Question: This is the link for complete General Ledger: http://docdro.id/KcC8xY2 *Office Furniture owned by the business: original purchase price was $9,000, estimated useful life was 5

This is the link for complete "General Ledger": http://docdro.id/KcC8xY2

*Office Furniture owned by the business: original purchase price was $9,000, estimated useful life was 5 years, and estimated residual value was $1,000 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year.

*Office Equipment owned by the business: original purchase price was $41,000, estimated useful life was 9 years, and estimated residual value was $3,500 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year.

*Office supplies totalling $2,414 are still on hand at June 30.

*2 months of rent remained pre-paid at the start of June.

*3 months of advertising remained pre-paid at the start of June.

*5 months of insurance remained pre-paid at the start of June

Account: Accum Depn: Office Furniture

Account No. 151

| Date | Description | Ref. | Debit | Credit | Balance | ||

| May | 31 | Balance | 1,867 CR | ||||

| Jun | 30 | Balance | 1,867 CR | ||||

Account: Accum Depn: Office Equipment Account No. 161

| Date | Description | Ref. | Debit | Credit | Balance | ||

| May | 31 | Balance | 24,653 CR | ||||

| Jun | 30 | Balance | 24,653 CR | ||||

Account: Depn Expense: Office Furniture Account No. 560

| Date | Description | Ref. | Debit | Credit | Balance | ||

| May | 31 | Balance | 0 | ||||

| Jun | 30 | Balance | 0 | ||||

Account: Depn Expense: Office Equipment Account No. 561

| Date | Description | Ref. | Debit | Credit | Balance | ||

| May | 31 | Balance | 0 | ||||

| Jun | 30 | Balance | 0 | ||||

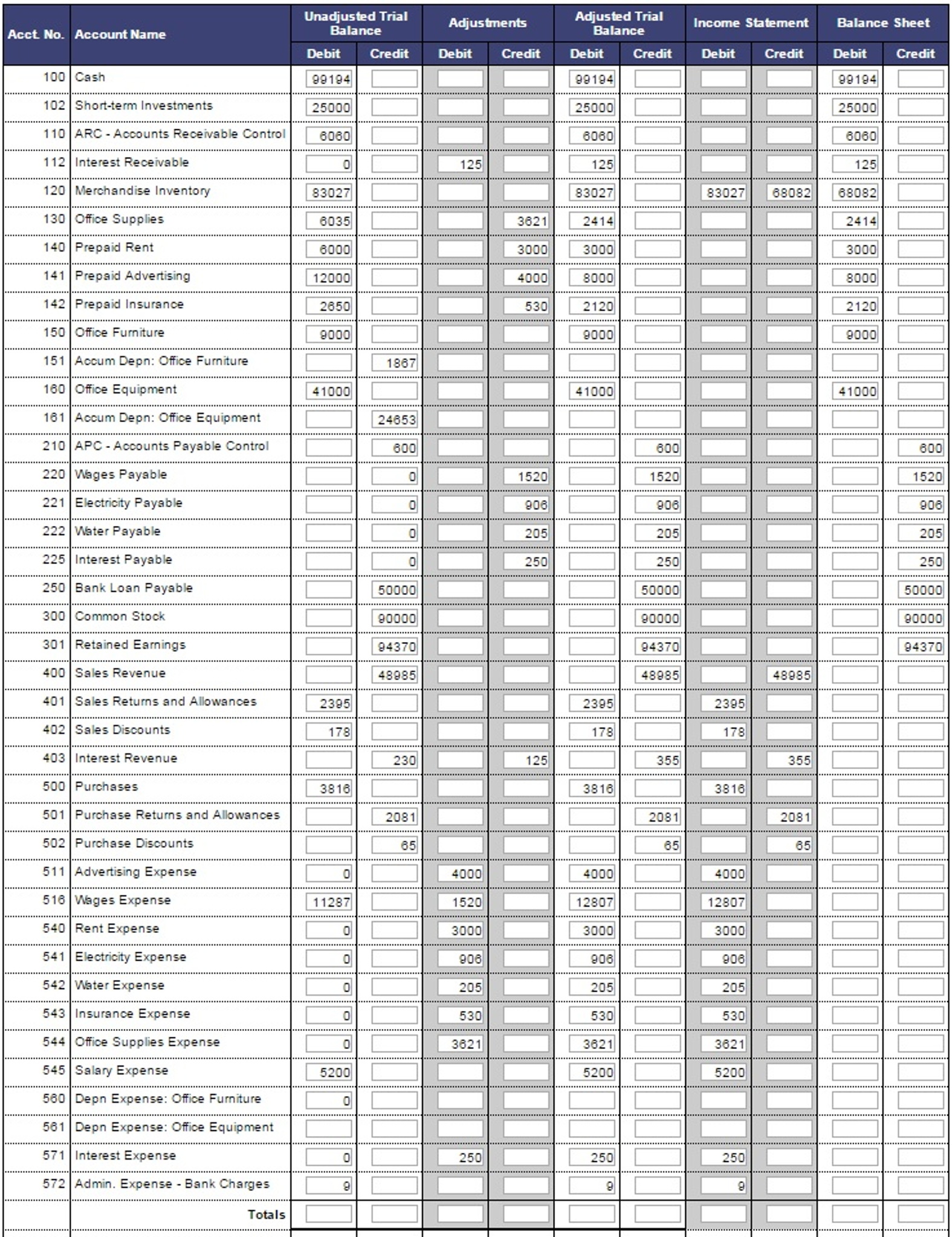

The "Worksheet" so far, I just need help with those up there only.

This is the link for complete "General Ledger": http://docdro.id/KcC8xY2

Unadjusted Trial Adjustments Adjusted Trial Income Statement Balance Sheet Acct No. Account Name Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit 00 Cash 99 194 O O O 90 104 O O O 90194 O 102 Short-term investments 25000 O O O 25000 O O O 25000 110 ARC - Accounts Receivable Control 8080 O O O 8080 O O O 8060 112 in Iterest Receivable 120M Chandis Inventory 83027 O O O 83027 O 83027 68082 88082 130 office supplies 6035 O O 3821 2414 O O O 2414 O 140 Prepaid Ren 8000 O O 3000 3000 O O O 3000 14 Prepaid Advertising 12000 O O 4000 8000 O O O 8000 O 142 Prepaid Insuran 2850 O O 530 2120 O O O 2120 150 Office Furnit 9000 9000 9000 151 Accum Depn: Office Furniture 160 office Equipme 41000 O O O 41000 O O O 41000 I 181 Accum Depn: Office Equipment 210 |APC - Accounts Payable Control 220 ages Payable DD Electricity payable 222 Water Payable 225 interest payable 250 Bank Loan Payabl O 50000 O O O 50000 O O O 50000 300 Common Stoc O 90000 O O O 90000 O O O 90000 30 Retained Earnings O) 94370 O O O 94370 O O O| 04370 400 Sales Revenue O 43085 O O O 48085 O 43085 O O 01 Sales Returns and Allowances 2305 O O O 2305 O 2305 O O 402 Sales Discout 03 in terest Revenue 500 Purchases 50 Purchase Returns and Allowances 502 Purchase Discounts Advertising Expense 518 Wages Expense 11297 O1520 O 12907 O 12907 O O 540 Rent Expens 3000 3000 3000 ctricity Expens 542 Water Expense 543 Insurance Expens 530 530 544 Office Supplies Expense 545 Salary Expens 5200 O O O 5200 O| 5200 O 560 Depn Expense: Office furnit 561 Depn Expense: Office Equipment 57 terest Expense 572 Admin. Expense - Bank Charges Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts