Question: This is the question with the answer below. What exactly happened to the capital gain loss for 0 when finding out the taxable income for

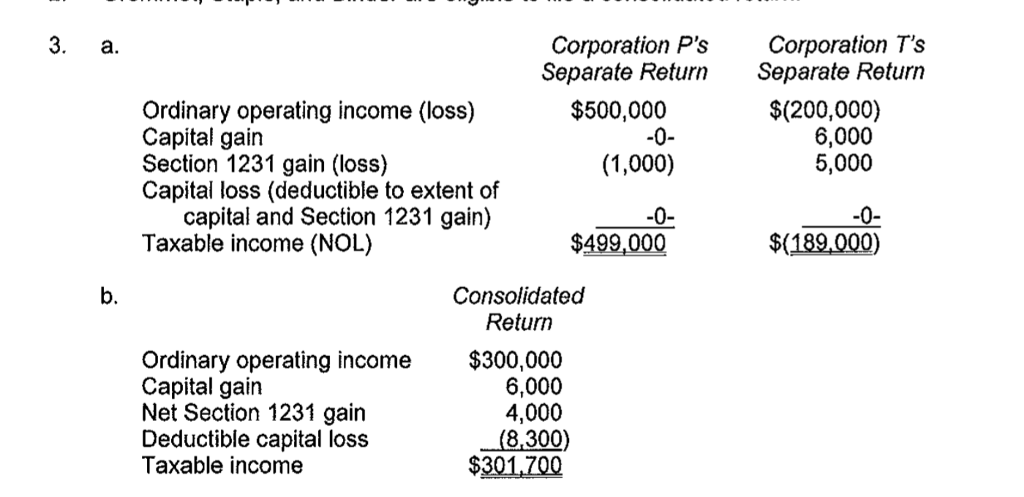

This is the question with the answer below. What exactly happened to the capital gain loss for 0 when finding out the taxable income for Corporation P?

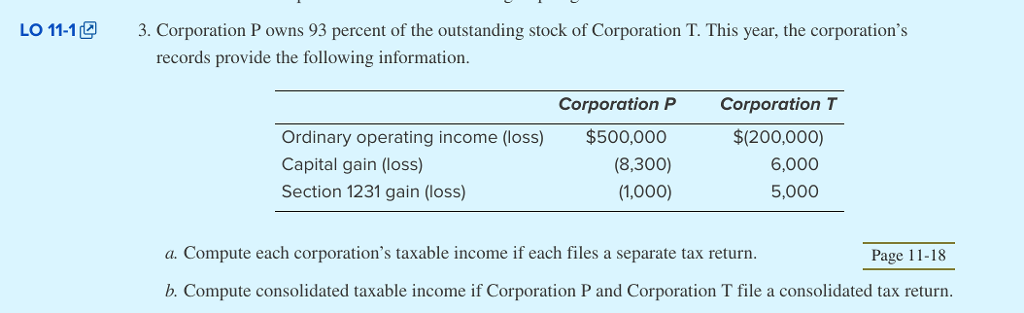

LO 11-13. Corporation P owns 93 percent of the outstanding stock of Corporation T. This year, the corporation's records provide the following information Corporation P Corporation T Ordinary operating income (loss) Capital gain (loss) Section 1231 gain (loss) $500,000 (8,300) (1,000) $(200,000) 6,000 5,000 a. Compute each corporation's taxable income if each files a separate tax return. Page 11-18 b. Compute consolidated taxable income if Corporation P and Corporation T file a consolidated tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts