Question: this is the full question, any help will be appreciated im stuck at b) and d) Question 2 (a) In the context of asset pricing

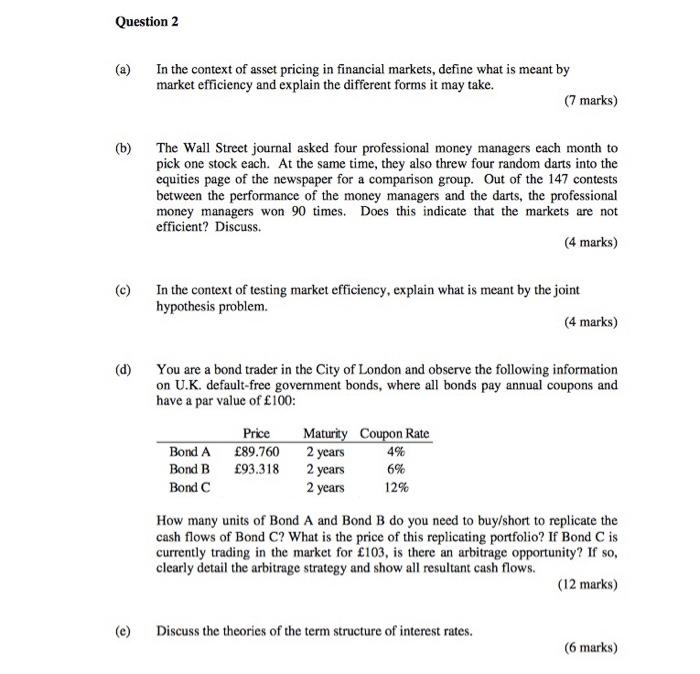

Question 2 (a) In the context of asset pricing in financial markets, define what is meant by market efficiency and explain the different forms it may take. (7 marks) (b) The Wall Street journal asked four professional money managers each month to pick one stock each. At the same time, they also threw four random darts into the equities page of the newspaper for a comparison group. Out of the 147 contests between the performance of the money managers and the darts, the professional money managers won 90 times. Does this indicate that the markets are not efficient? Discuss. (4 marks) In the context of testing market efficiency, explain what is meant by the joint hypothesis problem. (4 marks) (d) You are a bond trader in the City of London and observe the following information on U.K. default-free government bonds, where all bonds pay annual coupons and have a par value of 100: Price Maturity Coupon Rate Bond A 89.760 2 years 4% Bond B 93.318 2 years Bond C 2 years 12% How many units of Bond A and Bond B do you need to buy/short to replicate the cash flows of Bond C? What is the price of this replicating portfolio? If Bond C is currently trading in the market for 103, is there an arbitrage opportunity? If so, clearly detail the arbitrage strategy and show all resultant cash flows. (12 marks) 6% (e) Discuss the theories of the term structure of interest rates. (6 marks) Question 2 (a) In the context of asset pricing in financial markets, define what is meant by market efficiency and explain the different forms it may take. (7 marks) (b) The Wall Street journal asked four professional money managers each month to pick one stock each. At the same time, they also threw four random darts into the equities page of the newspaper for a comparison group. Out of the 147 contests between the performance of the money managers and the darts, the professional money managers won 90 times. Does this indicate that the markets are not efficient? Discuss. (4 marks) In the context of testing market efficiency, explain what is meant by the joint hypothesis problem. (4 marks) (d) You are a bond trader in the City of London and observe the following information on U.K. default-free government bonds, where all bonds pay annual coupons and have a par value of 100: Price Maturity Coupon Rate Bond A 89.760 2 years 4% Bond B 93.318 2 years Bond C 2 years 12% How many units of Bond A and Bond B do you need to buy/short to replicate the cash flows of Bond C? What is the price of this replicating portfolio? If Bond C is currently trading in the market for 103, is there an arbitrage opportunity? If so, clearly detail the arbitrage strategy and show all resultant cash flows. (12 marks) 6% (e) Discuss the theories of the term structure of interest rates. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts