Question: This is the full and complete question with missing links or information Consider a two-factor economy. Assets A and B are well-diversified portfolios. The risk-free

This is the full and complete question with missing links or information

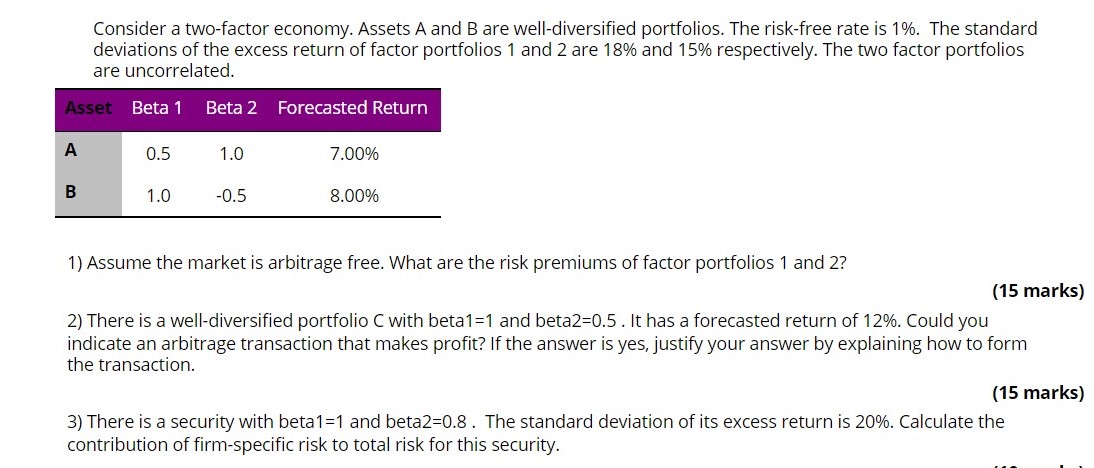

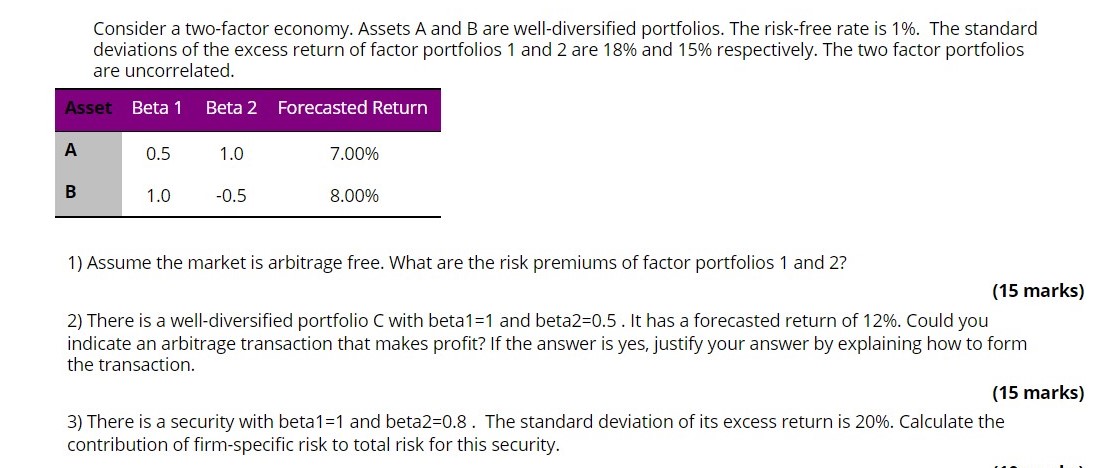

Consider a two-factor economy. Assets A and B are well-diversified portfolios. The risk-free rate is 1%. The standard deviations of the excess return offactor portfolios 1 and 2 are 18% and 15% respectively. The two factor portfolios are uncorrelated. Beta1 Beta 2 Forecasted Return 1) Assume the market is arbitrage free. What are the risk premiums of factor portfolios 1 and 2? (15 marks) 2) There is a well-diversified portfolio C with beta1=1 and beta2=0.5 . It has a forecasted return of 12%. Could you indicate an arbitrage transaction that makes profit? if the answer is yes. justify your answer by explaining how to form the transaction. (15 marks) 3) There is a security with beta1 =1 and beta2=0.8 . The standard deviation of its excess return is 20%. Calculate the contribution of firm-specic risk to total risk for this security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts