Question: this is the question: this is given information: The accounting firm of NICELY, DUNN and FASTE Memo to the File From: Due Date: 5/7/2019 FACTS:

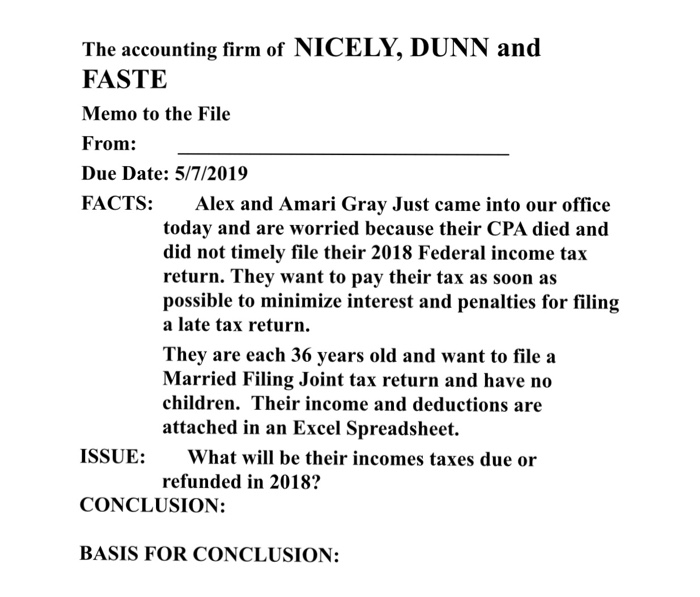

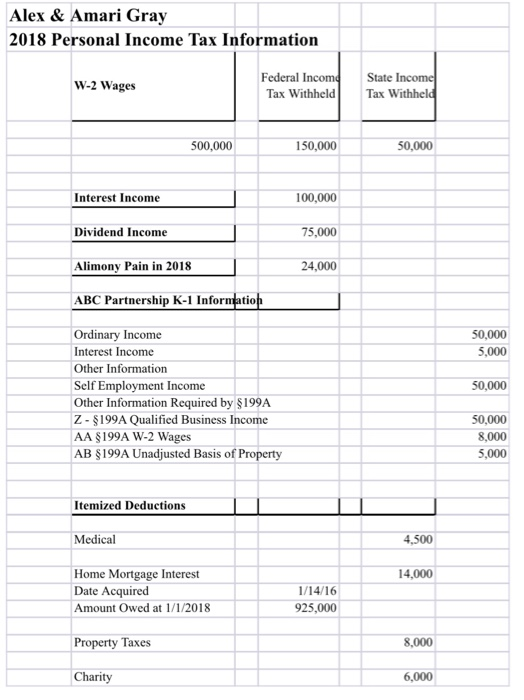

The accounting firm of NICELY, DUNN and FASTE Memo to the File From: Due Date: 5/7/2019 FACTS: Alex and Amari Gray Just came into our office today and are worried because their CPA died and did not timely file their 2018 Federal income tax return. They want to pay their tax as soon as possible to minimize interest and penalties for filing a late tax return. They are each 36 years old and want to file a Married Filing Joint tax return and have no children. Their income and deductions are attached in an Excel Spreadsheet. ISSUE:What will be their incomes taxes due or CONCLUSION: BASIS FOR CONCLUSION: refunded in 2018? Alex & Amari Gray 2018 Personal Income Tax Information Federal I State I Tax Wit W-2 Wages Tax Withheld 500,000 150,000 50,000 Interest Income 100,000 75,000 Dividend Incom Alimony Pain in 2018 ABC Partnership K-1 Informatio 24,000 Ordinary Income Interest Income Other Information Self Employment I Other Information Required by S199A Z $199A Qualified Business Income AA S199A W-2 Wages AB S199A Unadjusted Basis of Property 50,000 5,000 50,000 50,000 8,000 5,000 Itemized Deductions Medical 4,500 Home Mortgage Interest Date Acquired Amount Owed at 1/1/2018 14,000 1/14/16 925,000 Property Taxes 8,000 Charity 6,000 The accounting firm of NICELY, DUNN and FASTE Memo to the File From: Due Date: 5/7/2019 FACTS: Alex and Amari Gray Just came into our office today and are worried because their CPA died and did not timely file their 2018 Federal income tax return. They want to pay their tax as soon as possible to minimize interest and penalties for filing a late tax return. They are each 36 years old and want to file a Married Filing Joint tax return and have no children. Their income and deductions are attached in an Excel Spreadsheet. ISSUE:What will be their incomes taxes due or CONCLUSION: BASIS FOR CONCLUSION: refunded in 2018? Alex & Amari Gray 2018 Personal Income Tax Information Federal I State I Tax Wit W-2 Wages Tax Withheld 500,000 150,000 50,000 Interest Income 100,000 75,000 Dividend Incom Alimony Pain in 2018 ABC Partnership K-1 Informatio 24,000 Ordinary Income Interest Income Other Information Self Employment I Other Information Required by S199A Z $199A Qualified Business Income AA S199A W-2 Wages AB S199A Unadjusted Basis of Property 50,000 5,000 50,000 50,000 8,000 5,000 Itemized Deductions Medical 4,500 Home Mortgage Interest Date Acquired Amount Owed at 1/1/2018 14,000 1/14/16 925,000 Property Taxes 8,000 Charity 6,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts