Question: This is the full and complete question Explain why an Interest Rate Swap (assume LIBOR as the floating rate) with quarterly settlement (assume 90 days

This is the full and complete question

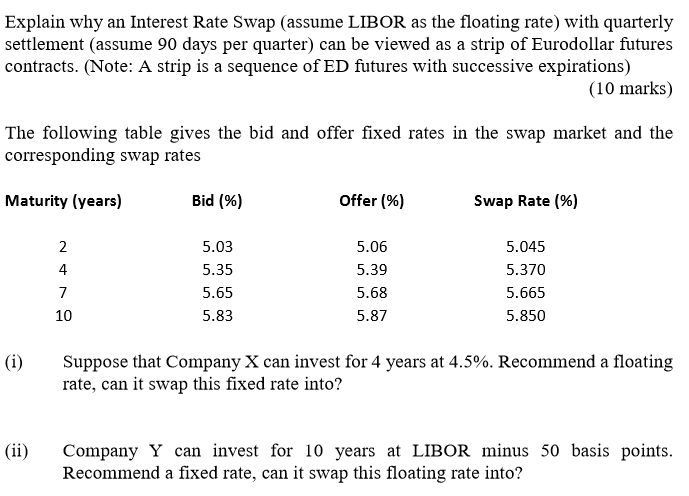

Explain why an Interest Rate Swap (assume LIBOR as the floating rate) with quarterly settlement (assume 90 days per quarter) can be viewed as a strip of Eurodollar futures contracts. (Note: A strip is a sequence of ED futures with successive expirations) (10 marks) The following table gives the bid and offer fixed rates in the swap market and the corresponding swap rates Maturity (years) Bid (%) Offer (96) Swap Rate (%) 5.03 5.35 5.65 5.83 5.06 5.39 5.68 5.87 5.045 5.370 5.665 5.850 4 10 Suppose that Company X can invest for 4 years at 4.5%. Recommend a floating rate, can it swap this fixed rate into? (ii) Company Y can invest for 10 years at LIBOR minus 50 basis points Recommend a fixed rate, can it swap this floating rate into

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts