Question: this is the questions 1. Select a commodity for which futures contracts exist and a futures contract on that commodity with an expiration date between

this is the questions

this is the questions

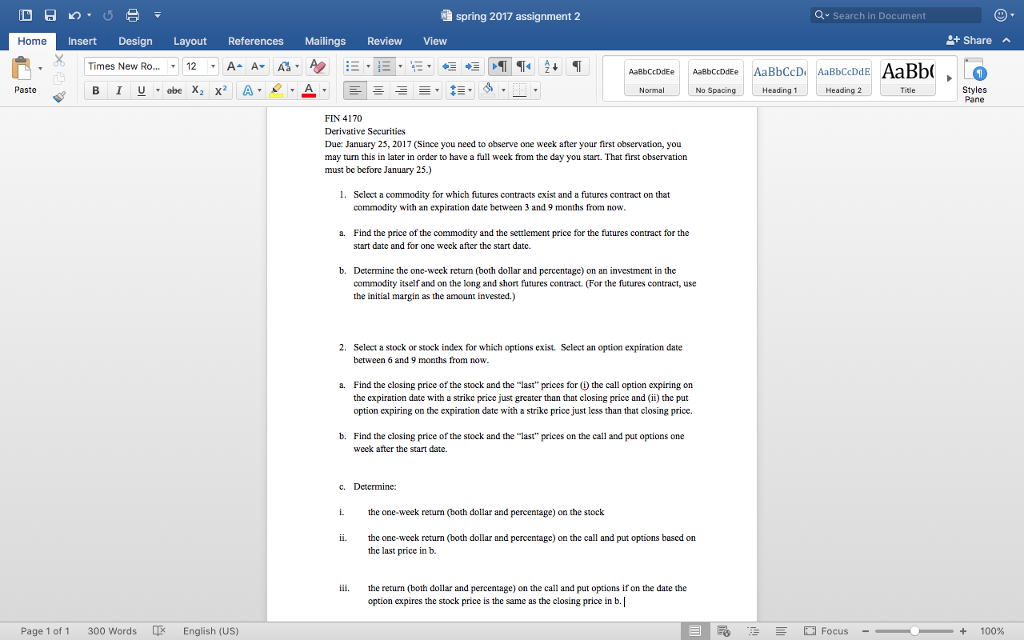

1. Select a commodity for which futures contracts exist and a futures contract on that commodity with an expiration date between 3 and 9 months from now.

a. Find the price of the commodity and the settlement price for the futures contract for the start date and for one week after the start date.

b. Determine the one-week return (both dollar and percentage) on an investment in the commodity itself and on the long and short futures contract. (For the futures contract, use the initial margin as the amount invested.)

a spring 2017 assignment 2 a search in Document Share Home Insert Design Layout References Mailings Review View Pat 2 Title Styles Pane FIN 4170 Derivative Securities Due January 25, 2017 (Since you need to observe one week after your first observation, you may turn this in later in order to have a full week from the day you start. That first observation must be before January 25. 1. Select a commodity for which futures contracts exist and a futures contract on that commodity with an expiration date between 3 and 9 months from now. a. Find the price of the commodity and the settlement price for the futures contract for the start date and for one weck after the start datc. b. Determine the one-week return (both dollar and percentage) on an investment in the commodity itself and on the long and short futures contract. For the futures contract, use the initial margin as the amount invested.) 2. Select a stock or stock index for which options exist. Select an option expiration date between 6 and 9 months from now. a. Find the closing price of the stock and the "last" prices for (i) the call option expiring on the expiration date with a strike priccjust greater than that closing price and ii) the put option expiring on the expiration date with a strike price just less than that closing price. b. Find the closing price of the stock and the "las" price on the call and put options one week after the start date. c, Determine: i. the one-week return (both dollar and percentage) on the stock ii. the one-week return. (both dollar and pcrccntage) on the call and put options based on the last price in b. iii. the return (both dollar and percentage) on the call and put options if on the date the option expires the stock price is the same as the closing price in b. Page 1 of 1 300 Words Ox English (US El Eis Focus 00% a spring 2017 assignment 2 a search in Document Share Home Insert Design Layout References Mailings Review View Pat 2 Title Styles Pane FIN 4170 Derivative Securities Due January 25, 2017 (Since you need to observe one week after your first observation, you may turn this in later in order to have a full week from the day you start. That first observation must be before January 25. 1. Select a commodity for which futures contracts exist and a futures contract on that commodity with an expiration date between 3 and 9 months from now. a. Find the price of the commodity and the settlement price for the futures contract for the start date and for one weck after the start datc. b. Determine the one-week return (both dollar and percentage) on an investment in the commodity itself and on the long and short futures contract. For the futures contract, use the initial margin as the amount invested.) 2. Select a stock or stock index for which options exist. Select an option expiration date between 6 and 9 months from now. a. Find the closing price of the stock and the "last" prices for (i) the call option expiring on the expiration date with a strike priccjust greater than that closing price and ii) the put option expiring on the expiration date with a strike price just less than that closing price. b. Find the closing price of the stock and the "las" price on the call and put options one week after the start date. c, Determine: i. the one-week return (both dollar and percentage) on the stock ii. the one-week return. (both dollar and pcrccntage) on the call and put options based on the last price in b. iii. the return (both dollar and percentage) on the call and put options if on the date the option expires the stock price is the same as the closing price in b. Page 1 of 1 300 Words Ox English (US El Eis Focus 00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts