Question: THIS IS THE QUESTION WITH THE ANSWER, PLEASE SHOW ME THE MATH(EXPLAIN) ON HOW TO GET THE CASH FLOWS. 3. Replacement: St. Edwards Co. is

THIS IS THE QUESTION WITH THE ANSWER, PLEASE SHOW ME THE MATH(EXPLAIN) ON HOW TO GET THE CASH FLOWS.

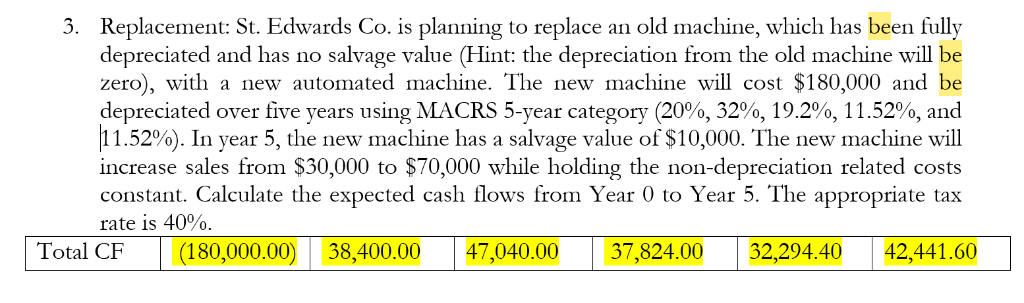

3. Replacement: St. Edwards Co. is planning to replace an old machine, which has been fully depreciated and has no salvage value (Hint: the depreciation from the old machine will be zero), with a new automated machine. The new machine will cost $180,000 and be depreciated over five years using MACRS 5-year category (20%, 32%, 19.2%, 11.52%, and 11.52%). In year 5, the new machine has a salvage value of $10,000. The new machine will increase sales from $30,000 to $70,000 while holding the non-depreciation related costs constant. Calculate the expected cash flows from Year 0 to Year 5. The appropriate tax rate is 40%. Total CF 38,400.00 47,040.00 37,824.00 32,294.40 42,441.60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts