Question: This is the cost accounting class and need help for this case. There's some questions below!! Thank you somuch for your help. Spiritual Airlines Spiritual

This is the cost accounting class and need help for this case. There's some questions below!! Thank you somuch for your help.

Spiritual Airlines

Spiritual Airlines is considering a proposal to initiate air service

between Phoenix, Arizona and Las Vegas, Nevada. The route would be

designed primarily to serve the recreating and tourist travelers that

frequently travel between the two cities. By offering lowcost tourist

fares, the airlines hope to persuade persons who now travel by other

modes of transportation to switch and fly Spiritual on this route.

In addition, the airline expects to attract business travelers during

the hours of am to pm on Mondays and Fridays. The fare price

schedule or tariff would be designed to charge a higher fare during

businesstravel hours so that tourist demand would be reduced during

those hours. The company believes that a business far of $ one way

during business hours and a fare of $ for all other hours would result in

the passenger load being equal during businesstravel and touristtravel

hours.

To operate the route, the airline would need two passenger jet

aircraft. The aircraft would be leased at an annual cost of $

each. Other fixed costs for ground services would amount to $

per year.

Operation of each aircraft requires a flight crew whose salaries are

based primarily on the hours of flying time. The costs of the flight crew

are approximately $ per hour of flying time.

Fuel costs are also a function of flying time. These costs are

estimated at $ per hour of flying time. Flying time between Phoenix

and Las Vegas is estimated at minutes each way.

The costs associated with processing each passenger amount to $

This includes ticket processing, agent commissions, and variable costs of

baggage handling. Food and beverage services cost $ per passenger

and will be offered at no charge on flights during business hours. The

cost of this service on nonbusiness hour flights is expected to be

recovered through the charges levied for alcoholic beverages.

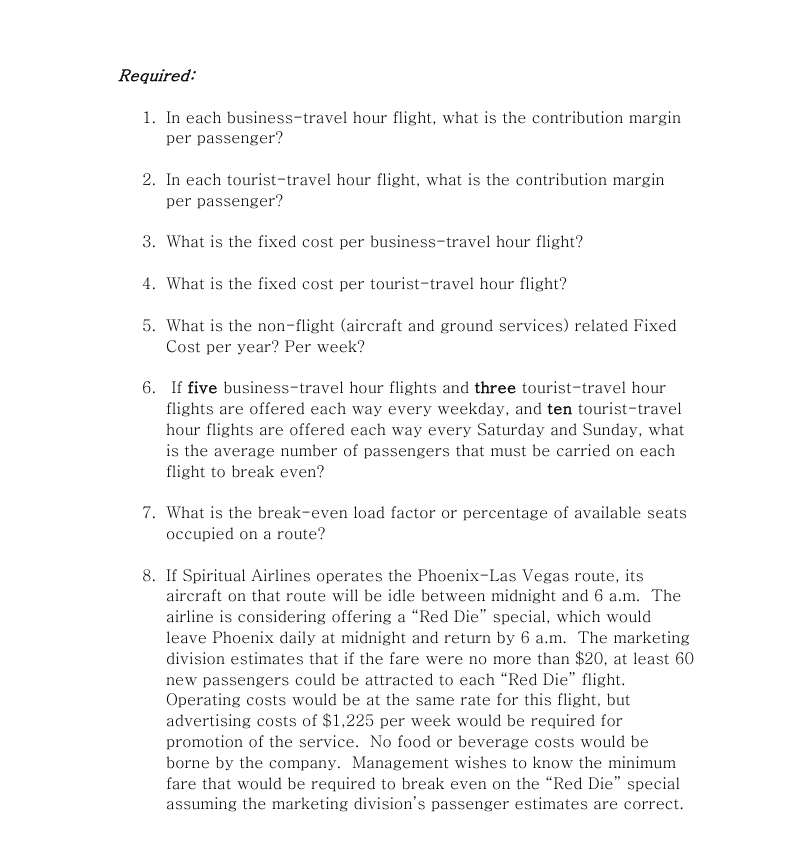

Required:

In each businesstravel hour flight, what is the contribution margin

per passenger?

In each touristtravel hour flight, what is the contribution margin

per passenger?

What is the fixed cost per businesstravel hour flight?

What is the fixed cost per touristtravel hour flight?

What is the nonflight aircraft and ground services related Fixed

Cost per year? Per week?

If five businesstravel hour flights and three touristtravel hour

flights are offered each way every weekday, and ten touristtravel

hour flights are offered each way every Saturday and Sunday, what

is the average number of passengers that must be carried on each

flight to break even?

What is the breakeven load factor or percentage of available seats

occupied on a route?

If Spiritual Airlines operates the PhoenixLas Vegas route, its

aircraft on that route will be idle between midnight and am The

airline is considering offering a "Red Die" special, which would

leave Phoenix daily at midnight and return by am The marketing

division estimates that if the fare were no more than $ at least

new passengers could be attracted to each "Red Die" flight.

Operating costs would be at the same rate for this flight, but

advertising costs of $ per week would be required for

promotion of the service. No food or beverage costs would be

borne by the company. Management wishes to know the minimum

fare that would be required to break even on the "Red Die" special

assuming the marketing division's passenger estimates are correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock