Question: This is the only information given to this question. On January 1, Year 4, Cat Ltd. purchased common shares of Mouse Ltd. for $1,500,000. On

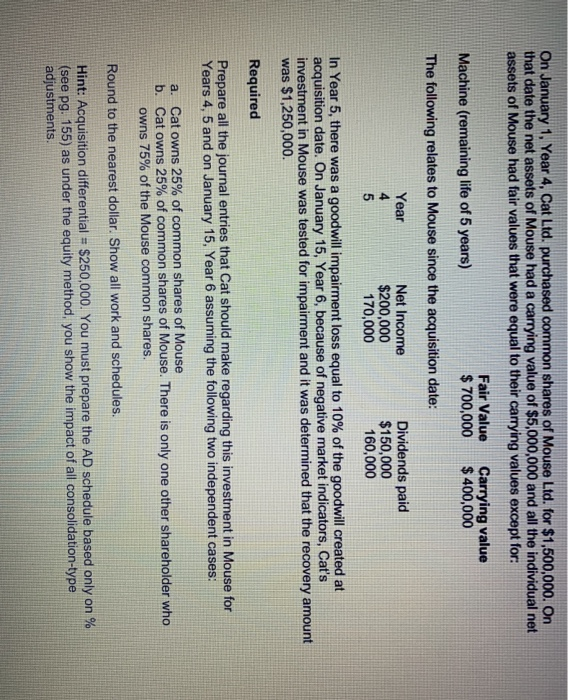

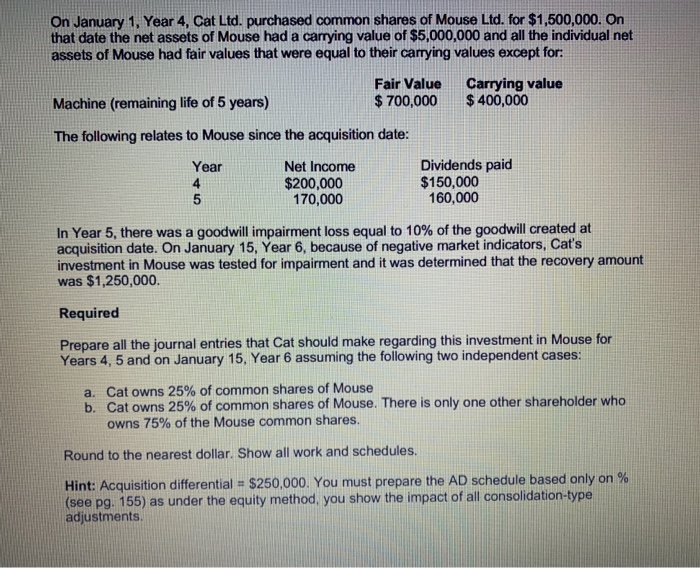

On January 1, Year 4, Cat Ltd. purchased common shares of Mouse Ltd. for $1,500,000. On that date the net assets of Mouse had a carrying value of $5,000,000 and all the individual net assets of Mouse had fair values that were equal to their carrying values except for: Fair Value $ 700,000 Carrying value $ 400,000 Machine (remaining life of 5 years) The following relates to Mouse since the acquisition date: Year 4 5 Net Income $200,000 170,000 Dividends paid $150,000 160,000 In Year 5, there was a goodwill impairment loss equal to 10% of the goodwill created at acquisition date. On January 15, Year 6, because of negative market indicators, Cat's investment in Mouse was tested for impairment and it was determined that the recovery amount was $1,250,000. Required Prepare all the journal entries that Cat should make regarding this investment in Mouse for Years 4, 5 and on January 15, Year 6 assuming the following two independent cases: a. Cat owns 25% of common shares of Mouse b. Cat owns 25% of common shares of Mouse. There is only one other shareholder who owns 75% of the Mouse common shares. Round to the nearest dollar. Show all work and schedules. Hint: Acquisition differential = $250,000. You must prepare the AD schedule based only on % (see pg. 155) as under the equity method, you show the impact of all consolidation-type adjustments. On January 1, Year 4, Cat Ltd. purchased common shares of Mouse Ltd. for $1,500,000. On that date the net assets of Mouse had a carrying value of $5,000,000 and all the individual net assets of Mouse had fair values that were equal to their carrying values except for: Fair Value $ 700,000 Carrying value $ 400,000 Machine (remaining life of 5 years) The following relates to Mouse since the acquisition date: Year 4 5 Net Income $200,000 170,000 Dividends paid $150,000 160,000 In Year 5, there was a goodwill impairment loss equal to 10% of the goodwill created at acquisition date. On January 15, Year 6, because of negative market indicators, Cat's investment in Mouse was tested for impairment and it was determined that the recovery amount was $1,250,000. Required Prepare all the journal entries that Cat should make regarding this investment in Mouse for Years 4, 5 and on January 15, Year 6 assuming the following two independent cases: a. Cat owns 25% of common shares of Mouse b. Cat owns 25% of common shares of Mouse. There is only one other shareholder who owns 75% of the Mouse common shares. Round to the nearest dollar. Show all work and schedules. Hint: Acquisition differential = $250,000. You must prepare the AD schedule based only on % (see pg. 155) as under the equity method, you show the impact of all consolidation-type adjustments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts