Question: This is the right answer I just need solution or explanation . Will difinely give good feedback 6. B 11. B12. C13. B 6. On

This is the right answer I just need solution or explanation . Will difinely give good feedback 6. B 11. B12. C13. B

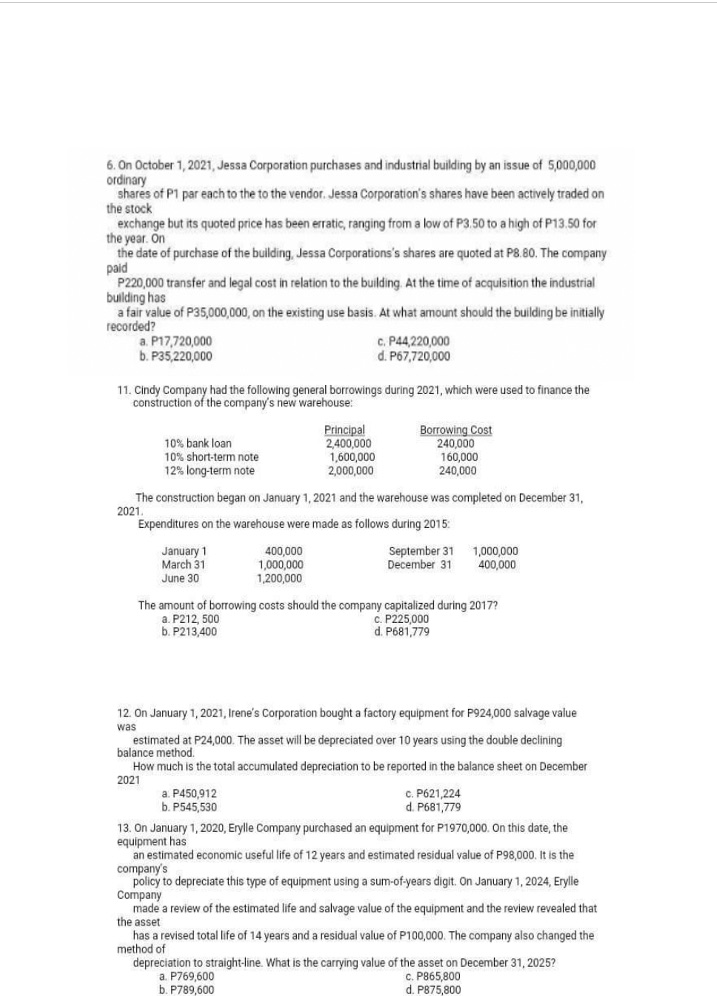

6. On October 1, 2021, Jessa Corporation purchases and industrial building by an issue of 5,000,000 ordinary shares of P1 par each to the to the vendor. Jessa Corporation's shares have been actively traded on the stock exchange but its quoted price has been erratic, ranging from a low of P3.50 to a high of P13.50 for the year. On the date of purchase of the building, Jessa Corporations's shares are quoted at P8.80. The company paid P220,000 transfer and legal cost in relation to the building. At the time of acquisition the industrial building has a fair value of P35,000,000, on the existing use basis. At what amount should the building be initially recorded? a. P17,720,000 c. P44,220,000 b. P35,220,000 d. P67,720,000 11. Cindy Company had the following general borrowings during 2021, which were used to finance the construction of the company's new warehouse: Principal Borrowing Cost 10% bank loan 2,400,000 240,000 10% short-term note 1,600,000 160,000 12% long-term note 2,000,000 240,000 The construction began on January 1, 2021 and the warehouse was completed on December 31, 2021. Expenditures on the warehouse were made as follows during 2015: January 1 400,000 September 31 1,000,000 March 31 1,000,000 December 31 400,000 June 30 1,200,000 The amount of borrowing costs should the company capitalized during 2017? a. P212, 500 C. P225,000 b. P213,400 d. P681,779 12. On January 1, 2021, Irene's Corporation bought a factory equipment for P924,000 salvage value was estimated at P24,000. The asset will be depreciated over 10 years using the double declining balance method. How much is the total accumulated depreciation to be reported in the balance sheet on December 2021 a. P450,912 C. P621,224 b. P545,530 d. P681,779 13. On January 1, 2020, Erylle Company purchased an equipment for P1970,000. On this date, the equipment has an estimated economic useful life of 12 years and estimated residual value of P98,000. It is the company's policy to depreciate this type of equipment using a sum-of-years digit. On January 1, 2024, Erylle Company made a review of the estimated life and salvage value of the equipment and the review revealed that the asset has a revised total life of 14 years and a residual value of P100,000. The company also changed the method of depreciation to straight-line. What is the carrying value of the asset on December 31, 2025? a. P769,600 C. P865,800 b. P789,600 d. P875,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts