Question: this is the question Home Assignment # 2 You have been asked for your advice in selecting a portfolio of assets and have been given

this is the question

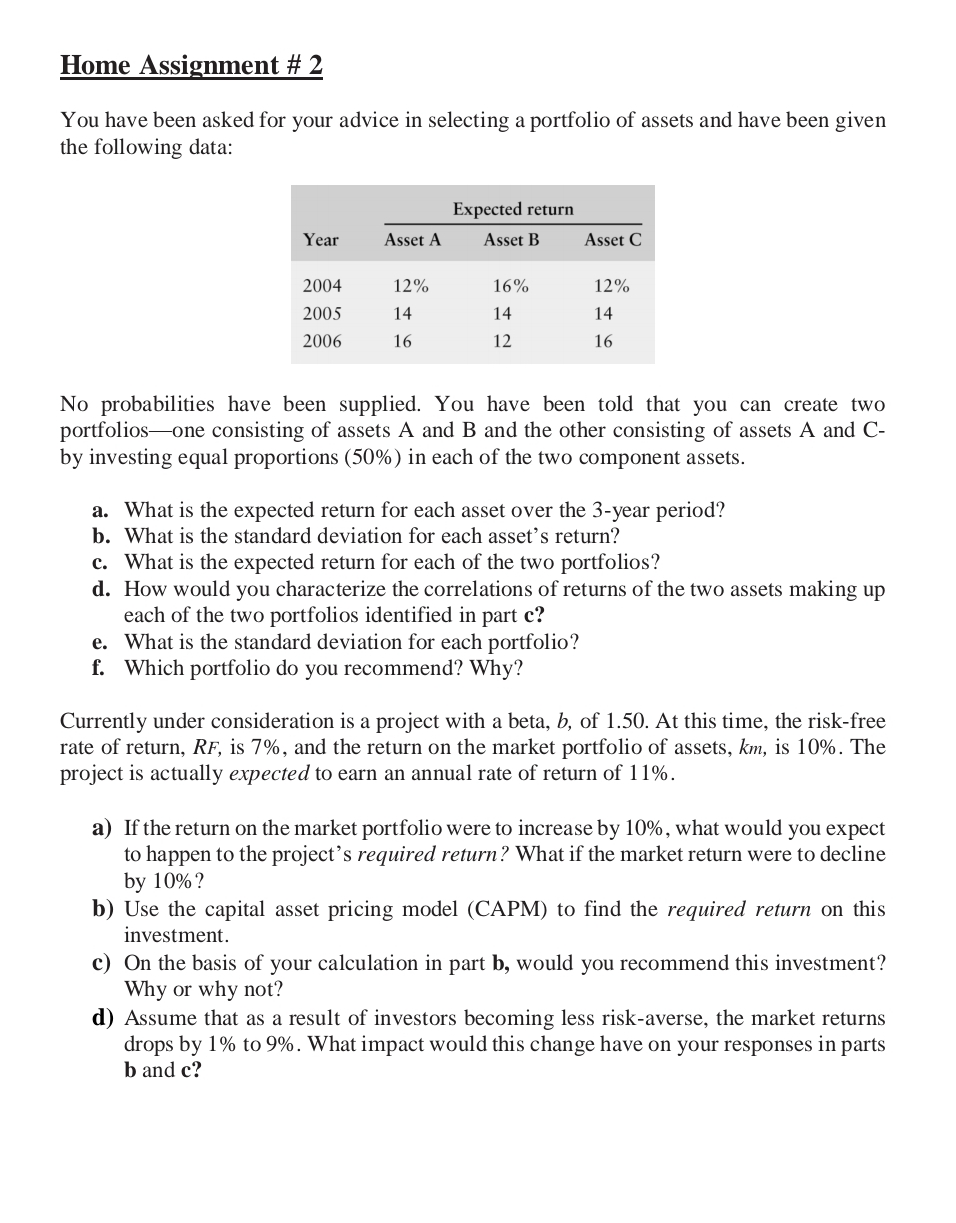

Home Assignment # 2 You have been asked for your advice in selecting a portfolio of assets and have been given the following data: Elli-Madam Year Anetta Asset]! Assetc 2004 12%. 16% 12% 2005 14 14 14 2006 16 12 16 No probabilities have been supplied. You have been told that you can create two portfoliosone consisting of assets A and B and the other consisting of assets A and C- by investing equal proportions (50%) in each of the two component assets. What is the expected return for each asset over the 3-year period? . What is the standard deviation for each asset's return? What is the expected return for each of the two portfolios? . How would you characterize the correlations of returns of the two assets making up each of the two portfolios identified in part c? What is the standard deviation for each portfolio? Which portfolio do you recommend? Why? ape-go '3'\"? Currently under consideration is a project with a beta, 5, of 1.50. At this time, the risk-free rate of return, RF, is 7%, and the return on the market portfolio of assets, km, is 10%. The project is actually expected to earn an annual rate of return of 11%. a) If the return on the market portfolio were to increase by 10% , what would you expect to happen to the project '3 required return ? What if the market return were to decline by 10% ? b) Use the capital asset pricing model (CAPM) to find the required return on this investment. c) On the basis of your calculation in part b, would you recommend this investment? Why or why not? (1) Assume that as a result of investors becoming less risk-averse, the market returns drops by 1% to 9% . What impact would this change have on your responses in parts I) and c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts