Question: This is the entire question Consider this case: Big Kahuna Burger Inc. needs to take out a one-year bank loan of $400,000 and has been

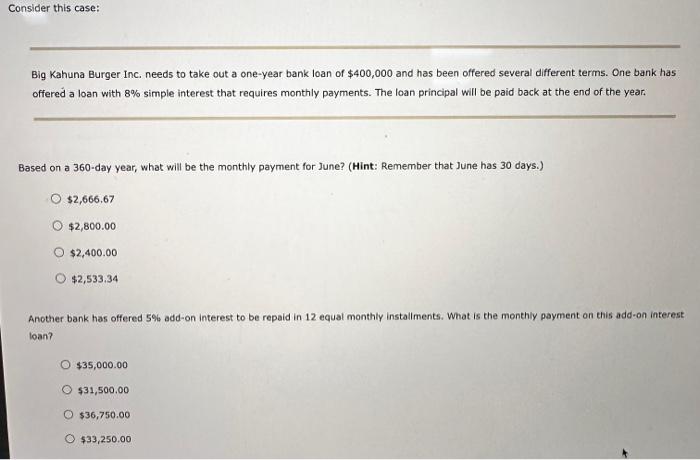

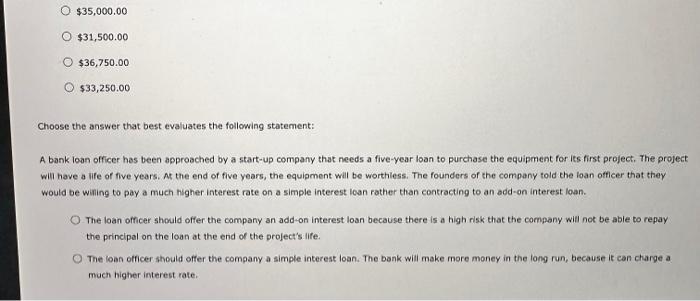

Consider this case: Big Kahuna Burger Inc. needs to take out a one-year bank loan of $400,000 and has been offered several different terms. One bank has offered a loan with 8% simple interest that requires monthly payments. The loan principal will be paid back at the end of the year. Based on a 360-day year, what will be the monthly payment for June? (Hint: Remember that June has 30 days.) $2,666.67$2,800.00$2,400.00$2,533.34 Another bank has offered 5% add-on interest to be repaid in 12 equal monthly installments. What is the monthly payment on this add-on interest loan? $35,000.00$31,500.00$36,750.00$33,250.00 $35,000.00$31,500.00$36,750.00$33,250.00 Choose the answer that best evaluates the following statement: A bank loan officer has been approached by a start-up company that needs a five-year loan to purchase the equipment for its first project, The project will have a life of five years. At the end of five years, the equipment will be worthless. The founders of the company told the loan offlcer that they would be wining to pay a much higher interest rate on a simple interest lean rather than contracting to an acd-on interest loan. The loan officer should offer the company an add-on interest loan because there is a high risk that the company will not be able to repay the principal on the loan at the end of the project's life. The loan officer sheuld offer the company a simple interest loan. The bank will make more money in the long run, because it can charge a much higher interest rate. $2,666.67$2,800.00$2,400.00$2,533.34 Another bank has offered 5% add-on interest to be repaid in 12 equal monthly installments. What is the monthly payment on this add-on interest loan? $35,000.00$31,500.00$36,750.00$33,250.00 Choose the answer that best evaluates the following statement: A bank loan officer has been approached by a start-up company that needs a five-year loan to purchase the equipment for is fifst project. The project will have a life of five years. At the end of five years, the equipment will be worthless. The founders of the company told the loan officer that they would be willing to pay a much higher interest rate on a simple interest loan rather than contracting to an add-on interest loan. The loon oflcer should offer the company an add-on interest loan because there is a high risk that the company will not be able to repay the prindipal on the loan at the end of the project's life. The loan officer should offer the company a simple interest loan. The bank will make more money in the long run, becsuse it con charge a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts