Question: This is the right answer, I just need to see steps. Thank you! Q4) Assume that your utility function is equal to U = [E(r)]'

This is the right answer, I just need to see steps. Thank you!

This is the right answer, I just need to see steps. Thank you!

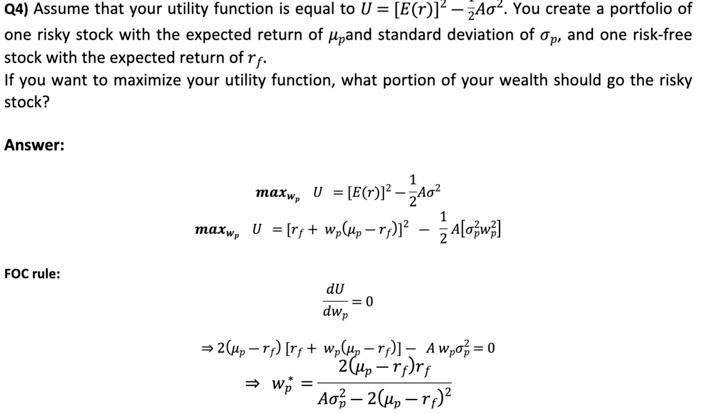

Q4) Assume that your utility function is equal to U = [E(r)]' - 2A0'. You create a portfolio of one risky stock with the expected return of Upand standard deviation of Op, and one risk-free stock with the expected return of rf. If you want to maximize your utility function, what portion of your wealth should go the risky stock? Answer: 1 maxw, U = [E(r)]2 2402 E maxw, U = [ry + wp(up - rp)]? , ? - 4103w3] [ow FOC rule: du = 0 dwp = 2(up - rp) [rf + wolky - rp)] - A w20= 0 2(up - rp)rf > WP A0 - 2(up - r12 =

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock