Question: This is the full question as asked. Comprehensive Consolidated Working Paper, Consolidated Financial Statements Several years ago PK Flyers acquired 65 percent of the voting

This is the full question as asked.

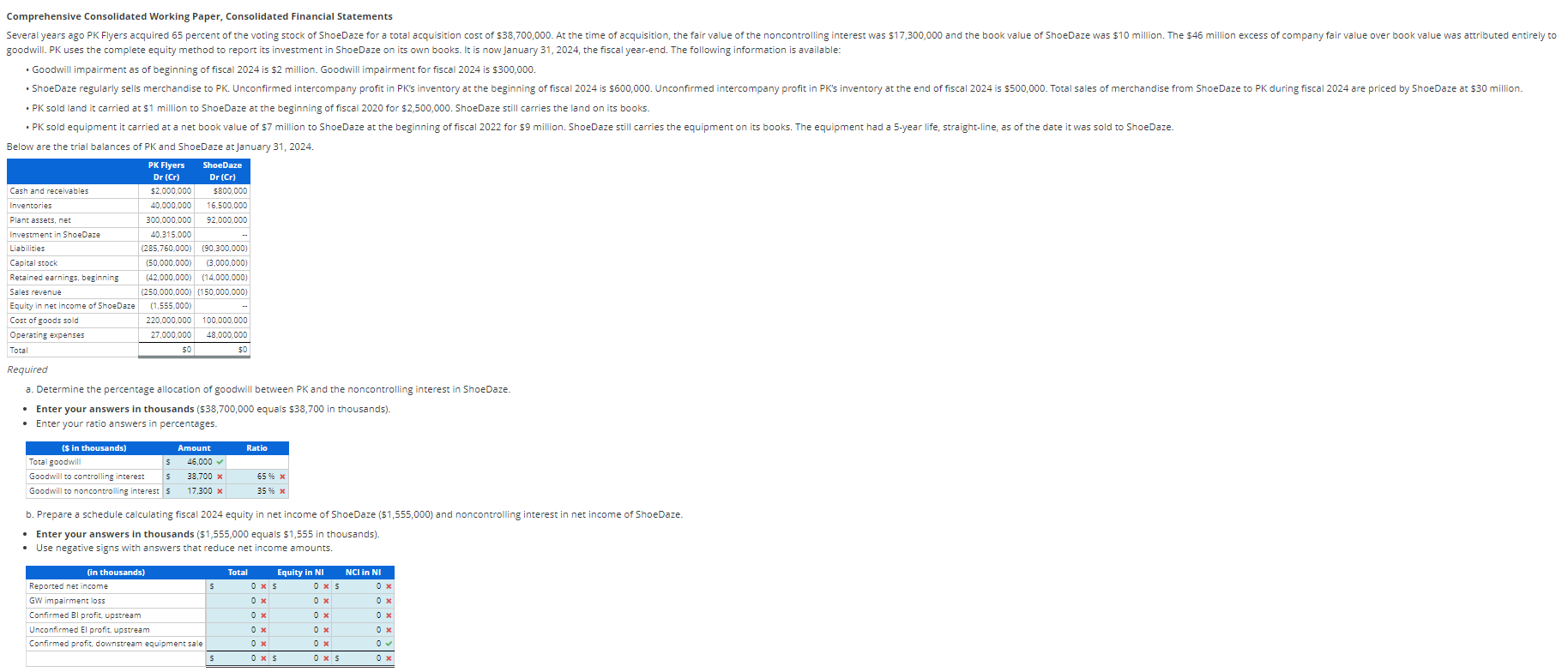

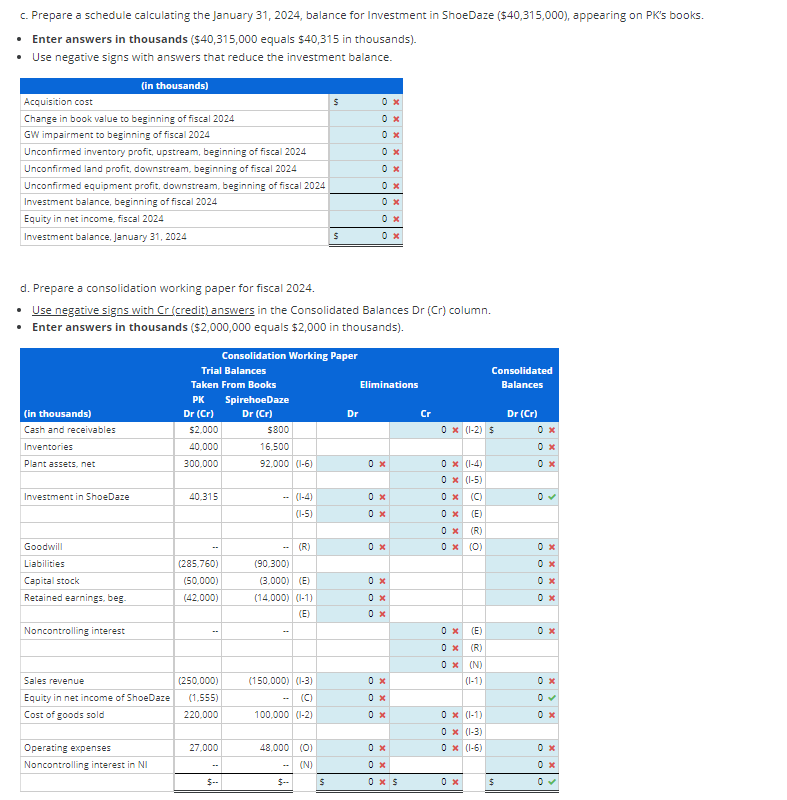

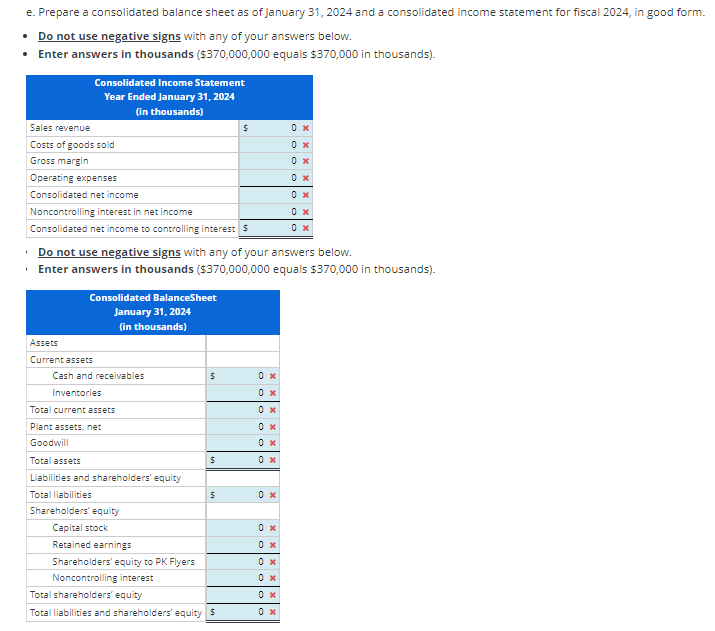

Comprehensive Consolidated Working Paper, Consolidated Financial Statements Several years ago PK Flyers acquired 65 percent of the voting stock of ShoeDaze for a total acquisition cost of $38,700,000. At the time of acquisition, the fair value of the noncontrolling interest was $17,300,000 and the book value of ShoeDaze was $10 million. The $46 million excess of company fair value over book value was attributed entirely to goodwill. PK uses the complete equity method to report its investment in ShoeDaze on its own books. It is now January 31, 2024, the fiscal year-end. The following information is available: . Goodwill impairment as of beginning of fiscal 2024 is $2 million. Goodwill impairment for fiscal 2024 is $300,000. . ShoeDaze regularly sells merchandise to PK. Unconfirmed intercompany profit in PK's inventory at the beginning of fiscal 2024 is $600,000. Unconfirmed intercompany profit in PK's inventory at the end of fiscal 2024 is $500,000. Total sales of merchandise from ShoeDaze to PK during fiscal 2024 are priced by ShoeDaze at $30 million. PK sold land it carried at $1 million to ShoeDaze at the beginning of fiscal 2020 for $2,500,000. ShoeDaze still carries the land on its books. . PK sold equipment it carried at a net book value of $7 million to ShoeDaze at the beginning of fiscal 2022 for $9 million. ShoeDaze still carries the equipment on its books. The equipment had a 5-year life, straight-line, as of the date it was sold to ShoeDaze. Below are the trial balances of PK and ShoeDaze at January 31, 2024. PK Flyers ShoeDaze Dr (Cr) Dr (Cr) Cash and receivables $2,000,000 $800,000 Inventories 40,000,000 16,500,000 Plant assets, net 300,000,000 92,000,000 Investment in ShoeDaze 40,315,000 Liabilities (285,760,000) (90,300,000) Capital stock (50,000,000) (3,000,000) Retained earnings, beginning (42,000.000) (14,000,000) Sales revenue (250,000,000) (150,000,000) Equity in net income of ShoeDaze (1,555,000) Cost of goods sold 220,000,000 100,000,000 Operating expenses 27,000,000 48,000,000 Total so Required a. Determine the percentage allocation of goodwill between PK and the noncontrolling interest in ShoeDaze. Enter your answers in thousands ($38,700,000 equals $38,700 in thousands). Enter your ratio answers in percentages. ($ in thousands) Amount Ratio Total goodwill 46,000 Goodwill to controlling interest 38,700 * 65 % % Goodwill to noncontrolling interest $ 17,300 * 35 % % b. Prepare a schedule calculating fiscal 2024 equity in net income of ShoeDaze ($1,555,000) and noncontrolling interest in net income of ShoeDaze. Enter your answers in thousands ($1,555,000 equals $1,555 in thousands). Use negative signs with answers that reduce net income amounts. (in thousands Tota Equity in NI NCI in NI Reported net income $ 0 x S 0 x GW impairment loss 0 0 x Confirmed BI profit, upstream O X 0 x Unconfirmed El profit, upstream 0 x 0 x Confirmed profit, downstream equipment sale O X 0 x OV D X D x 0 xc. Prepare a schedule calculating the January 31, 2024, balance for Investment in ShoeDaze ($40,315,000), appearing on PK's books. . Enter answers in thousands ($40,315,000 equals $40,315 in thousands). Use negative signs with answers that reduce the investment balance (in thousands) Acquisition cost Change in book value to beginning of fiscal 2024 GW impairment to beginning of fiscal 2024 Unconfirmed inventory profit, upstream, beginning of fiscal 2024 0 * Unconfirmed land profit, downstream, beginning of fiscal 2024 Unconfirmed equipment profit, downstream, beginning of fiscal 2024 0 * Investment balance, beginning of fiscal 2024 Equity in net income, fiscal 2024 Investment balance, January 31, 2024 d. Prepare a consolidation working paper for fiscal 2024. Use negative signs with Cr (credit) answers in the Consolidated Balances Dr (Cr) column. Enter answers in thousands ($2,000,000 equals $2,000 in thousands). Consolidation Working Paper Trial Balances Consolidated Taken From Books Eliminations Balances PK SpirehoeDaze (in thousands) Or (Cr) Dr (Cr) Dr Cr Dr (Cr) Cash and receivables $2,000 $800 0 x (1-2) $ Inventories 40,00 16,500 Plant assets, net 300,000 92,000 (1-6) 0 x 0 x (1-4) 0 x (1-5) Investment in ShoeDaze 40,315 - (1-4) 0 x 0 x (C) (-51 O X (E) 0 x (R) Goodwill (R) 0 x 0 x (0) 0 * Liabilities (285,760) (90 300) 0 # Capital stock (50,000) (3.000) (E) 0 x 0 * Retained earnings, beg (42.000) (14,000) (1-1) 0 x (E) Noncontrolling interest D X (E) O X (R) 0 * (N) Sales revenue (250,000) (150,000) (1-3) (1-1) 0 * Equity in net income of ShoeDaze (1,555) (C) 0 x Cost of goods sold 220,000 100,000 (1-2) 0 * (1-1) 0 * (1-3) Operating expenses 27,000 48,000 (0) 0 x D X (1-6) 0 * Noncontrolling interest in NI (N) $-e. Prepare a consolidated balance sheet as of January 31, 2024 and a consolidated income statement for fiscal 2024, in good form. . Do not use negative signs with any of your answers below. . Enter answers in thousands ($370,000,000 equals $370,000 in thousands). Consolidated Income Statement Year Ended January 31, 2024 (in thousands) Sales revenue 0 * Costs of goods sold 0 # Gross margin 0 * Operating expenses 0 # Consolidated net income 0 x Noncontrolling interest in net income 0 * Consolidated net income to controlling interest $ Do not use negative signs with any of your answers below. Enter answers in thousands ($370,000,000 equals $370,000 in thousands). Consolidated BalanceSheet January 31, 2024 (in thousands) Assets Current assets Cash and receivables 0 * Inventories 0 # Total current assets 0 # Plant assets, net 0 # Goodwill Total assets 0 * Liabilities and shareholders' equity Total liabilities Shareholders' equity Capital stock 0 # Retained earnings 0 # Shareholders' equity to PK Flyers 0 # Noncontrolling interest Total shareholders' equity Total liabilities and shareholders' equity $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts