Question: This is the second time I posted this please answer correctly. 10 T Blossom Co uses the percentage of sales approach to record bad debt

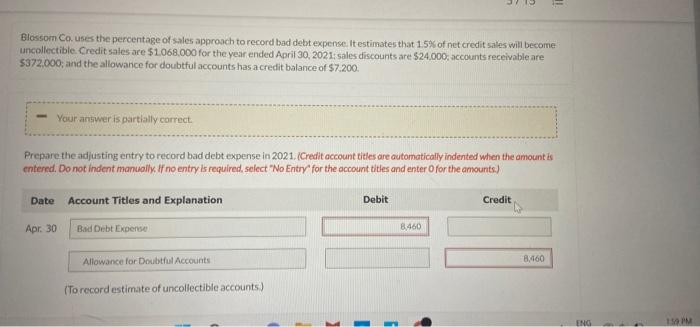

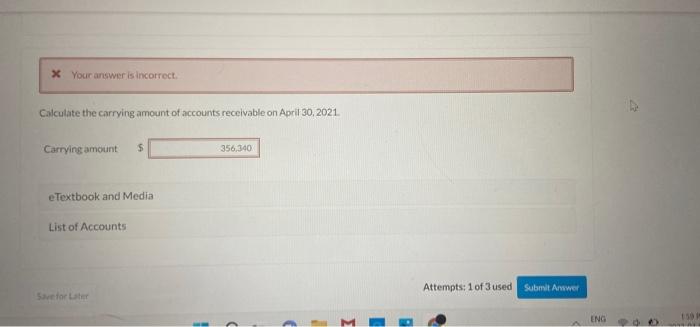

10 T Blossom Co uses the percentage of sales approach to record bad debt expense. It estimates that 1.5% of net credit sales will become uncollectible Credit sales are $1.068,000 for the year ended April 30, 2021: sales discounts are $24,000 accounts receivable are $372,000; and the allowance for doubtful accounts has a credit balance of $7.200. Your answer is partially correct. Prepare the adjusting entry to record bad debt expense in 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Apr. 30 Bad Debt Expense 8.460 Allowance for Doubtful Accounts 8.460 (To record estimate of uncollectible accounts) ENG 19 PM x Your answer is incorrect Calculate the carrying amount of accounts receivable on April 30, 2021 Carrying amount $ 356,340 e Textbook and Media List of Accounts Attempts: 1 of 3 used Submit Answer savetor Lator M ENG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts