Sales method? 5. If the firm is able to reduce its projected DSI by 10 days compared to 2014 figures, what would the new projected EFN be (in millions of dollars)? Round your answer to the nearest tenth (Ex. 28,470,725-> 28.5 million-> enter "28.5) Use your work from 1 &2 to caleulate your answer for 3 1. A firm has a ROE of 16.875%, asset turnover of 2.5, and an equity multiplier of 1.5 If the firm has sales revenue of $10000, what is its net income? 2.A firm has cash flow from assets of $200, cash flow to creditors of $125, and $15 of net equity raised. Calculate the amount of dividends paid to shareholders 3. What is the firm's sustainable growth rate? Use the following balance sheet for 4 & 5. (Note: nothing from 1-3 carries over to these problems.) Z Carp. 2014 Income Statement 100 Accounts Parable Notes Payable Accounts Recerrable 100 COGS Toral Current Liabilites otal Current Aaser BIT Long-term Deb Common Stock Retained Eamin Tocal Equity Taxable Income Tanes Net Income 300 Fixed Atsets 1900 1300 1650 375 Addition to RE Liab+ ealee growth rate shares outstanting milions) price per share 500 What is the projected EFN (in millions of dollars) for 2015 according to the Percentage of Sales method? 5. If the firm is able to reduce its projected DSI by 10 days compared to 2014 figures, what would the new projected EFN be (in millions of dollars)? Round your answer to the nearest tenth (Ex. 28,470,725-> 28.5 million-> enter "28.5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts