Question: This is the full question, no additional information was given QUESTION 2 CAPITAL GAINS TAX Part (a) Loma Curtail has decided that she would like

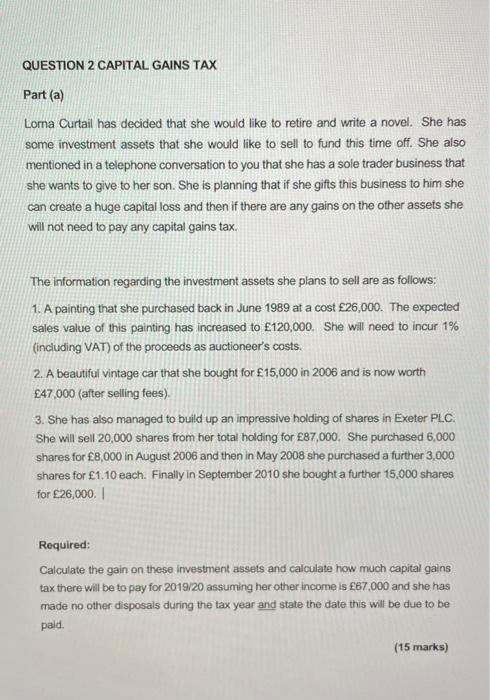

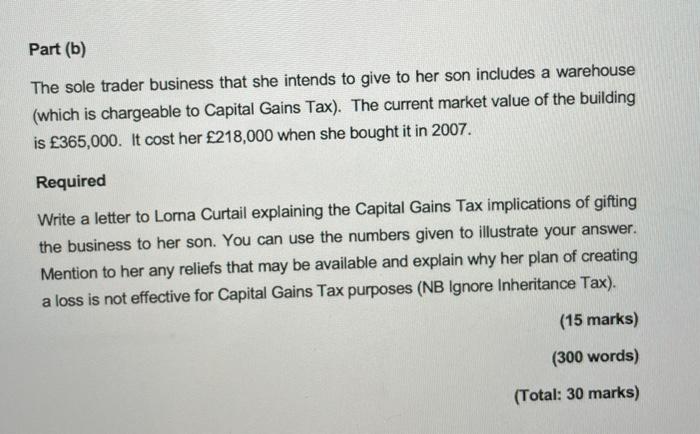

QUESTION 2 CAPITAL GAINS TAX Part (a) Loma Curtail has decided that she would like to retire and write a novel. She has some investment assets that she would like to sell to fund this time off. She also mentioned in a telephone conversation to you that she has a sole trader business that she wants to give to her son. She is planning that if she gifts this business to him she can create a huge capital loss and then if there are any gains on the other assets she will not need to pay any capital gains tax. The information regarding the investment assets she plans to sell are as follows: 1. A painting that she purchased back in June 1989 at a cost 26,000. The expected sales value of this painting has increased to 120,000. She will need to incur 1% (including VAT) of the proceeds as auctioneer's costs. 2. A beautiful Vintage car that she bought for 15,000 in 2006 and is now worth 47,000 (after selling fees). 3. She has also managed to build up an impressive holding of shares in Exeter PLC. She will sell 20,000 shares from her total holding for 87,000. She purchased 6,000 shares for 8,000 in August 2006 and then in May 2008 she purchased a further 3,000 shares for 1.10 each. Finally in September 2010 she bought a further 15,000 shares for 26,000. Required: Calculate the gain on these investment assets and calculate how much capital gains tax there will be to pay for 2019/20 assuming her other income is 67,000 and she has made no other disposals during the tax year and state the date this will be due to be pald. (15 marks) Part (b) The sole trader business that she intends to give to her son includes a warehouse (which is chargeable to Capital Gains Tax). The current market value of the building is 365,000. It cost her 218,000 when she bought it in 2007. Required Write a letter to Lorna Curtail explaining the Capital Gains Tax implications of gifting the business to her son. You can use the numbers given to illustrate your answer. Mention to her any reliefs that may be available and explain why her plan of creating a loss is not effective for Capital Gains Tax purposes (NB Ignore Inheritance Tax). (15 marks) (300 words) (Total: 30 marks) QUESTION 2 CAPITAL GAINS TAX Part (a) Loma Curtail has decided that she would like to retire and write a novel. She has some investment assets that she would like to sell to fund this time off. She also mentioned in a telephone conversation to you that she has a sole trader business that she wants to give to her son. She is planning that if she gifts this business to him she can create a huge capital loss and then if there are any gains on the other assets she will not need to pay any capital gains tax. The information regarding the investment assets she plans to sell are as follows: 1. A painting that she purchased back in June 1989 at a cost 26,000. The expected sales value of this painting has increased to 120,000. She will need to incur 1% (including VAT) of the proceeds as auctioneer's costs. 2. A beautiful Vintage car that she bought for 15,000 in 2006 and is now worth 47,000 (after selling fees). 3. She has also managed to build up an impressive holding of shares in Exeter PLC. She will sell 20,000 shares from her total holding for 87,000. She purchased 6,000 shares for 8,000 in August 2006 and then in May 2008 she purchased a further 3,000 shares for 1.10 each. Finally in September 2010 she bought a further 15,000 shares for 26,000. Required: Calculate the gain on these investment assets and calculate how much capital gains tax there will be to pay for 2019/20 assuming her other income is 67,000 and she has made no other disposals during the tax year and state the date this will be due to be pald. (15 marks) Part (b) The sole trader business that she intends to give to her son includes a warehouse (which is chargeable to Capital Gains Tax). The current market value of the building is 365,000. It cost her 218,000 when she bought it in 2007. Required Write a letter to Lorna Curtail explaining the Capital Gains Tax implications of gifting the business to her son. You can use the numbers given to illustrate your answer. Mention to her any reliefs that may be available and explain why her plan of creating a loss is not effective for Capital Gains Tax purposes (NB Ignore Inheritance Tax). (15 marks) (300 words) (Total: 30 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts