Question: This is the requirements in 3rd picture this is NOTE These last 2 pictures are the journal entries of june nd balance sheet needs to

This is the requirements in 3rd picture

This is the requirements in 3rd picture  this is NOTE

this is NOTE

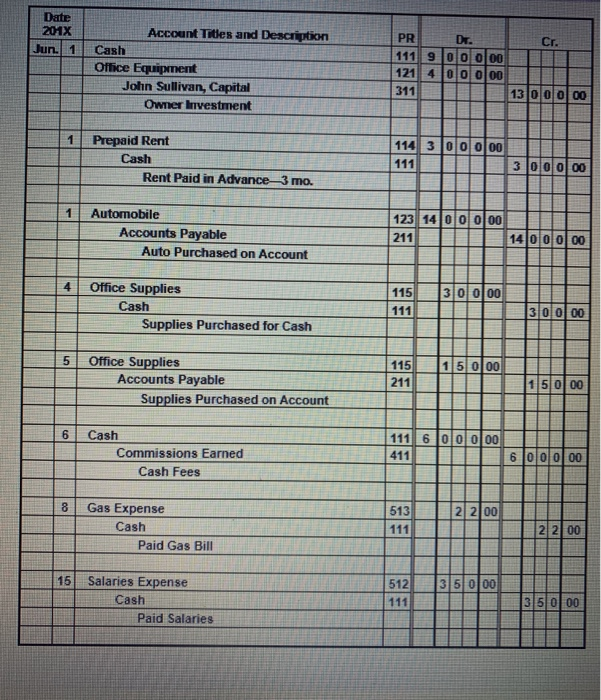

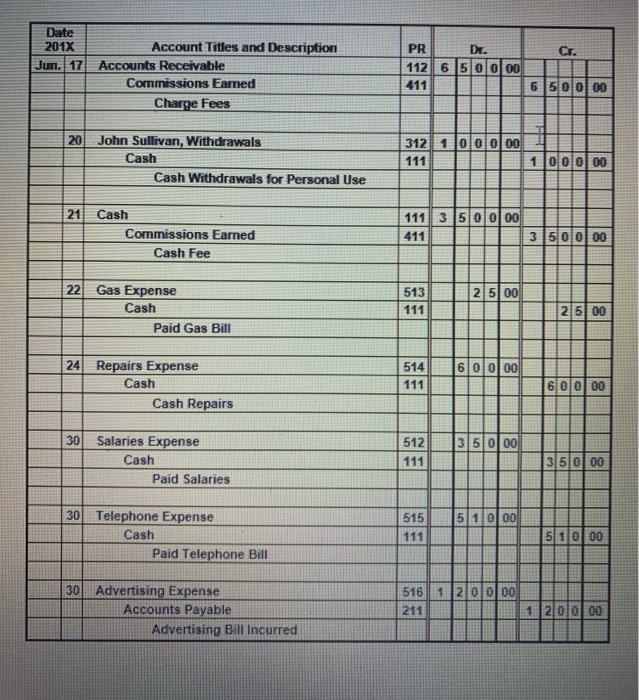

These last 2 pictures are the journal entries of june nd balance sheet needs to make so that it can be used for beginning balance for july.

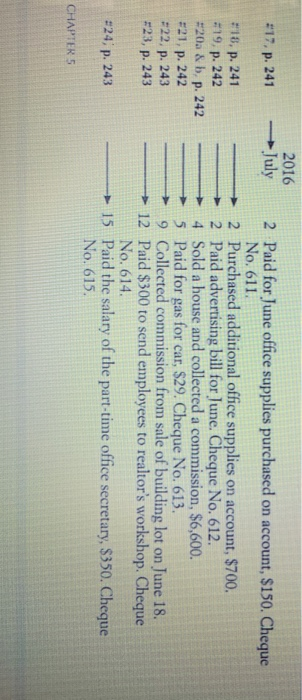

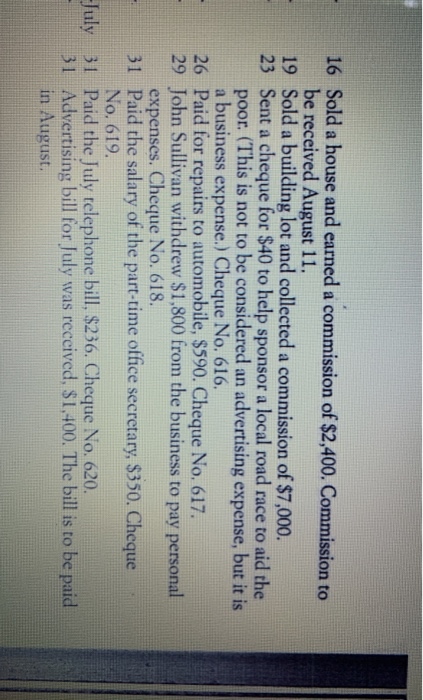

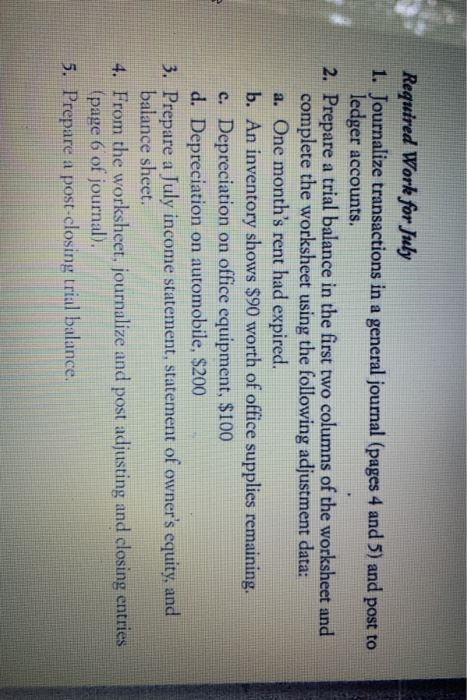

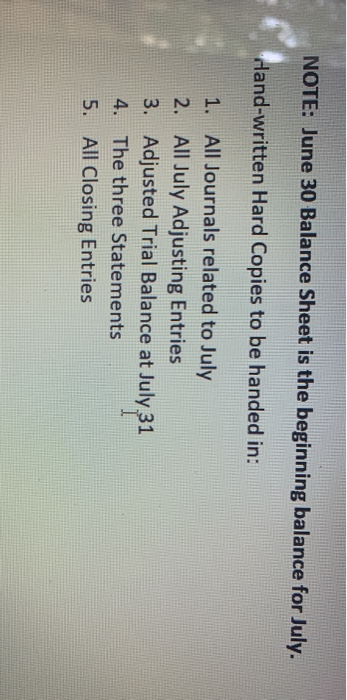

These last 2 pictures are the journal entries of june nd balance sheet needs to make so that it can be used for beginning balance for july.2016 - July #17. p. 241 #18, p. 241 -19, p. 242 #20. & b. p. 242 #21. p. 242 +22, p. 243 +23, p. 243 2 Paid for June office supplies purchased on account, $150. Cheque No. 611 2 Purchased additional office supplies on account, $700. 2 Paid advertising bill for June. Cheque No. 612. 4 Sold a house and collected a commission, $6,600. 5 Paid for gas for car, $29. Cheque No. 613. 9 Collected commission from sale of building lot on June 18. 12 Paid $300 to send employees to realtor's workshop. Cheque No. 614. 15 Paid the salary of the part-time office secretary, $350. Cheque No. 615. #24, p. 243 CHAPTERS 16 Sold a house and earned a commission of $2,400. Commission to be received August 11. 19 Sold a building lot and collected a commission of $7,000. 23 Sent a cheque for $40 to help sponsor a local road race to aid the poor. (This is not to be considered an advertising expense, but it is a business expense.) Cheque No. 616. 26 Paid for repairs to automobile, $590. Cheque No. 617. 29 John Sullivan withdrew $1,800 from the business to pay personal expenses. Cheque No. 618. 31 Paid the salary of the part-time office secretary, $350. Cheque No. 619. -July 31 Paid the July telephone bill, $236. Cheque No. 620. 31 Advertising bill for July was received, $1,400. The bill is to be paid in August Required Work for July 1. Journalize transactions in a general journal (pages 4 and 5) and post to ledger accounts. 2. Prepare a trial balance in the first two columns of the worksheet and complete the worksheet using the following adjustment data: a. One month's rent had expired. b. An inventory shows $90 worth of office supplies remaining, c. Depreciation on office equipment, $100 d. Depreciation on automobile, $200 3. Prepare a July income statement, statement of owner's equity, and balance sheet. 4. From the worksheet, journalize and post adjusting and closing entries (page 6 of journal). 5. Prepare a post-closing trial balance. NOTE: June 30 Balance Sheet is the beginning balance for July. dand-written Hard Copies to be handed in: 1. All Journals related to July 2. All July Adjusting Entries 3. Adjusted Trial Balance at July 31 4. The three Statements 5. All Closing Entries Date 2017 Jun 1 Account Titles and Description Cash Office Equipment John Sullivan, Capital Owner Investment PR Dr. Cr. 111 900 000 121 400 000 311 130 00 00 1 Prepaid Rent Cash Rent Paid in Advance3 mo. 114 3 0 0 0 00 111 300 000 1 Automobile Accounts Payable Auto Purchased on Account 123 14 0 0 000 211 14 000 00 4 30 000 Office Supplies Cash Supplies Purchased for Cash 115 111 310000 5 Office Supplies Accounts Payable Supplies Purchased on Account 115 211 15 000 150 00 6 Cash Commissions Earned Cash Fees 111 600 000 411 6 000 00 8 22.00 Gas Expense Cash Paid Gas Bill 513 111 2 200 15 35 000 Salaries Expense Cash Paid Salaries 512 111 35 000 Date 2017 Jun. 17 Account Titles and Description Accounts Receivable Commissions Eamed Charge Fees PR Dr. Cr. 112 650 000 411 650 000 20 John Sullivan, Withdrawals Cash Cash Withdrawals for Personal Use 312 1000.00 111 100 000 21 Cash Commissions Earned Cash Fee 111 350 000 411 350 000 22 Gas Expense Cash Paid Gas Bill 513 111 2 500 2 500 24 Repairs Expense Cash Cash Repairs 514 111 60 000 6 00 00 30 35 000 Salaries Expense Cash Paid Salaries 512 111 35.000 515 5 1 000 30 Telephone Expense Cash Paid Telephone Bill 111 5 10 00 30 Advertising Expense Accounts Payable Advertising Bill Incurred 516120000 211 120 000 2016 - July #17. p. 241 #18, p. 241 -19, p. 242 #20. & b. p. 242 #21. p. 242 +22, p. 243 +23, p. 243 2 Paid for June office supplies purchased on account, $150. Cheque No. 611 2 Purchased additional office supplies on account, $700. 2 Paid advertising bill for June. Cheque No. 612. 4 Sold a house and collected a commission, $6,600. 5 Paid for gas for car, $29. Cheque No. 613. 9 Collected commission from sale of building lot on June 18. 12 Paid $300 to send employees to realtor's workshop. Cheque No. 614. 15 Paid the salary of the part-time office secretary, $350. Cheque No. 615. #24, p. 243 CHAPTERS 16 Sold a house and earned a commission of $2,400. Commission to be received August 11. 19 Sold a building lot and collected a commission of $7,000. 23 Sent a cheque for $40 to help sponsor a local road race to aid the poor. (This is not to be considered an advertising expense, but it is a business expense.) Cheque No. 616. 26 Paid for repairs to automobile, $590. Cheque No. 617. 29 John Sullivan withdrew $1,800 from the business to pay personal expenses. Cheque No. 618. 31 Paid the salary of the part-time office secretary, $350. Cheque No. 619. -July 31 Paid the July telephone bill, $236. Cheque No. 620. 31 Advertising bill for July was received, $1,400. The bill is to be paid in August Required Work for July 1. Journalize transactions in a general journal (pages 4 and 5) and post to ledger accounts. 2. Prepare a trial balance in the first two columns of the worksheet and complete the worksheet using the following adjustment data: a. One month's rent had expired. b. An inventory shows $90 worth of office supplies remaining, c. Depreciation on office equipment, $100 d. Depreciation on automobile, $200 3. Prepare a July income statement, statement of owner's equity, and balance sheet. 4. From the worksheet, journalize and post adjusting and closing entries (page 6 of journal). 5. Prepare a post-closing trial balance. NOTE: June 30 Balance Sheet is the beginning balance for July. dand-written Hard Copies to be handed in: 1. All Journals related to July 2. All July Adjusting Entries 3. Adjusted Trial Balance at July 31 4. The three Statements 5. All Closing Entries Date 2017 Jun 1 Account Titles and Description Cash Office Equipment John Sullivan, Capital Owner Investment PR Dr. Cr. 111 900 000 121 400 000 311 130 00 00 1 Prepaid Rent Cash Rent Paid in Advance3 mo. 114 3 0 0 0 00 111 300 000 1 Automobile Accounts Payable Auto Purchased on Account 123 14 0 0 000 211 14 000 00 4 30 000 Office Supplies Cash Supplies Purchased for Cash 115 111 310000 5 Office Supplies Accounts Payable Supplies Purchased on Account 115 211 15 000 150 00 6 Cash Commissions Earned Cash Fees 111 600 000 411 6 000 00 8 22.00 Gas Expense Cash Paid Gas Bill 513 111 2 200 15 35 000 Salaries Expense Cash Paid Salaries 512 111 35 000 Date 2017 Jun. 17 Account Titles and Description Accounts Receivable Commissions Eamed Charge Fees PR Dr. Cr. 112 650 000 411 650 000 20 John Sullivan, Withdrawals Cash Cash Withdrawals for Personal Use 312 1000.00 111 100 000 21 Cash Commissions Earned Cash Fee 111 350 000 411 350 000 22 Gas Expense Cash Paid Gas Bill 513 111 2 500 2 500 24 Repairs Expense Cash Cash Repairs 514 111 60 000 6 00 00 30 35 000 Salaries Expense Cash Paid Salaries 512 111 35.000 515 5 1 000 30 Telephone Expense Cash Paid Telephone Bill 111 5 10 00 30 Advertising Expense Accounts Payable Advertising Bill Incurred 516120000 211 120 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts