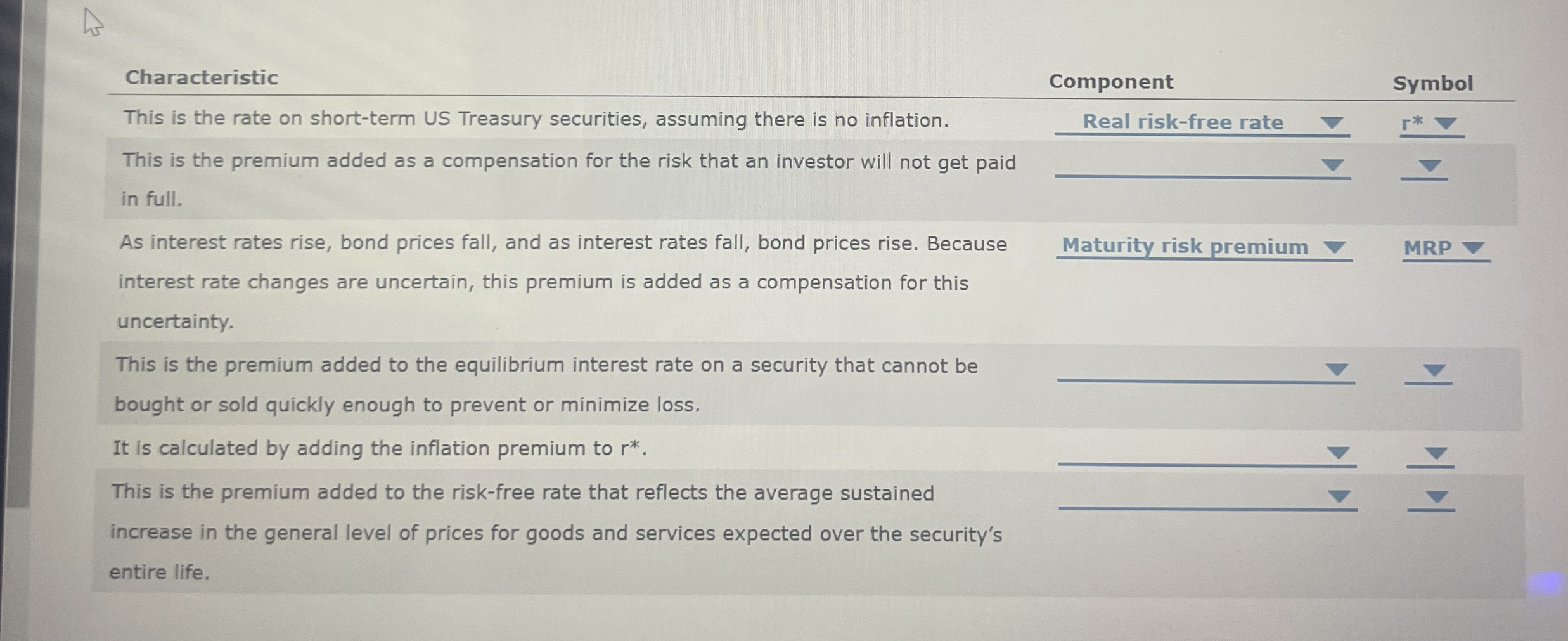

Question: This is the rate on short - term US Treasury securities , assuming there is no inflation. This is the premium added as a compensation

This is the rate on shortterm US Treasury securities assuming there is no inflation.

This is the premium added as a compensation for the risk that an investor will not get paid

in full.

As interest rates rise, bond prices fall, and as interest rates fall, bond prices rise. Because

interest rate changes are uncertain, this premium is added as a compensation for this

uncertainty.

This is the premium added to the equilibrium interest rate on a security that cannot be

bought or sold quickly enough to prevent or minimize loss.

It is calculated by adding the inflation premium to

This is the premium added to the riskfree rate that reflects the average sustained

increase in the general level of prices for goods and services expected over the securitys

entire life.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock