Question: This is the question CASE 2 (30 points) Consider the data for the following two projects, Beta and Zeta: Year Cash Flow (Beta) Cash Flow

This is the question

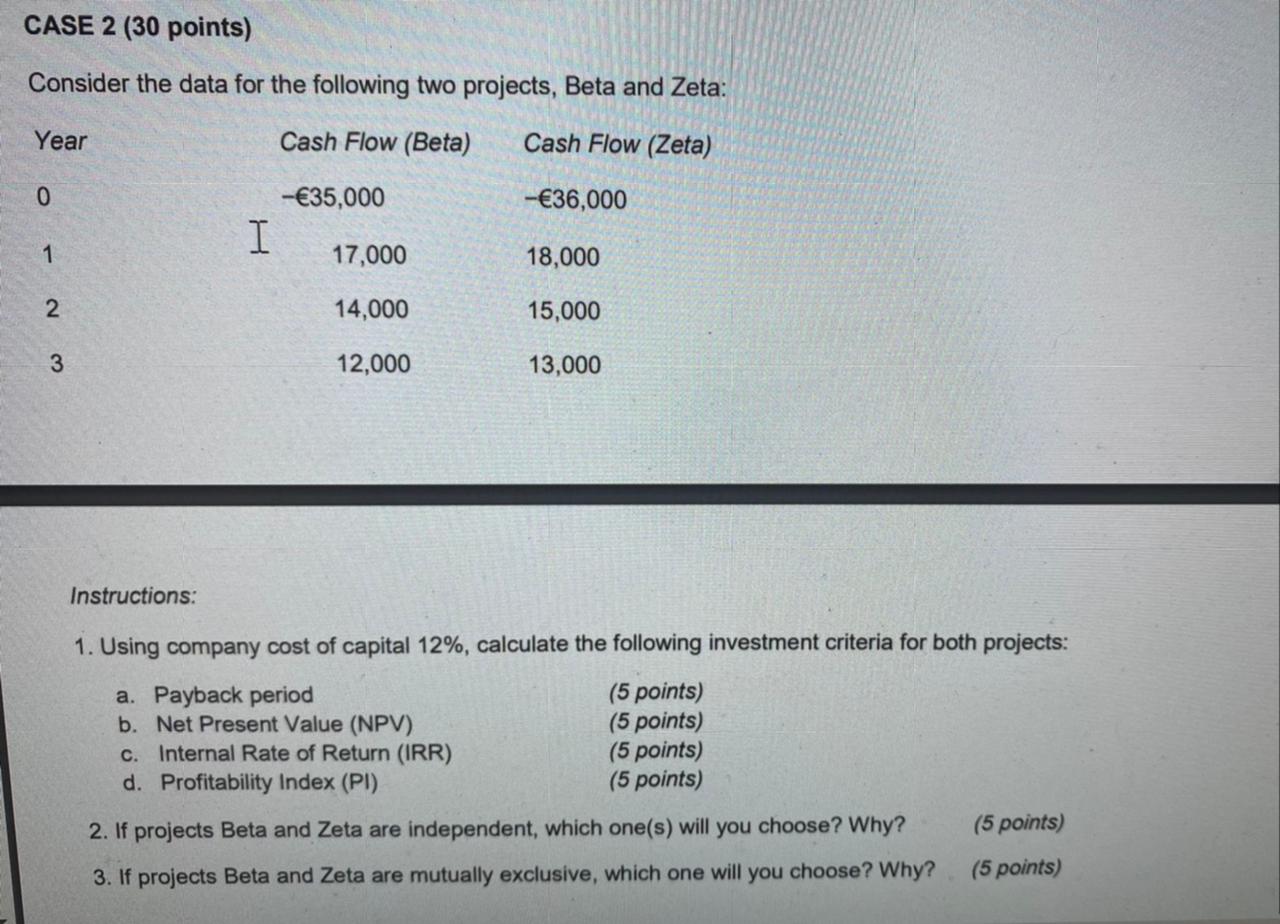

CASE 2 (30 points) Consider the data for the following two projects, Beta and Zeta: Year Cash Flow (Beta) Cash Flow (Zeta) O -635,000 -E36,000 I 17,000 18,000 14,000 15,000 W N 12,000 13,000 Instructions: 1. Using company cost of capital 12%, calculate the following investment criteria for both projects: a. Payback period (5 points) b. Net Present Value (NPV) (5 points) c. Internal Rate of Return (IRR) (5 points) d. Profitability Index (PI) (5 points) 2. If projects Beta and Zeta are independent, which one(s) will you choose? Why? (5 points) 3. If projects Beta and Zeta are mutually exclusive, which one will you choose? Why? . (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts