Question: This is the given question, it is not wrong. I saw many people solve it with different numbers. They calculate the weight of portfolio themselves.

This is the given question, it is not wrong. I saw many people solve it with different numbers. They calculate the weight of portfolio themselves. If you can't solve it, please give it to someone else.

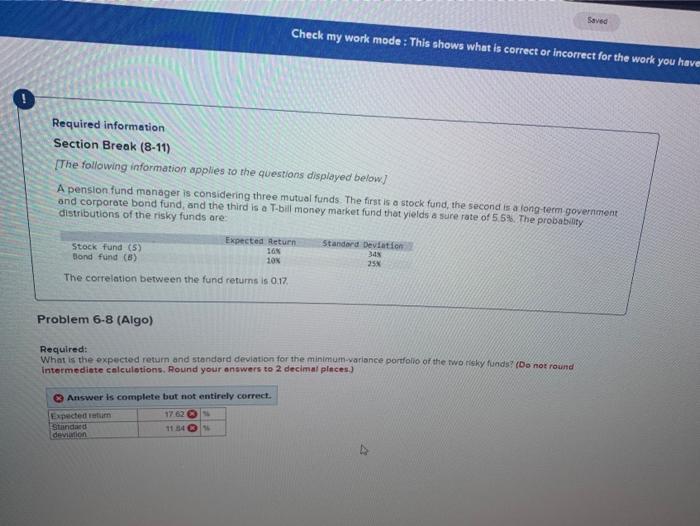

Saved Check my work mode: This shows what is correct or incorrect for the work you have Required information Section Break (8-11) [The following information applies to the questions displayed below) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 5.5%. The probability distributions of the risky funds are Expected Return Standard deviation Stock fund (5) 16 Bond fund (8) 10% 25 The correlation between the fund returns is 0.17 Problem 6-8 (Algo) Required: What is the expected return and standard deviation for the minimum variance portfolio of the two rieky funds? (Do not round Intermediate calculations. Round your answers to 2 decimal places) 3 Answer is complete but not entirely correct. Expected return 17.62 Standard 11 54 devin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts