Question: THIS IS THE QUESTION 2. Suppose that there is a progressive tax on labor income. We model this by supposing that for a given wage

THIS IS THE QUESTION

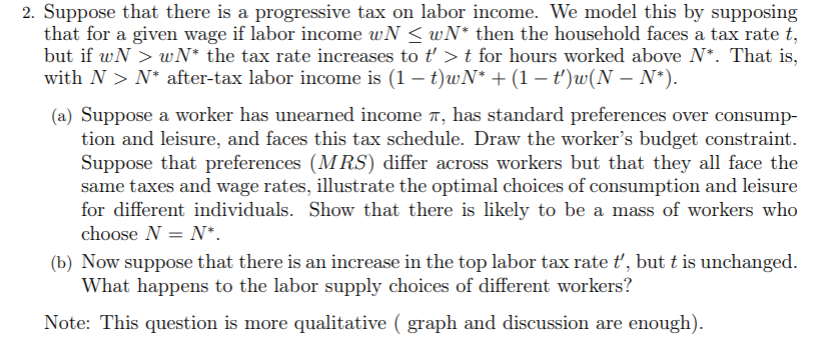

2. Suppose that there is a progressive tax on labor income. We model this by supposing that for a given wage if labor income wN S wN' then the household faces a tax rate t, but if wN > wN" the tax rate increases to t' > t for hours worked above N *. That is, with N > N' after~tax labor income is (1 t)wN' + (1 t')w{N N'). (3} Suppose a worker has unearned income 1r, has standard preferences over consump tion and leisure, and faces this tax schedule. Draw the worker's budget constraint. Suppose that preferences (MRS) di'er across workers but that they all face the same taxes and wage rates, illustrate the optinlal choices: of consumption and leisure for djerent individuals. Show that there is likely to be a mass of workers who choose N = N '. (b) Now suppose that there is an increase in the top labor tax rate H, but if is unchanged. What happens to the labor supply choices of differ-t workers? Note: This question is more qualitative ( graph and discussion are enough)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts