Question: This is the full info I have, please let me know what else you need? Consider a situation where homebuyers find the home of their

This is the full info I have, please let me know what else you need?

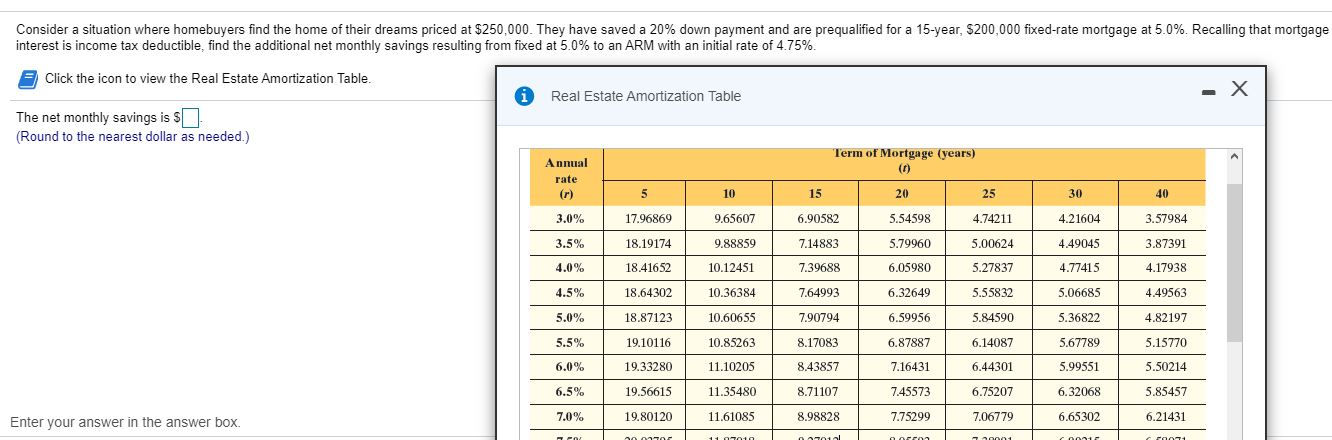

Consider a situation where homebuyers find the home of their dreams priced at $250,000. They have saved a 20% down payment and are prequalified for a 15-year, $200,000 fixed-rate mortgage at 5.0%. Recalling that mortgage interest is income tax deductible, find the additional net monthly savings resulting from fixed at 5.0% to an ARM with an initial rate of 4.75% Click the icon to view the Real Estate Amortization Table. Real Estate Amortization Table x The net monthly savings is $ (Round to the nearest dollar as needed.) Term of Mortgage (years) (1) Annual rate (r) 5 10 15 20 25 30 40 3.0% 17.96869 9.65607 6.90582 5.54598 4.74211 4.21604 3.57984 3.5% 18.19174 9.88859 7.14883 5.79960 5.00624 4.49045 3.87391 4.0% 18.41652 10.12451 7.39688 6.05980 5.27837 4.77415 4.17938 4.5% 18.64302 10.36384 7.64993 6.32649 5.55832 5.06685 4.49563 5.0% 10.60655 7.90794 6.59956 5.84590 5.36822 4.82197 5.5% 18.87123 19.10116 19.33280 10.85263 8.17083 6.87887 6.14087 5.67789 5.15770 6.0% 11.10205 8.43857 7.16431 6.44301 5.99551 5.50214 6.5% 19.56615 11.35480 8.71107 7.45573 6.75207 6.32068 5.85457 7.0% 19.80120 11.61085 8.98828 7.75299 7.06779 6.65302 6.21431 Enter your answer in the answer box 2000- 1 1 1 01010 narron 1 2000 021- c01 Consider a situation where homebuyers find the home of their dreams priced at $250,000. They have saved a 20% down payment and are prequalified for a 15-year, $200,000 fixed-rate mortgage at 5.0%. Recalling that mortgage interest is income tax deductible, find the additional net monthly savings resulting from fixed at 5.0% to an ARM with an initial rate of 4.75% Click the icon to view the Real Estate Amortization Table. Real Estate Amortization Table x The net monthly savings is $ (Round to the nearest dollar as needed.) Term of Mortgage (years) (1) Annual rate (r) 5 10 15 20 25 30 40 3.0% 17.96869 9.65607 6.90582 5.54598 4.74211 4.21604 3.57984 3.5% 18.19174 9.88859 7.14883 5.79960 5.00624 4.49045 3.87391 4.0% 18.41652 10.12451 7.39688 6.05980 5.27837 4.77415 4.17938 4.5% 18.64302 10.36384 7.64993 6.32649 5.55832 5.06685 4.49563 5.0% 10.60655 7.90794 6.59956 5.84590 5.36822 4.82197 5.5% 18.87123 19.10116 19.33280 10.85263 8.17083 6.87887 6.14087 5.67789 5.15770 6.0% 11.10205 8.43857 7.16431 6.44301 5.99551 5.50214 6.5% 19.56615 11.35480 8.71107 7.45573 6.75207 6.32068 5.85457 7.0% 19.80120 11.61085 8.98828 7.75299 7.06779 6.65302 6.21431 Enter your answer in the answer box 2000- 1 1 1 01010 narron 1 2000 021- c01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts