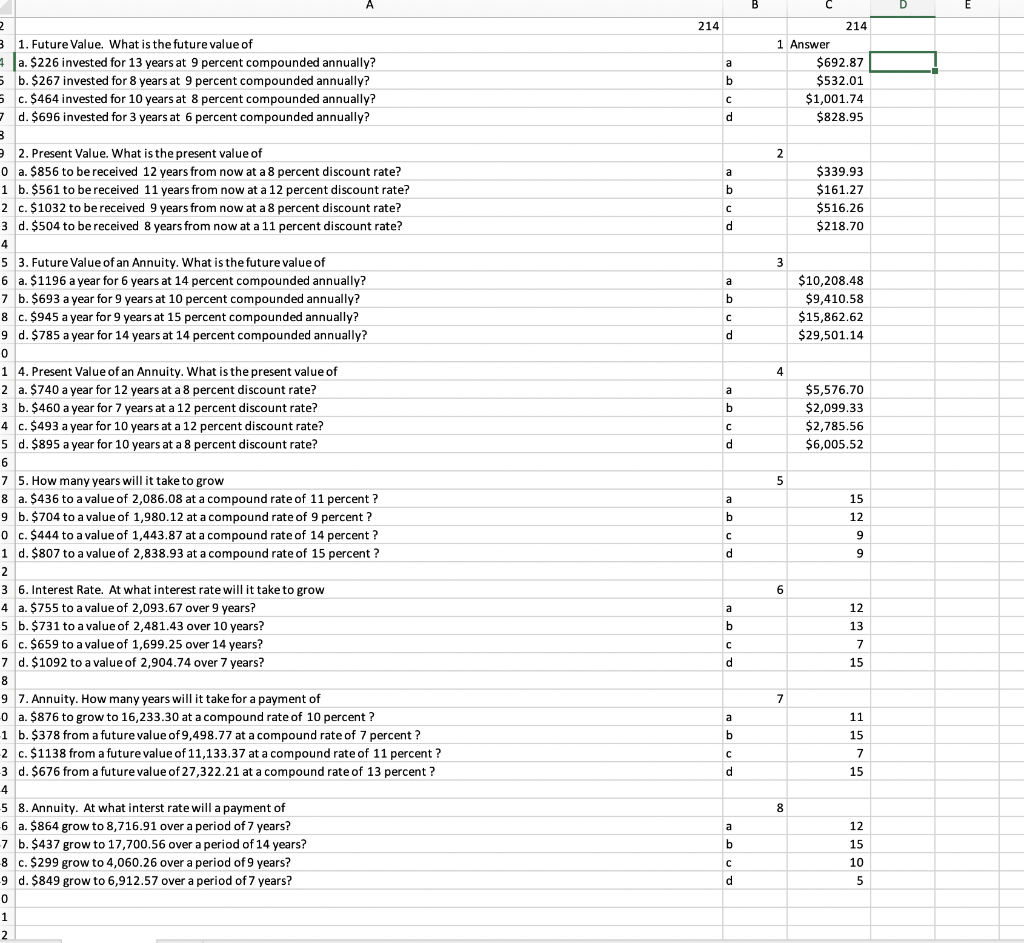

Question: This is the direction given on the assignment ... Use Excel functions, formulas (mathematical operations), or both to duplicate the answers provided. so the answers

This is the direction given on the assignment ... Use Excel functions, formulas (mathematical operations), or both to duplicate the answers provided.

so the answers to each question has already been given to me but now I need to find out the formulas, functions, and/or equations that were used to get to the answer.

214 214 1,Future Value, what is the future value of 1 Answer a. $226 invested for 13 years at 9 percent compounded annually? $692.87 $532.01 $1,001.74 $828.95 b. $267 invested for 8 years at 9 percent compounded annually? c. $464 invested for 10 years at 8 percent compounded annually? 7 d. $696 invested for 3 years at 6 percent compounded annually? 2. Present Value. What is the present value of 0 a. $856 to be received 12 years from now at a 8 percent discount rate? 1 339.93 $161.27 $516.26 $218.70 b. $561 to be received 11 years from now at a 12 percent discount rate? 2 c. $1032 to be received 9 years from now at a 8 percent discount rate? 3 d. $504 to be received 8 years from now at a 11 percent discount rate? 5 3. Future Value of an Annuity. What is the future value of 6 $10,208.48 $9,410.58 $15,862.62 $29,501.14 a. $1196 a year for 6 years at 14 percent compounded annually? 7 b. $693 a year for 9 years at 10 percent compounded annually? c. $945 a year for 9 years at 15 percent compounded annually? 9 8 d. $785 a year for 14 years at 14 percent compounded annually? 1 4. Present Value of an Annuity. What is the present value of 2 a. $740 a year for 12 years at a 8 percent discount rate? $5,576.70 $2,099.33 $2,785.56 $6,005.5:2 b. $460 a year for 7 years at a 12 percent discount rate? 4 3 c. $493 a year for 10 years at a 12 percent discount rate? 5 d. $895 a year for 10 years at a 8 percent discount rate? 5. How many years will it take to grow 8 7 a. $436 to a value of 2,086.08 at a compound rate of 11 percent? 9 15 b. $704 to a value of 1,980.12 at a compound rate of 9 percent? 0 12 c. $444 to a value of 1,443.87 at a compound rate of 14 percent? 1 d. $807 to a value of 2,838.93 at a compound rate of 15 percent? 6. Interest Rate. At what interest rate will it take to grow 4 3 a. $755 to a value of 2,093.67 over 9 years? 12 b. $731 to a value of 2,481.43 over 10 years? 6 5 13 c. $659 to a value of 1,699.25 over 14 years? 7 d. $1092 to a value of 2,904.74 over 7 years? 15 97. Annuity. How many years will it take for a payment of 0 a. $876 to grow to 16,233.30 at a compound rate of 10 percent? 1 b. $378 from a future value of 9,498.77 at a compound rate of 7 percent? 2 c. $1138 from a future value of 11,133.37 at a compound rate of 11 percent? 3 d. $676 from a future value of 27,322.21 at a compound rate of 13 percent? 4 58. Annuity. At what interst rate will a payment of 6 a. $864 grow to 8,716.91 over a period of 7 years? 7 b. $437 grow to 17,700.56 over a period of 14 years? 8 c. $299 grow to 4,060.26 over a period of 9 years? 9 d. $849 grow to 6,912.57 over a period of 7 years? 15 15 12 15 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts