Question: This is the format I need it to be . Mainly the Fixed ratio allocation. Can someone explain how to figure this out? Partnership A,

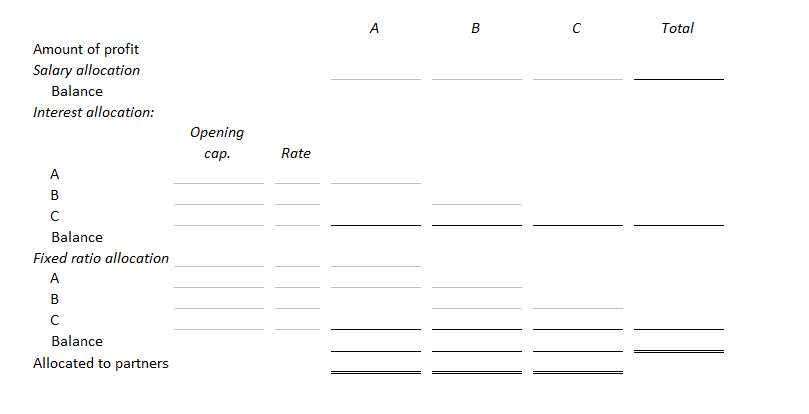

This is the format I need it to be . Mainly the Fixed ratio allocation. Can someone explain how to figure this out?

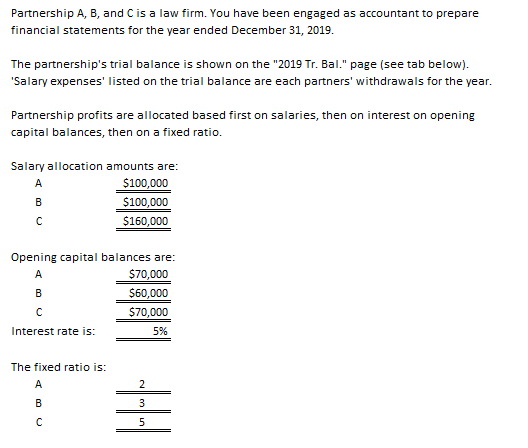

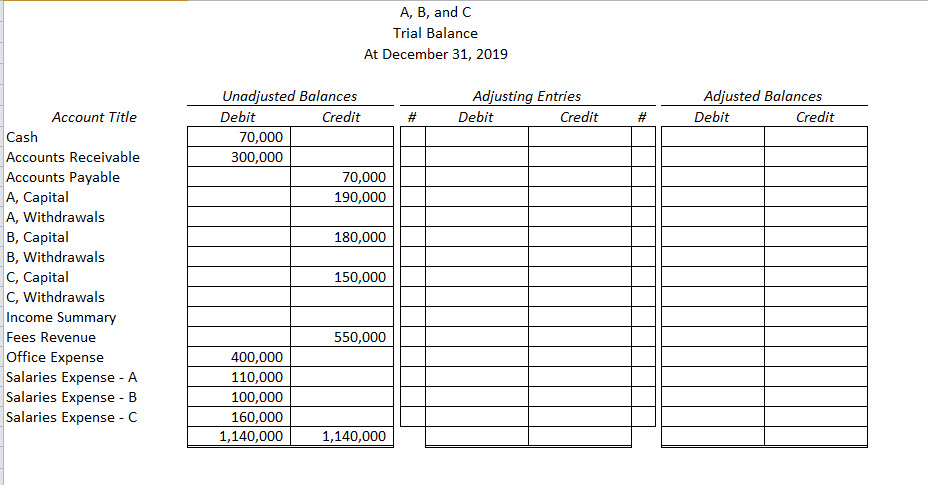

Partnership A, B, and C is a law firm. You have been engaged as accountant to prepare financial statements for the year ended December 31, 2019. The partnership's trial balance is shown on the "2019 Tr. Bal." page (see tab below). 'Salary expenses' listed on the trial balance are each partners' withdrawals for the year. Partnership profits are allocated based first on salaries, then on interest on opening capital balances, then on a fixed ratio. Salary allocation amounts are: A $100,000 B $100,000 $160,000 Opening capital balances are: A $70,000 B $60,000 C $70,000 Interest rate is: 5% The fixed ratio is: 2 B 3 5 A, B, and C Trial Balance At December 31, 2019 Adjusting Entries Debit Credit Adjusted Balances Debit Credit # # Unadjusted Balances Debit Credit 70,000 300,000 70,000 190,000 180,000 Account Title Cash Accounts Receivable Accounts Payable A, Capital A, Withdrawals B, Capital B, Withdrawals C, Capital C, Withdrawals Income Summary Fees Revenue Office Expense Salaries Expense - A Salaries Expense - B Salaries Expense- 150,000 550,000 400,000 110,000 100,000 160,000 1,140,000 1,140,000 A B Total Amount of profit Salary allocation Balance Interest allocation: Opening cap. Rate A B C Balance Fixed ratio allocation A B Balance Allocated to partners

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts