Question: This is the Comprehensive Problem Chapter 5 & 6. Requirements 5,6,7,8,9 & 10 5. Prepare quality formatted adjusting entries for the year ended December 31,2024

This is the Comprehensive Problem Chapter 5 & 6.

Requirements 5,6,7,8,9 & 10

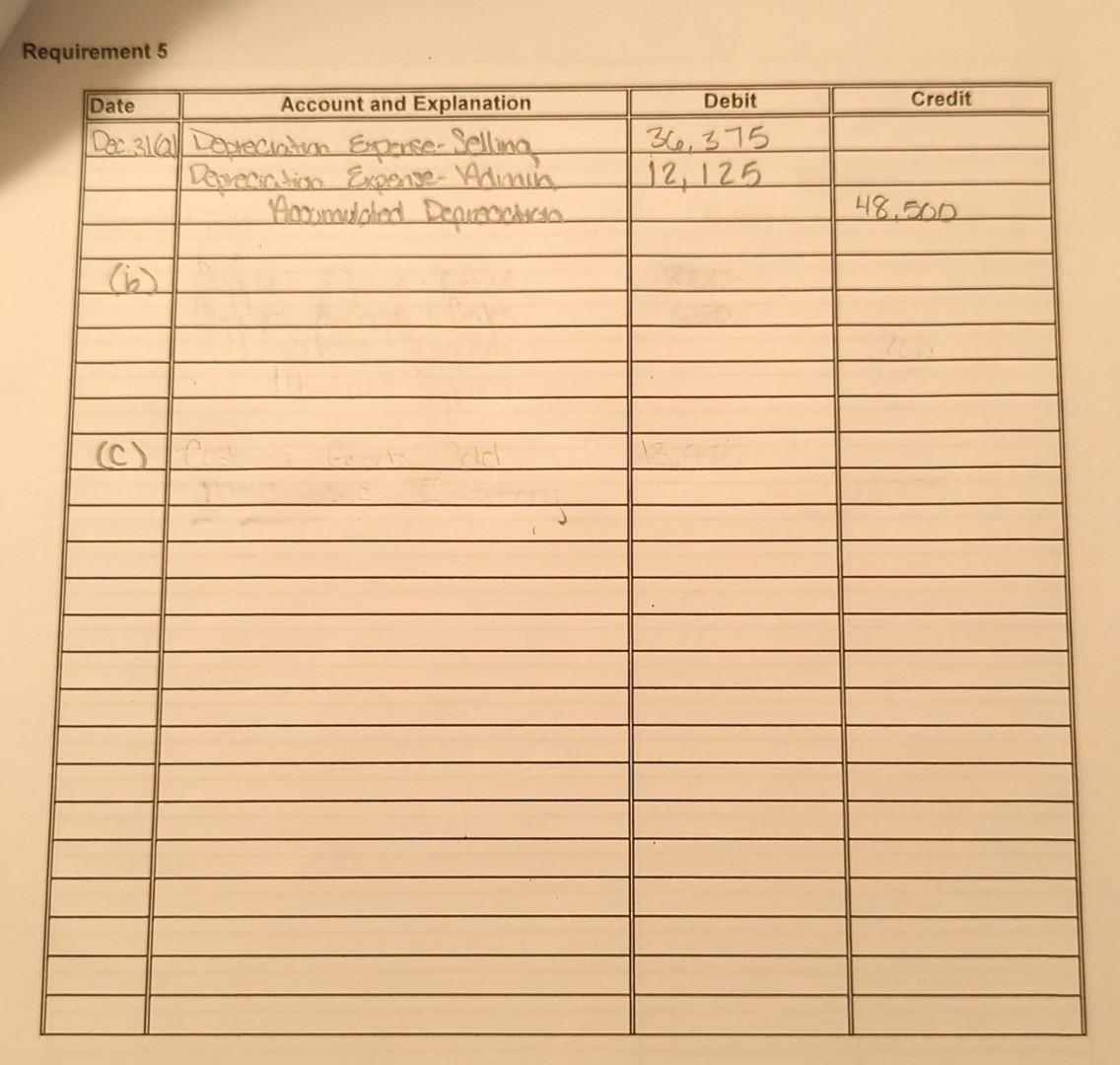

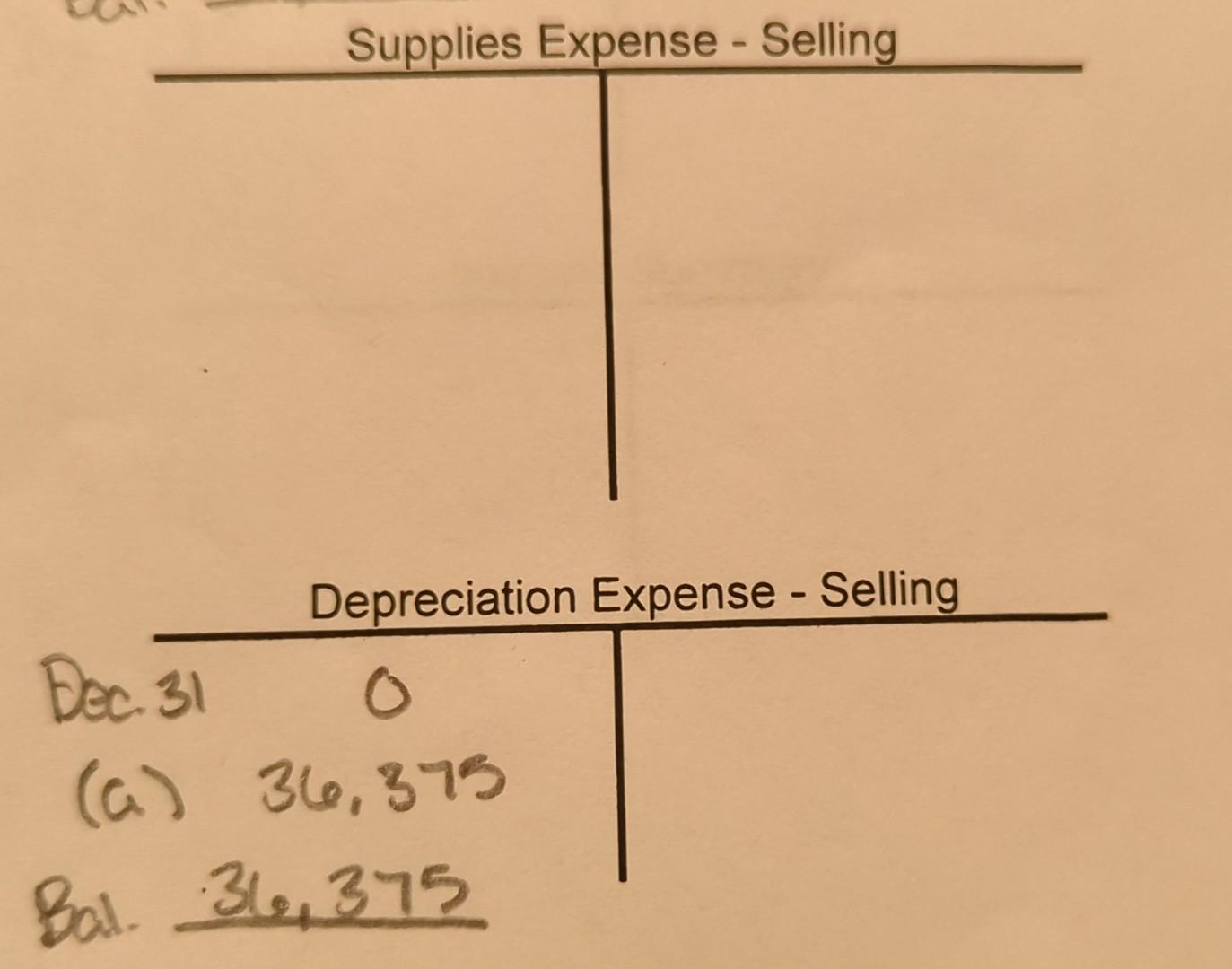

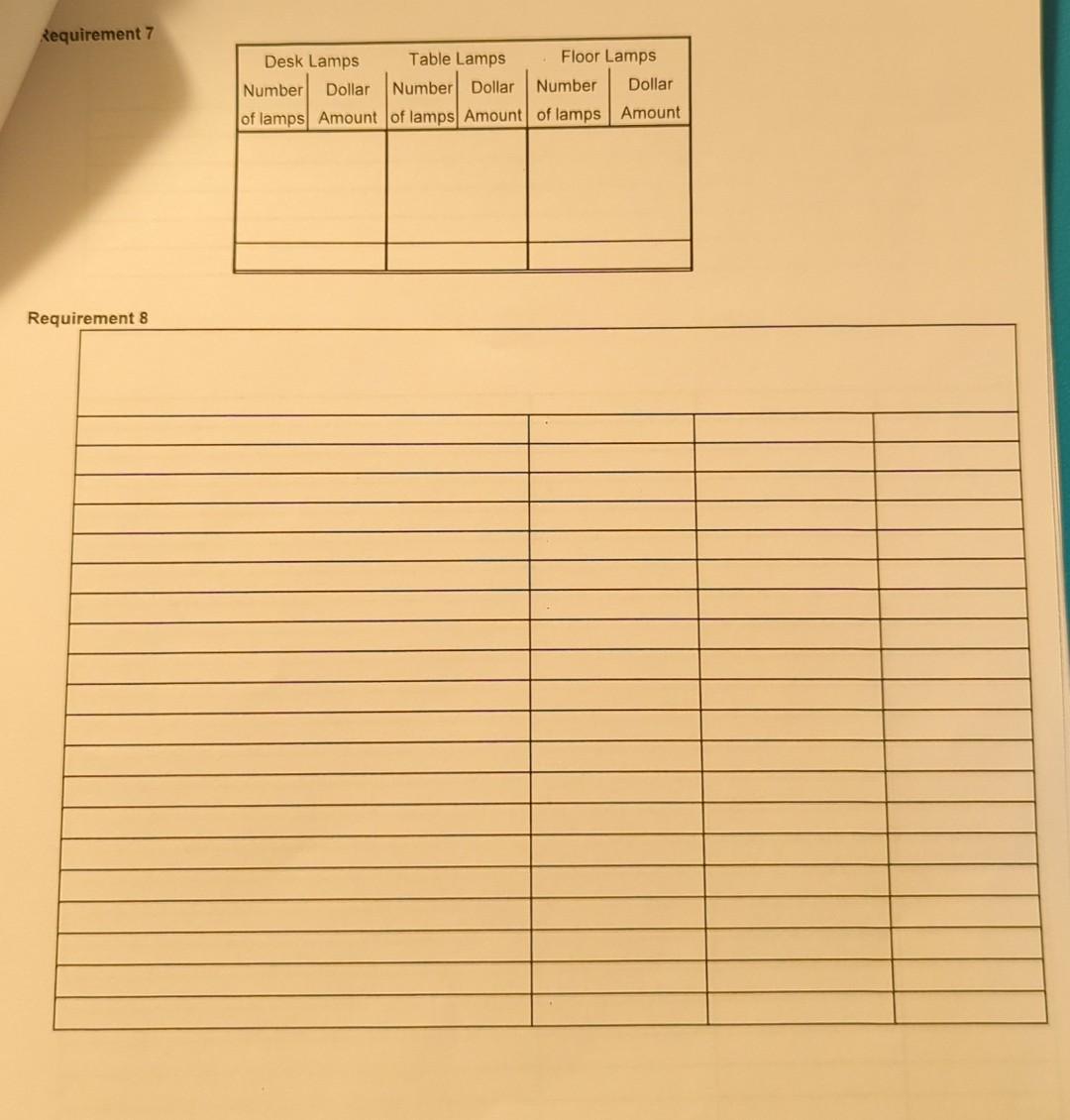

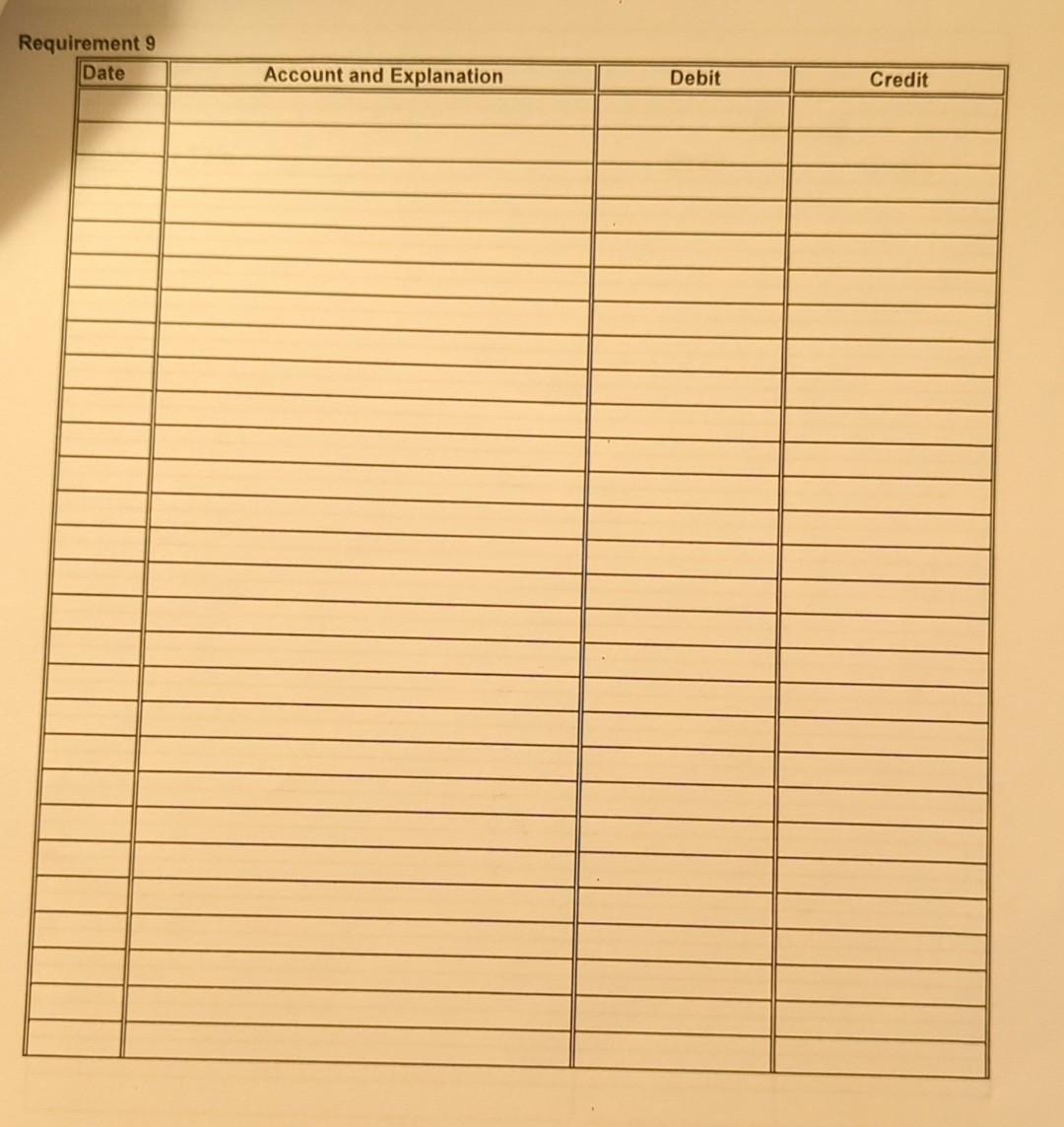

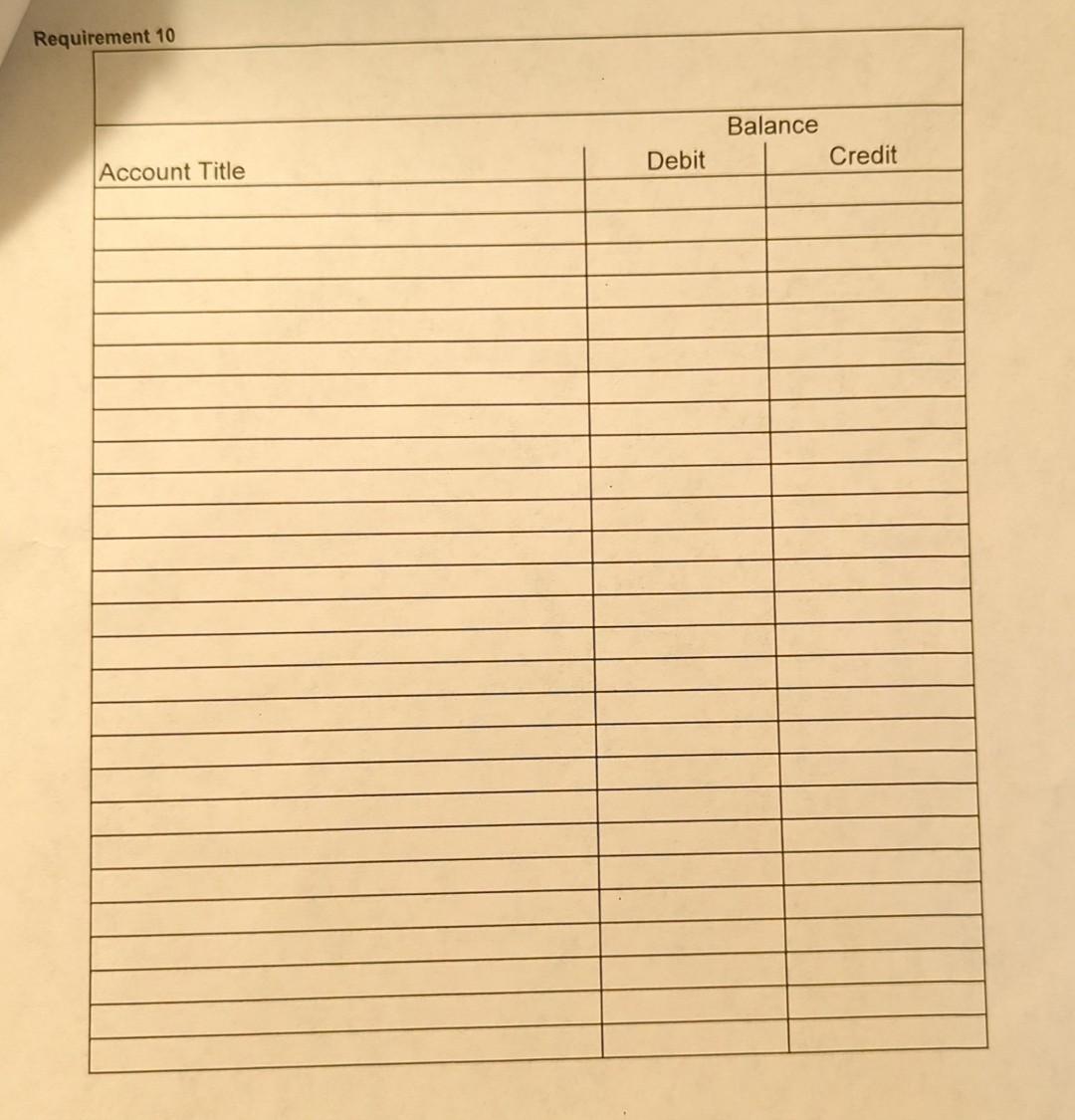

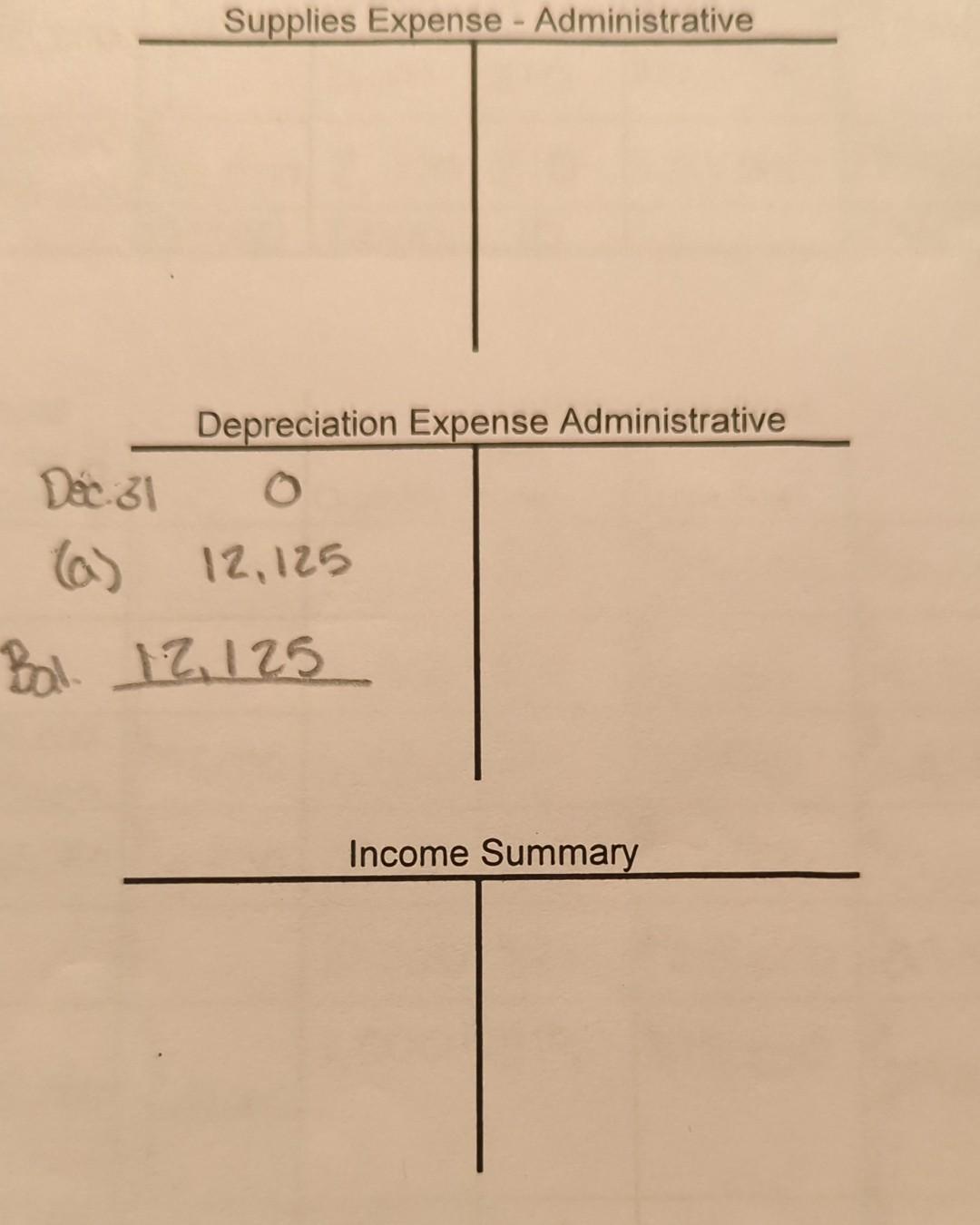

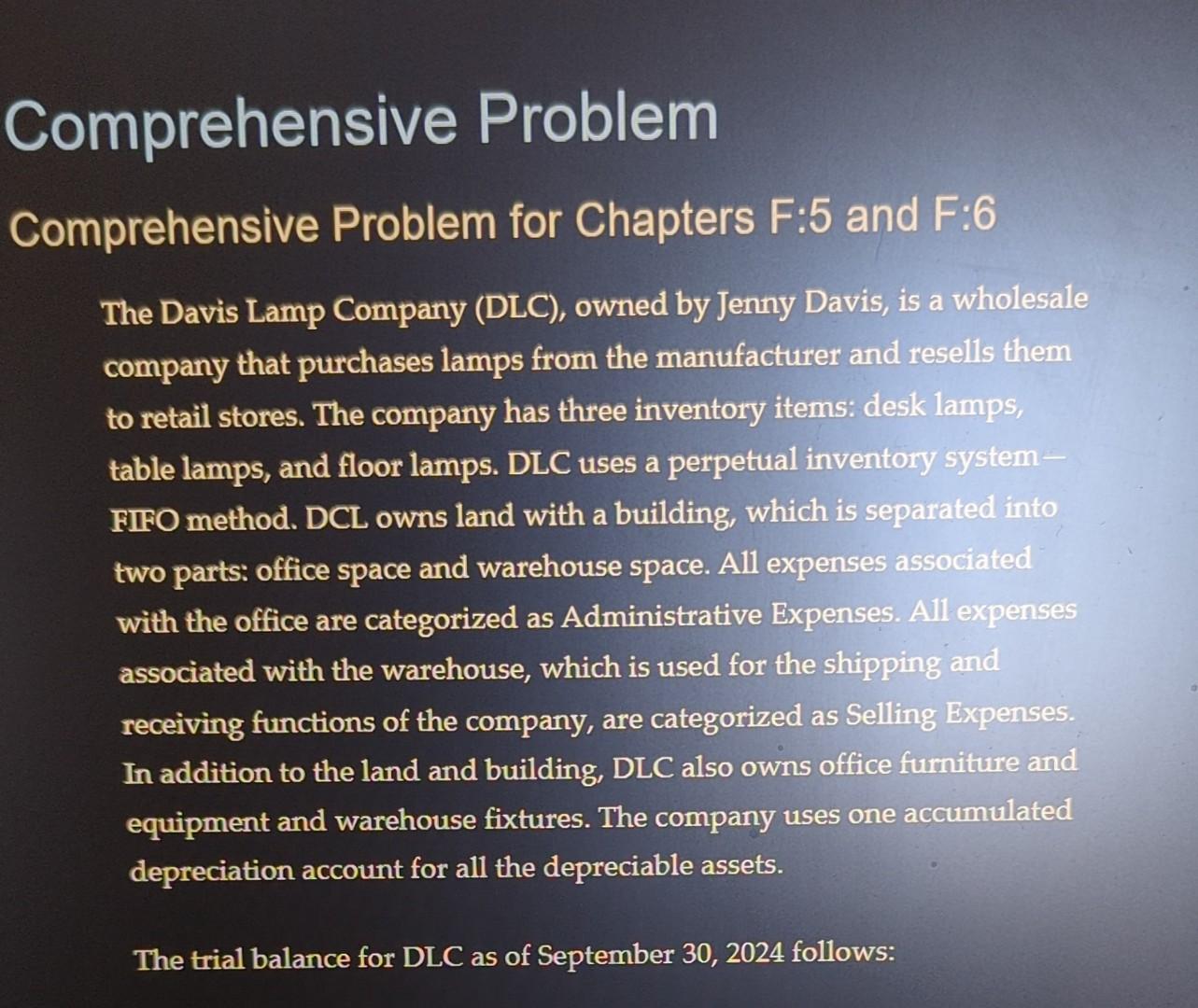

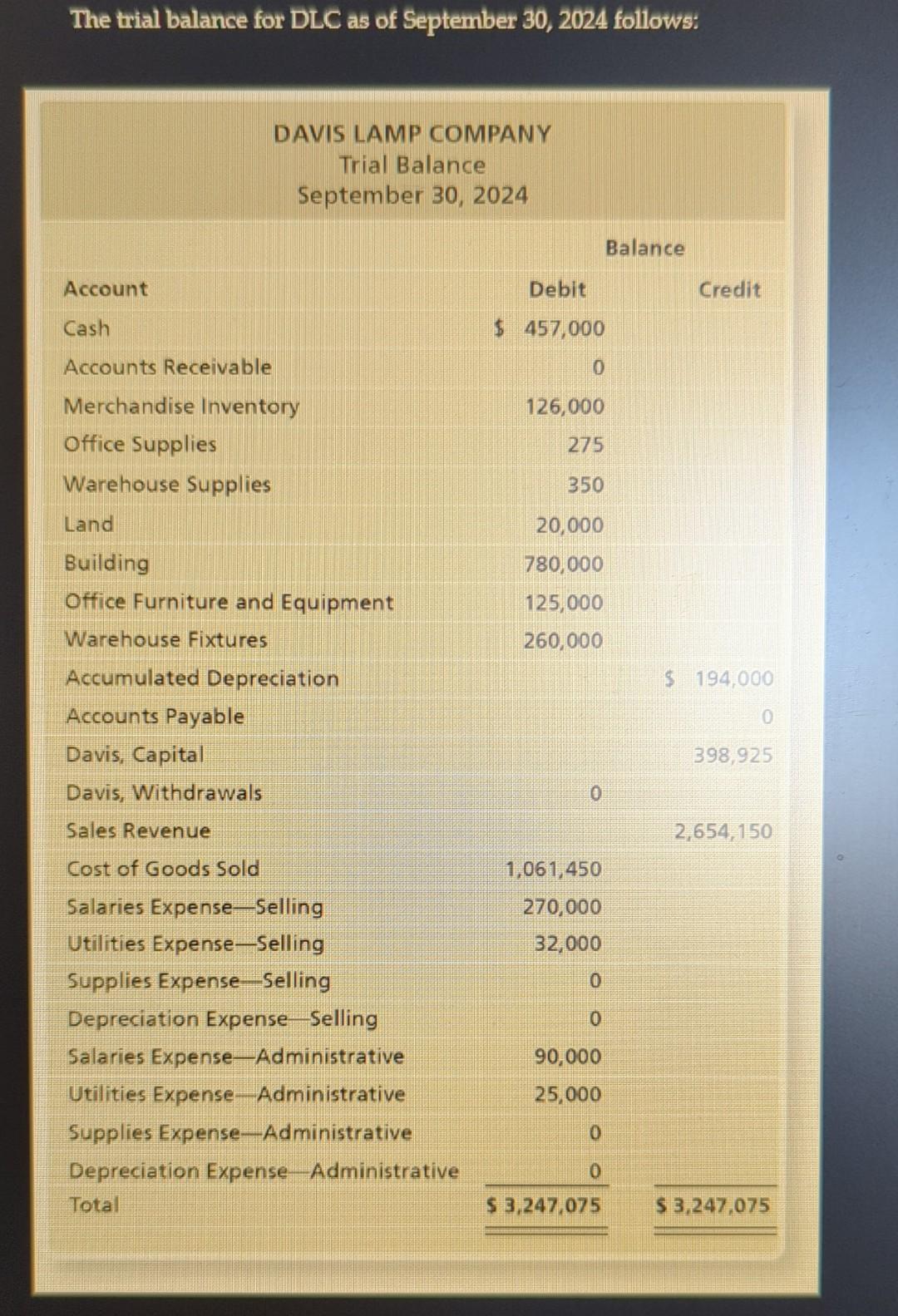

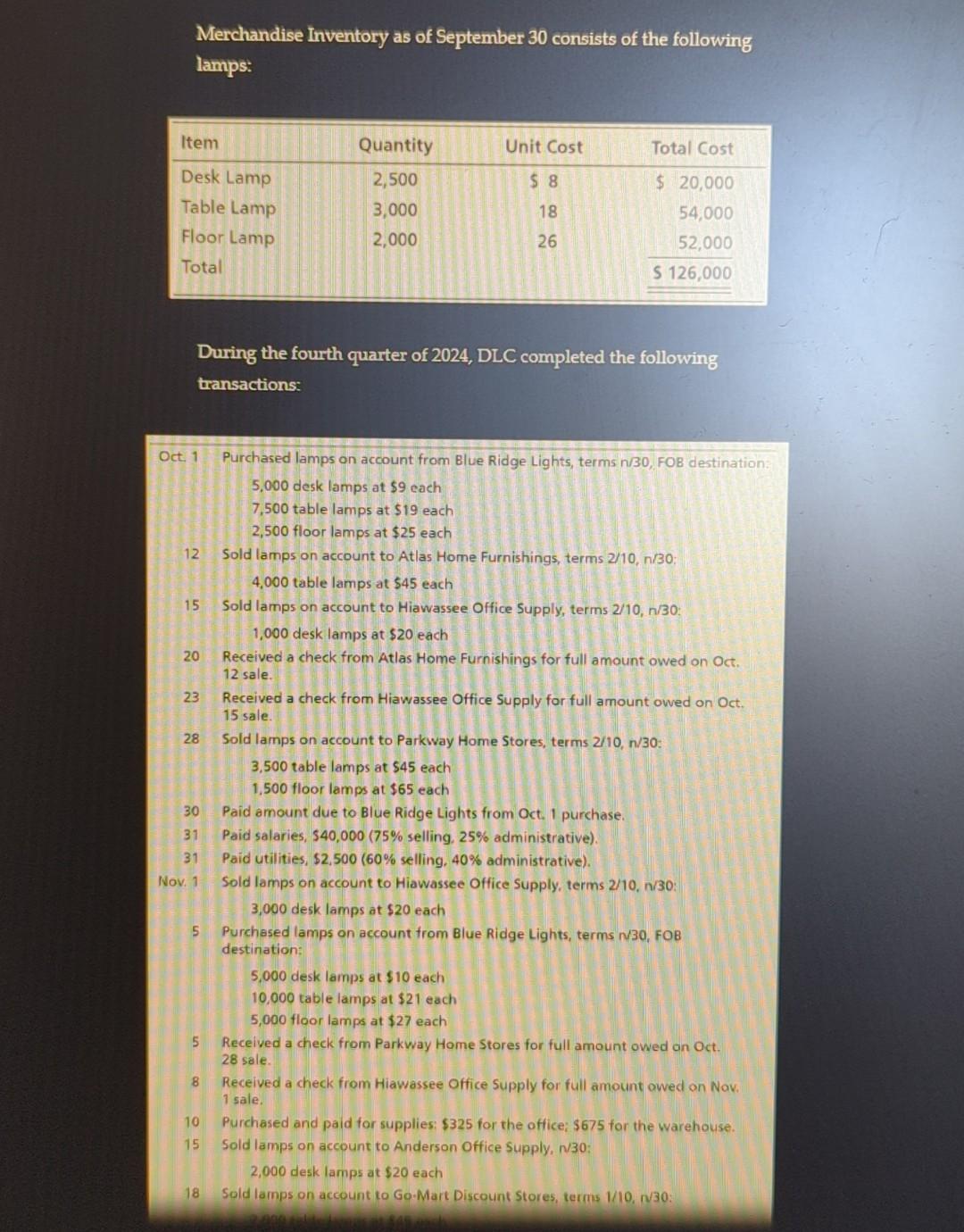

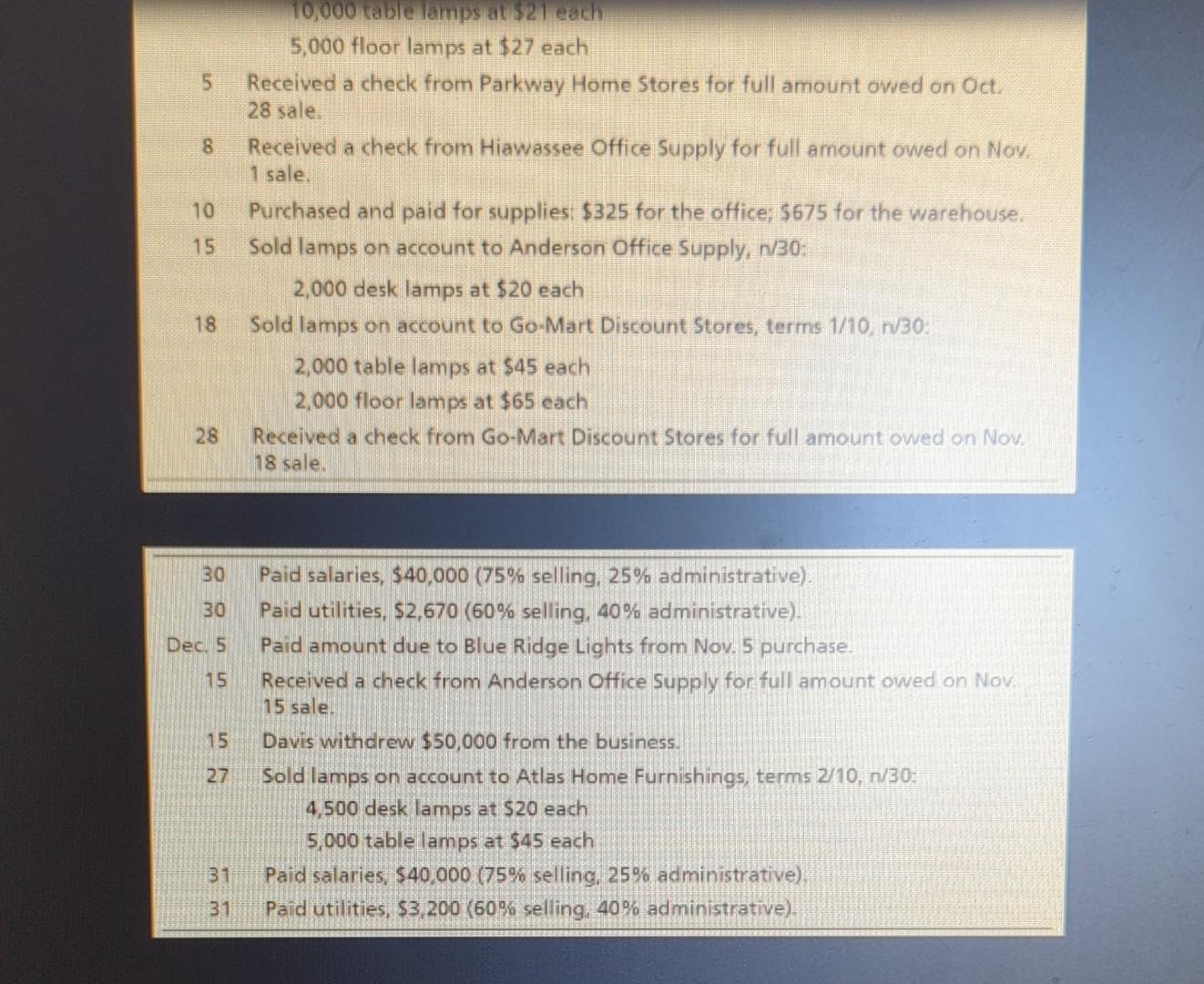

5. Prepare quality formatted adjusting entries for the year ended December 31,2024 , and post to the ledger. 6. Prepare an adjusted trial balance. 7. Provide a summary for the month, in both units and dollars, of the change in inventory for each item. 8. Prepare Davis Lamp Company's multi-step income statement, statement of owner's equity, and a classified balance sheet using quality format. 9. Record quality entries and post the closing entries. 10. Prepare a post-closing trial balance. 5. Prepare adjusting entries for the year ended December 31, 2024, and post to the ledger: a. Depreciation, $48,500 (75\% selling, 25% administrative). b. Supplies on hand: office, $200; and warehouse, $650. c. A physical inventory account resulted in the following counts: desk lamps, 1,990; table lamps, 5,995; and floor lamps, 6,000. Update the inventory records. Requirement 5 Requirement 6 Supplies Expense - Selling Depreciation Expense - Selling Dec. 310 (a) 36,375 Bal. 36,375 Requirement 7 Requirement 8 Rit Requirement 10 Supplies Expense - Administrative Depreciation Expense Administrative Dec: 31 (a) 12,125 Bal 12,125 Income Summary omprehensive Problem omprehensive Problem for Chapters F:5 and F:6 The Davis Lamp Company (DLC), owned by Jenny Davis, is a wholesale company that purchases lamps from the manufacturer and resells them to retail stores. The company has three inventory items: desk lamps, table lamps, and floor lamps. DLC uses a perpetual inventory system FIFO method. DCL owns land with a building, which is separated into two parts: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, DLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets. The trial balance for DLC as of September 30, 2024 follows: The trial balance for DLC as of September 30, 2024 follows: DAVIS LAMP COMPANY Trial Balance September 30,2024 Balance Account Debit Credit Cash $457,000 Accounts Receivable 0 Merchandise Inventory 126,000 Office Supplies 275 Warehouse Supplies 350 Land 20,000 Building Office Furniture and Equipment 125,000 Warehouse Fixtures 260,000 Accumulated Depreciation $194,000 Accounts Payable Davis, Capital Davis, Withdrawals Sales Revenue 2,654,150 Cost of Goods Sold 1,061,450 Salaries Expense-Selling 270,000 Utilities Expense-Selling 32,000 Supplies Expense-Selling 0 Depreciation Expense Selling Salaries Expense-Administrative 90,000 Utilities Expense-Administrative 25,000 Supplies Expense-Administrative 0 Depreciation Expense - Administrative Total $3,247,0750$3,247,075 Merchandise Inventory as of September 30 consists of the following lamps: During the fourth quarter of 2024, DLC completed the following transactions: Oct. 1 Purchased lamps on account from Blue Ridge Lights, terms n/30, FOB destination: 5,000 desk lamps at $9 each 7,500 table lamps at $19 each 2,500 floor lamps at $25 each 12 Sold lamps on account to Atlas Home Furnishings, terms 2/10,n/30; 4,000 table lamps at $45 each 15 Sold lamps on account to Hiawassee Office Supply, terms 2/10,n/30 : 1,000 desk lamps at $20 each 20 Received a check from Atlas Home Furnishings for full amount owed on Oct. 12 sale. 23 Received a check from Hiawassee Office Supply for full amount owed on Oct. 15 sale. 28 Sold lamps on account to Parkway Home Stores, terms 2/10,n/30 : 3,500 table lamps at $45 each 1,500 floor lamps at $65 each 30 Paid amount due to Blue Ridge Lights from Oct. 1 purchase. 31 Paid salaries, $40,000(75% selling, 25% administrative). 31 Paid utilities, $2,500 ( 60% selling, 40% administrative). Nov. 1 Sold lamps on account to Hiawassee Office Supply, terms 2/10, n/30: 3,000 desk lamps at $20 each 5 Purchased lamps on account from Blue Ridge Lights, terms N/30, FOB destination: 5,000 desk lamps at $10 each 10,000 table lamps at $21 each 5,000 floor lamps at $27 each 5 Received a check from Parkway Home Stores for full amount owed on Oct. 28 sale. 8 Received a check from Hiawassee Office Supply for full amount awed on Nov. 1 sale. 10 Purchased and paid for supplies: $325 for the office; $675 for the warehouse. 15 Sold lamps on account to Anderson Office Supply, n/30: 2,000 desk lamps at $20 each 18 Sold lamps on account to Go-Mart Discount Stores, terms 1/10, n/30: 5,000 floor lamps at $27 each 5 Received a check from Parkway Home Stores for full amount ovied on Oct. 28 sale. 8 Received a check from Hiawassee Office Supply for full amount owed on Now. 1 sale. 10 Purchased and paid for supplies: $325 for the office; $675 for the warehouse. 15 Sold lamps on account to Anderson Office Supply, n/30 : 2,000 desk lamps at $20 each 18 Sold lamps on account to Go-Mart Discount Stores, terms 1/10,n/30 : 2,000 table lamps at $45 each 2,000 floor lamps at $65 cach 28 Received a check from Go-Mart Discount Stores for full amount owed on Nov. 18 sale. 5. Prepare quality formatted adjusting entries for the year ended December 31,2024 , and post to the ledger. 6. Prepare an adjusted trial balance. 7. Provide a summary for the month, in both units and dollars, of the change in inventory for each item. 8. Prepare Davis Lamp Company's multi-step income statement, statement of owner's equity, and a classified balance sheet using quality format. 9. Record quality entries and post the closing entries. 10. Prepare a post-closing trial balance. 5. Prepare adjusting entries for the year ended December 31, 2024, and post to the ledger: a. Depreciation, $48,500 (75\% selling, 25% administrative). b. Supplies on hand: office, $200; and warehouse, $650. c. A physical inventory account resulted in the following counts: desk lamps, 1,990; table lamps, 5,995; and floor lamps, 6,000. Update the inventory records. Requirement 5 Requirement 6 Supplies Expense - Selling Depreciation Expense - Selling Dec. 310 (a) 36,375 Bal. 36,375 Requirement 7 Requirement 8 Rit Requirement 10 Supplies Expense - Administrative Depreciation Expense Administrative Dec: 31 (a) 12,125 Bal 12,125 Income Summary omprehensive Problem omprehensive Problem for Chapters F:5 and F:6 The Davis Lamp Company (DLC), owned by Jenny Davis, is a wholesale company that purchases lamps from the manufacturer and resells them to retail stores. The company has three inventory items: desk lamps, table lamps, and floor lamps. DLC uses a perpetual inventory system FIFO method. DCL owns land with a building, which is separated into two parts: office space and warehouse space. All expenses associated with the office are categorized as Administrative Expenses. All expenses associated with the warehouse, which is used for the shipping and receiving functions of the company, are categorized as Selling Expenses. In addition to the land and building, DLC also owns office furniture and equipment and warehouse fixtures. The company uses one accumulated depreciation account for all the depreciable assets. The trial balance for DLC as of September 30, 2024 follows: The trial balance for DLC as of September 30, 2024 follows: DAVIS LAMP COMPANY Trial Balance September 30,2024 Balance Account Debit Credit Cash $457,000 Accounts Receivable 0 Merchandise Inventory 126,000 Office Supplies 275 Warehouse Supplies 350 Land 20,000 Building Office Furniture and Equipment 125,000 Warehouse Fixtures 260,000 Accumulated Depreciation $194,000 Accounts Payable Davis, Capital Davis, Withdrawals Sales Revenue 2,654,150 Cost of Goods Sold 1,061,450 Salaries Expense-Selling 270,000 Utilities Expense-Selling 32,000 Supplies Expense-Selling 0 Depreciation Expense Selling Salaries Expense-Administrative 90,000 Utilities Expense-Administrative 25,000 Supplies Expense-Administrative 0 Depreciation Expense - Administrative Total $3,247,0750$3,247,075 Merchandise Inventory as of September 30 consists of the following lamps: During the fourth quarter of 2024, DLC completed the following transactions: Oct. 1 Purchased lamps on account from Blue Ridge Lights, terms n/30, FOB destination: 5,000 desk lamps at $9 each 7,500 table lamps at $19 each 2,500 floor lamps at $25 each 12 Sold lamps on account to Atlas Home Furnishings, terms 2/10,n/30; 4,000 table lamps at $45 each 15 Sold lamps on account to Hiawassee Office Supply, terms 2/10,n/30 : 1,000 desk lamps at $20 each 20 Received a check from Atlas Home Furnishings for full amount owed on Oct. 12 sale. 23 Received a check from Hiawassee Office Supply for full amount owed on Oct. 15 sale. 28 Sold lamps on account to Parkway Home Stores, terms 2/10,n/30 : 3,500 table lamps at $45 each 1,500 floor lamps at $65 each 30 Paid amount due to Blue Ridge Lights from Oct. 1 purchase. 31 Paid salaries, $40,000(75% selling, 25% administrative). 31 Paid utilities, $2,500 ( 60% selling, 40% administrative). Nov. 1 Sold lamps on account to Hiawassee Office Supply, terms 2/10, n/30: 3,000 desk lamps at $20 each 5 Purchased lamps on account from Blue Ridge Lights, terms N/30, FOB destination: 5,000 desk lamps at $10 each 10,000 table lamps at $21 each 5,000 floor lamps at $27 each 5 Received a check from Parkway Home Stores for full amount owed on Oct. 28 sale. 8 Received a check from Hiawassee Office Supply for full amount awed on Nov. 1 sale. 10 Purchased and paid for supplies: $325 for the office; $675 for the warehouse. 15 Sold lamps on account to Anderson Office Supply, n/30: 2,000 desk lamps at $20 each 18 Sold lamps on account to Go-Mart Discount Stores, terms 1/10, n/30: 5,000 floor lamps at $27 each 5 Received a check from Parkway Home Stores for full amount ovied on Oct. 28 sale. 8 Received a check from Hiawassee Office Supply for full amount owed on Now. 1 sale. 10 Purchased and paid for supplies: $325 for the office; $675 for the warehouse. 15 Sold lamps on account to Anderson Office Supply, n/30 : 2,000 desk lamps at $20 each 18 Sold lamps on account to Go-Mart Discount Stores, terms 1/10,n/30 : 2,000 table lamps at $45 each 2,000 floor lamps at $65 cach 28 Received a check from Go-Mart Discount Stores for full amount owed on Nov. 18 sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts