Question: This is the inputs for problem 7. I need the answers to Q.9 (a) and (b). Call B DE I G BINOMIAL OPTION PRICING 1

This is the inputs for problem 7. I need the answers to Q.9 (a) and (b).

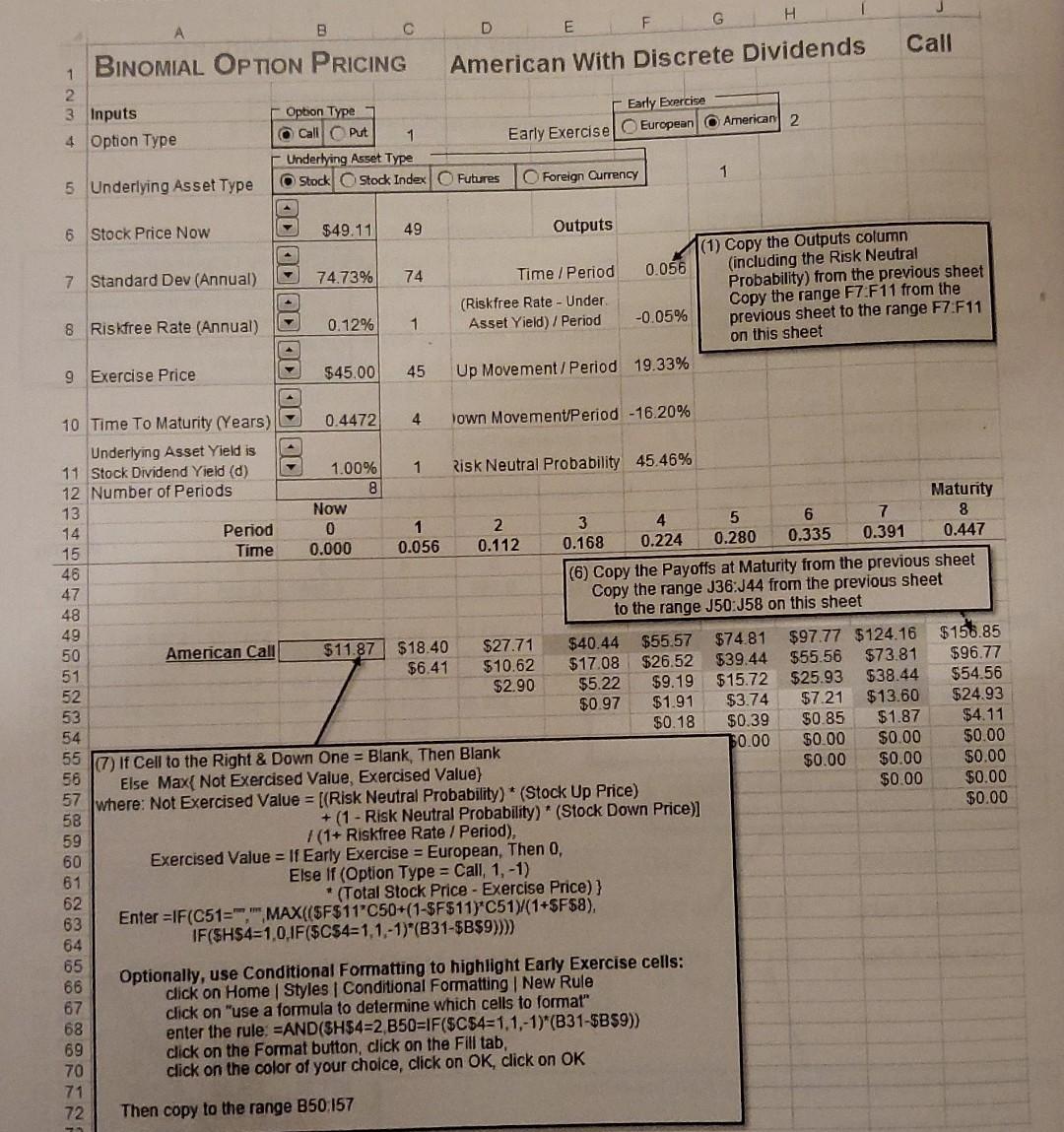

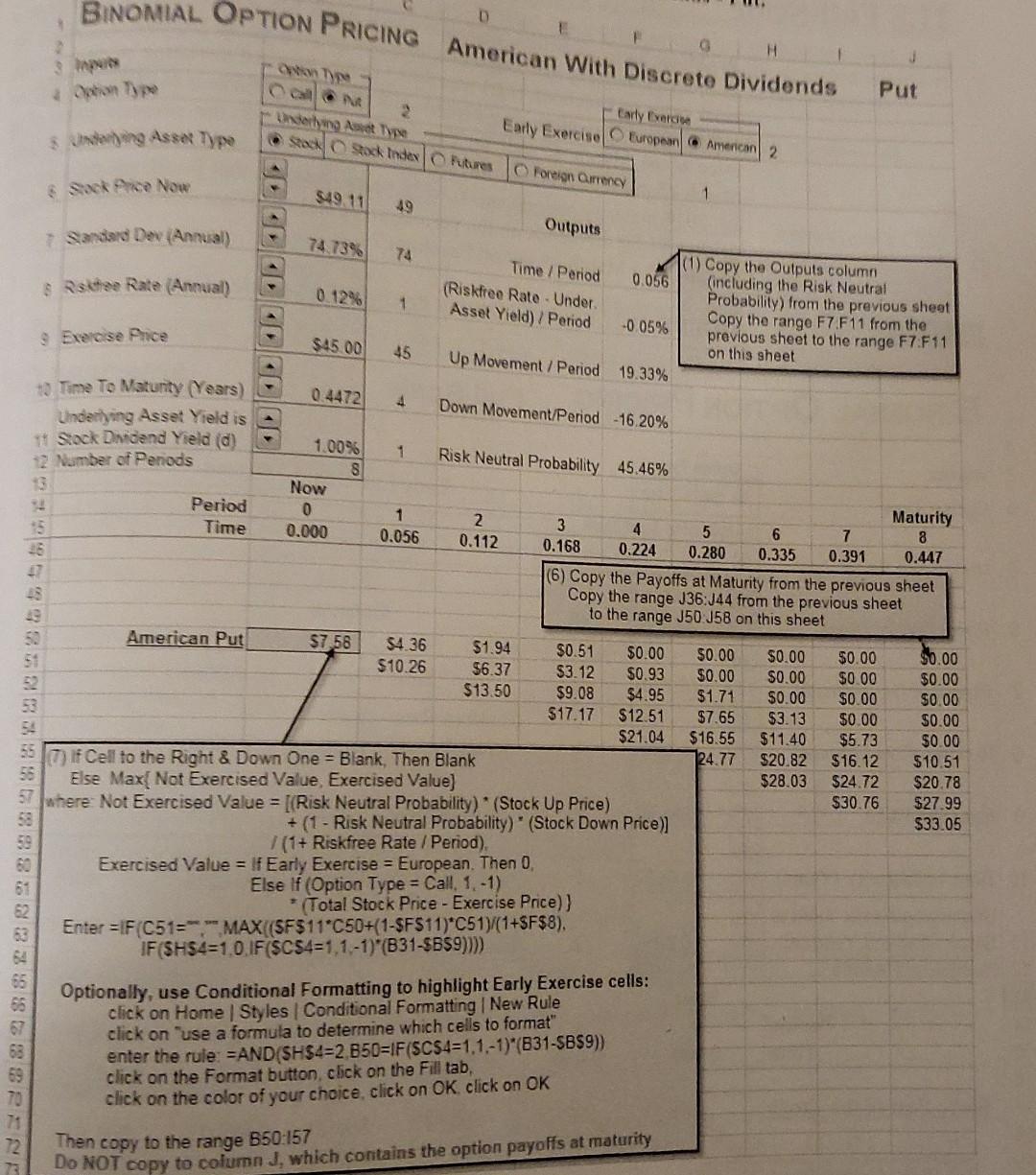

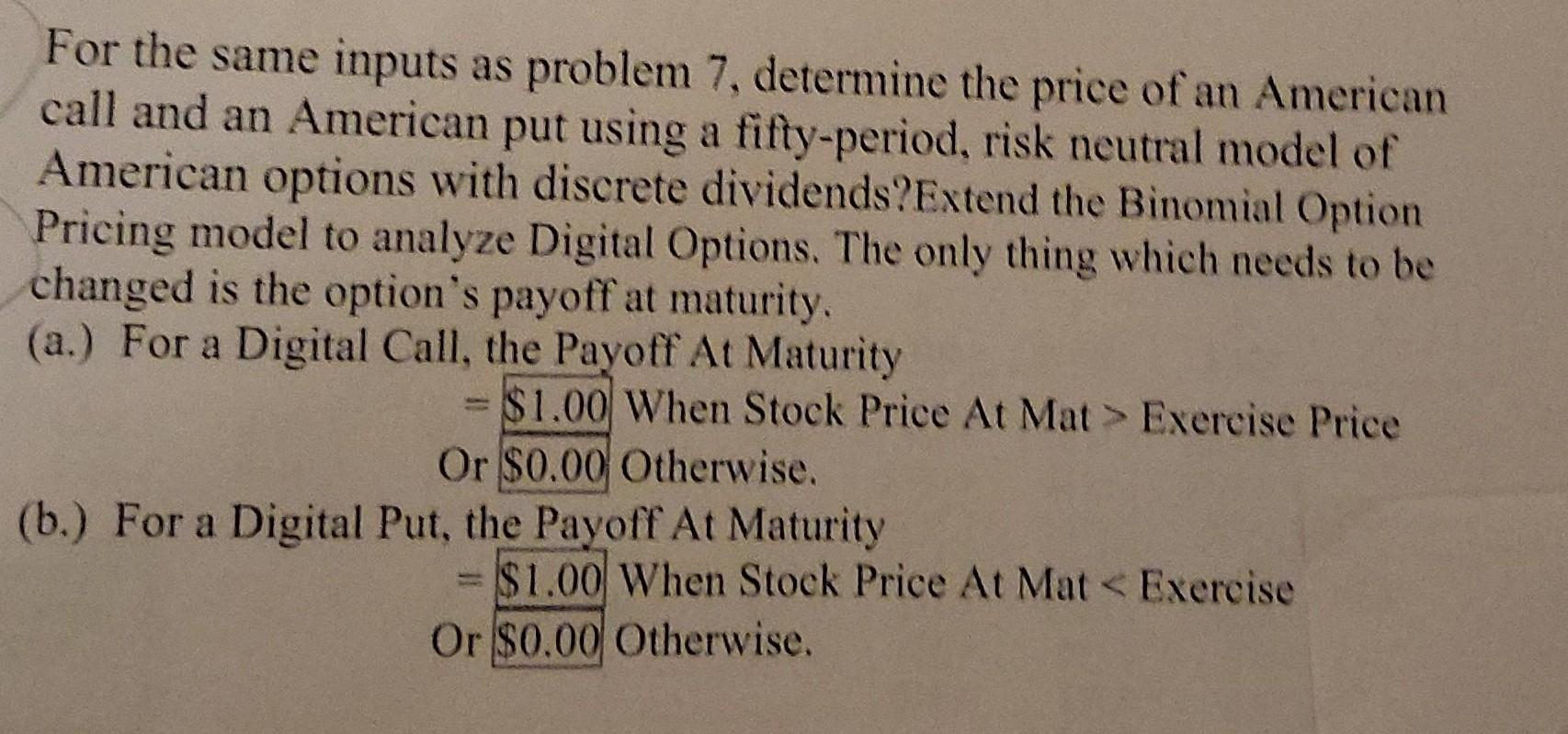

Call B DE I G BINOMIAL OPTION PRICING 1 American With Discrete Dividends 2 3 Inputs Option Type Early Exercise 4 Option Type O Call Put Early Exercise European American 2 -Underlying Asset Type 5 Underlying Asset Type Stock Stock Index Futures Foreign Currency 1 $49.11 49 Outputs 6 Stock Price Now 74.73% 7 Standard Dev (Annual) 0.056 74 Time / Period (1) Copy the Outputs column (including the Risk Neutral Probability) from the previous sheet Copy the range F7 F11 from the previous sheet to the range F7 F11 on this sheet (Riskfree Rate - Under Asset Yield) / Period -0.05% 8 Riskfree Rate (Annual) 0.12% 1 9 Exercise Price $45.00 45 Up Movement Period 19.33% HUPDF 10 Time To Maturity (Years) 0.4472 4 Town Movement Period -16.20% Underlying Asset Yield is 11 Stock Dividend Yield (d) 1.00% 1 Risk Neutral Probability 45.46% 12 Number of Periods 8 13 Now Maturity Period 14 0 2 3 1 7 4 5 8 6 Time 15 0.000 0.056 0.112 0.168 0.224 0.280 0.335 0.391 0.447 46 (6) Copy the Payoffs at Maturity from the previous sheet 47 Copy the range J36.J44 from the previous sheet 48 to the range J50:J58 on this sheet 49 50 American Call $11.87 $18.40 $27.71 $40.44 $55.57 $74.81 $97.77 $124.16 $155.85 51 $6.41 $10.62 $17.08 $26.52 $39.44 $55.56 $73.81 $96.77 52 $2.90 $5.22 $9.19 $15.72 $25.93 $38.44 $54.56 53 $0.97 $1.91 $3.74 $7.21 $13.60 $24.93 54 $0.18 $0.39 $0.85 $1.87 $4.11 150.00 $0.00 $0.00 $0.00 55 (7) If Cell to the Right & Down One = Blank, Then Blank 56 $0.00 $0.00 $0.00 Else Max{ Not Exercised Value, Exercised Value) $0.00 $0.00 57 where: Not Exercised Value = [(Risk Neutral Probability) * (Stock Up Price) 58 $0.00 + (1 - Risk Neutral Probability) (Stock Down Price)] 59 /(1+ Riskfree Rate / Period), 60 Exercised Value = If Early Exercise - European, Then 0, 61 Else if (Option Type = Call, 1,-1) 62 (Total Stock Price - Exercise Price) } 63 Enter =IF(C51=MAX(($F$11C50+(1-$F$11)'C51Y(1+SF$8), 64 IF(SHS4=1,0,1F($C$4=1,1,-1)"(B31-$B$9)))) 65 Optionally, use Conditional Formatting to highlight Early Exercise cells: 66 click on Home Styles Conditional Formatting | New Rule 67 click on "use a formula to determine which cells to format" 68 enter the rule =AND(SH$4=2,B50=IF($C$4=1,1,-1)" (B31-$B$9)) 69 click on the Format button, click on the Fill tab, 70 click on the color of your choice, click on OK, click on OK 71 72 Then copy to the range B50,157 D BINOMIAL OPTION PRICING American With Discrete Dividends Option Early Everco ca 2 Early Exercise Europa American 2 underlying Asset Type Stock Stock Index Futures Foreign currency H 3 Put 3 Under Asser Type Sack Price Now $49.11 1 49 Outputs * Sandard Dev (Annual) 74.73% 74 8 Ride Rate (Annual) Time / Period (Riskfree Rate - Under Asset Yield) / Period 0.056 0.12% 1 (1) Copy the Outputs column (including the Risk Neutral Probability) from the previous sheet Copy the range F7 F11 from the previous sheet to the range F7.F11 on this sheet -0.05% Exercise Price $45.00 45 Up Movement / Period 19.33% 0.4472 Down Movement/Period -16.20% Risk Neutral Probability 45.46% Time 0.112 $0.00 10 Time To Natunty (Years) 4 Underlying Asset Yield is 11 Stock Dividend Yield (d) 1.00% 1 12 Number of Penods 8 3 Now Period 0 1 2 Maturity 5 0.000 3 4 0.056 5 6 7 8 0.168 16 0.224 0.280 0.335 0.391 0.447 (6) Copy the Payoffs at Maturity from the previous sheet 48 Copy the range J36:J44 from the previous sheet 19 to the range J50358 on this sheet 50 American Put 57 58 $4.36 $1.94 $0.51 $0.00 $0.00 $0.00 $0.00 51 $10.26 $6.37 $3.12 $0.93 $0.00 $0.00 $0.00 $0.00 52 $13.50 $9.08 $4.95 $1.71 $0.00 $0.00 $0.00 53 $17.17 $12.51 $7.65 $3.13 $0.00 $0.00 54 $21.04 $16.55 $11.40 $5.73 $0.00 557) If Cell to the Right & Down One - Blank, Then Blank 124.77 $20.82 $16.12 $10.51 Else Max{ Not Exercised Value, Exercised Value) $28.03 $24.72 $20.78 where Not Exercised Value = [(Risk Neutral Probability) (Stock Up Price) $30.76 $27.99 + (1 - Risk Neutral Probability)" (Stock Down Price) $33.05 1 (1+ Riskfree Rate / Period). Exercised Value = If Early Exercise = European. Then 0 Else if (Option Type = Call, 1.-1) *(Total Stock Price - Exercise Price) Enter =IF(C51=-** MAX(SF$11*C50+(1-SF511)*C51)/(1+SF$8). IF(SHS4=1.0, IF($C$4=1,1,-1)"(B31-$B$9)))) Optionally, use Conditional Formatting to highlight Early Exercise cells: click on Home Styles Conditional Formatting | New Rule click on "use a formula to determine which cells to format" enter the rule =AND(SH$4=2 B50=IF($CS4=1,1,-1)"(831-SBS9)) click on the Format button, click on the Fill tab, click on the color of your choice, click on OK click on OK Then copy to the range B50-157 Do NOT copy to column J, which contains the option payoffs at maturity 71 72 For the same inputs as problem 7, determine the price of an American call and an American put using a fifty-period, risk neutral model of American options with discrete dividends?Extend the Binomial Option Pricing model to analyze Digital Options. The only thing which needs to be changed is the option's payoff at maturity. (a.) For a Digital Call, the Payoff At Maturity $1.00 When Stock Price At Mat > Exercise Price Or $0.00 Otherwise, (b.) For a Digital Put, the Payoff At Maturity $1.00 When Stock Price At Mat Exercise Price Or $0.00 Otherwise, (b.) For a Digital Put, the Payoff At Maturity $1.00 When Stock Price At Mat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts