Question: This is the full problem but please solve queations 2.4 and 2.5 An analyst in the risk management department of Kenowefa Bank is evaluating the

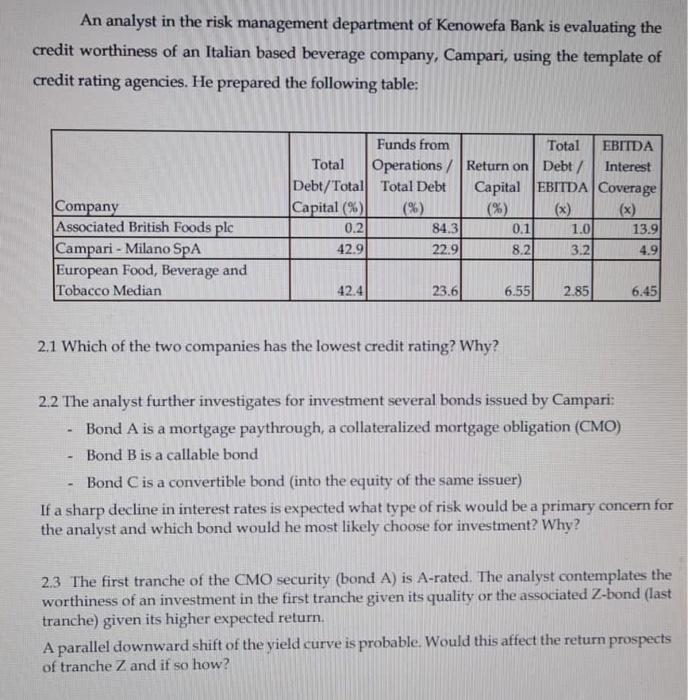

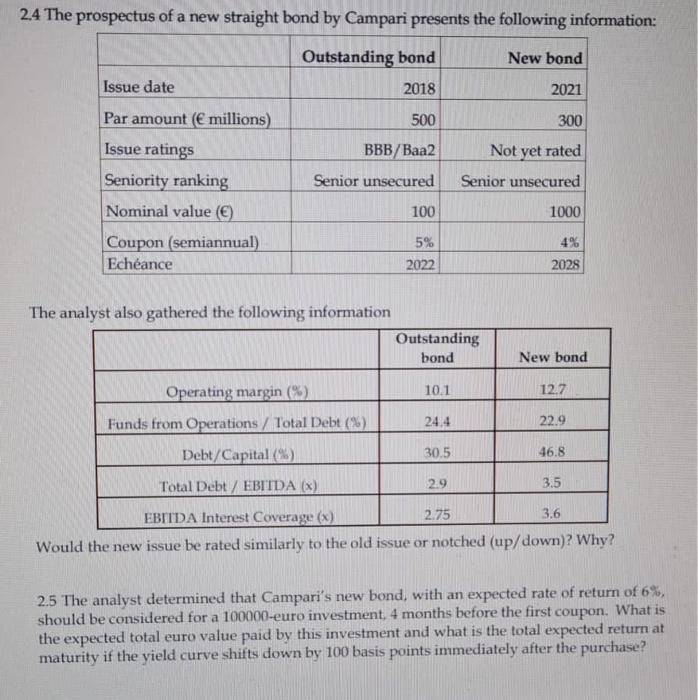

An analyst in the risk management department of Kenowefa Bank is evaluating the credit worthiness of an Italian based beverage company, Campari, using the template of credit rating agencies. He prepared the following table: Company Associated British Foods plc Campari - Milano SpA European Food, Beverage and Tobacco Median Funds from Total EBITDA Total Operations / Return on Debt / Interest Debt/Total Total Debt Capital EBITDA Coverage Capital (%) 0.2 84.31 0.1 1.0 13.9 42.9 22.9 8.2 3.2 4.91 42.4 23.6 6.55 2.85 6.45 2.1 Which of the two companies has the lowest credit rating? Why? 2.2 The analyst further investigates for investment several bonds issued by Campari: Bond A is a mortgage paythrough a collateralized mortgage obligation (CMO) Bond B is a callable bond Bond C is a convertible bond (into the equity of the same issuer) If a sharp decline in interest rates is expected what type of risk would be a primary concern for the analyst and which bond would he most likely choose for investment? Why? 2.3 The first tranche of the CMO security (bond A) is A-rated. The analyst contemplates the worthiness of an investment in the first tranche given its quality or the associated Z-bond (last tranche) given its higher expected return. A parallel downward shift of the yield curve is probable. Would this affect the return prospects of tranche Z and if so how? 2.4 The prospectus of a new straight bond by Campari presents the following information: Outstanding bond New bond Issue date 2018 2021 500 300 BBB/Baa2 Not yet rated Senior unsecured Senior unsecured Par amount ( millions) Issue ratings Seniority ranking Nominal value (E) Coupon (semiannual) Echance 100 1000 5% 2022 2028 The analyst also gathered the following information Outstanding bond New bond 10.1 12.7 Operating margin (%) Funds from Operations / Total Debt (%) Debt/Capital (%) 24.4 22.9 30.5 46.8 Total Debt / EBITDA (X) 2.9 3.5 EBITDA Interest Coverage (8) 2.75 3.6 Would the new issue be rated similarly to the old issue or notched (up/down)? Why? 2.5 The analyst determined that Campari's new bond, with an expected rate of return of 6%, should be considered for a 100000-euro investment 4 months before the first coupon. What is the expected total euro value paid by this investment and what is the total expected return at maturity if the yield curve shifts down by 100 basis points immediately after the purchase? An analyst in the risk management department of Kenowefa Bank is evaluating the credit worthiness of an Italian based beverage company, Campari, using the template of credit rating agencies. He prepared the following table: Company Associated British Foods plc Campari - Milano SpA European Food, Beverage and Tobacco Median Funds from Total EBITDA Total Operations / Return on Debt / Interest Debt/Total Total Debt Capital EBITDA Coverage Capital (%) 0.2 84.31 0.1 1.0 13.9 42.9 22.9 8.2 3.2 4.91 42.4 23.6 6.55 2.85 6.45 2.1 Which of the two companies has the lowest credit rating? Why? 2.2 The analyst further investigates for investment several bonds issued by Campari: Bond A is a mortgage paythrough a collateralized mortgage obligation (CMO) Bond B is a callable bond Bond C is a convertible bond (into the equity of the same issuer) If a sharp decline in interest rates is expected what type of risk would be a primary concern for the analyst and which bond would he most likely choose for investment? Why? 2.3 The first tranche of the CMO security (bond A) is A-rated. The analyst contemplates the worthiness of an investment in the first tranche given its quality or the associated Z-bond (last tranche) given its higher expected return. A parallel downward shift of the yield curve is probable. Would this affect the return prospects of tranche Z and if so how? 2.4 The prospectus of a new straight bond by Campari presents the following information: Outstanding bond New bond Issue date 2018 2021 500 300 BBB/Baa2 Not yet rated Senior unsecured Senior unsecured Par amount ( millions) Issue ratings Seniority ranking Nominal value (E) Coupon (semiannual) Echance 100 1000 5% 2022 2028 The analyst also gathered the following information Outstanding bond New bond 10.1 12.7 Operating margin (%) Funds from Operations / Total Debt (%) Debt/Capital (%) 24.4 22.9 30.5 46.8 Total Debt / EBITDA (X) 2.9 3.5 EBITDA Interest Coverage (8) 2.75 3.6 Would the new issue be rated similarly to the old issue or notched (up/down)? Why? 2.5 The analyst determined that Campari's new bond, with an expected rate of return of 6%, should be considered for a 100000-euro investment 4 months before the first coupon. What is the expected total euro value paid by this investment and what is the total expected return at maturity if the yield curve shifts down by 100 basis points immediately after the purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts