Question: this is the third time I'm submitting this question. Can you make sure your journal entries match the needed fields. Please answer in the correct

this is the third time I'm submitting this question. Can you make sure your journal entries match the needed fields. Please answer in the correct needed format Thanks!

this is the third time I'm submitting this question. Can you make sure your journal entries match the needed fields. Please answer in the correct needed format Thanks!

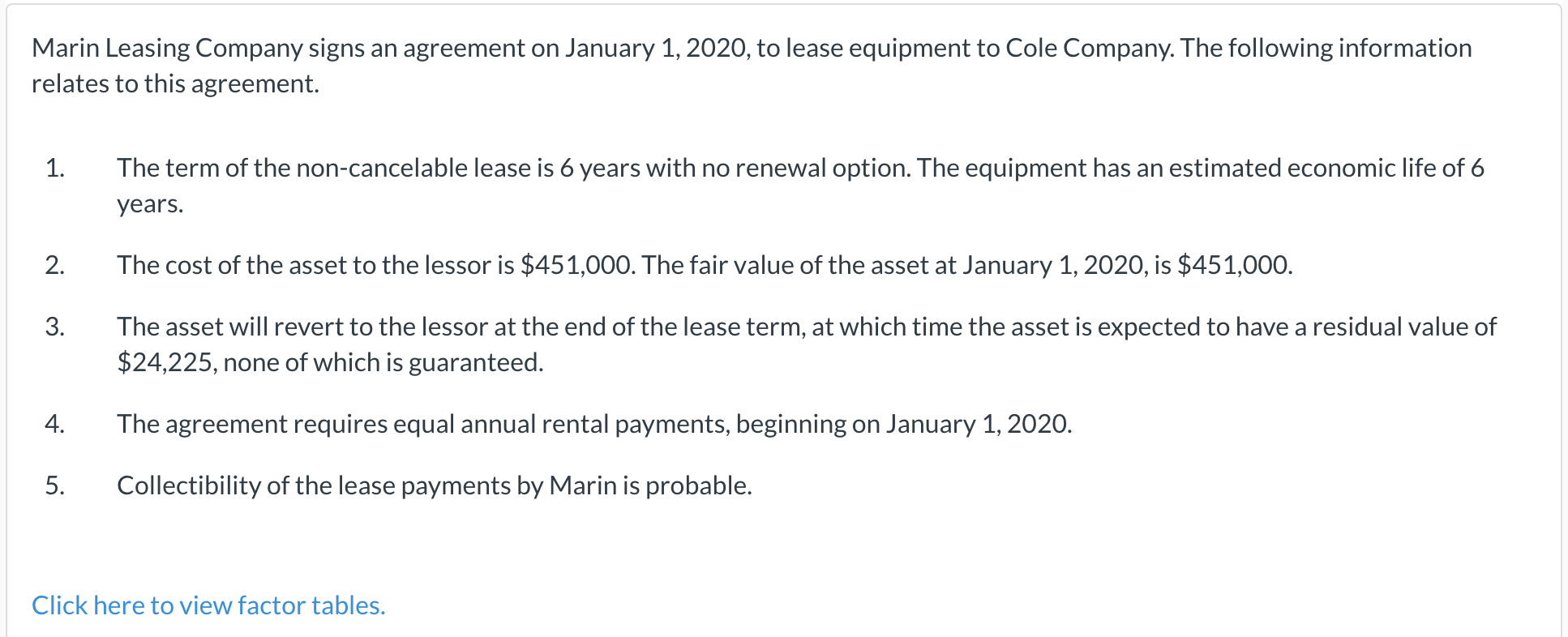

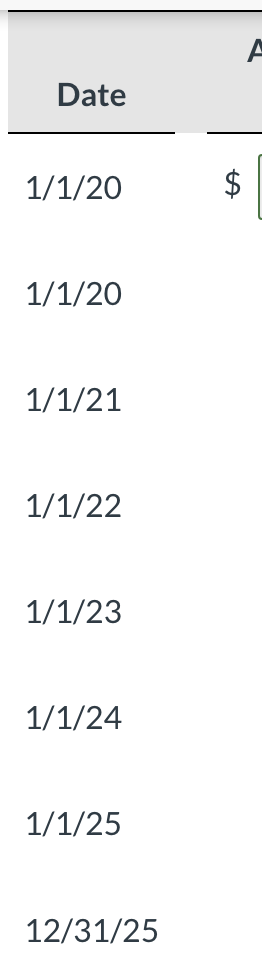

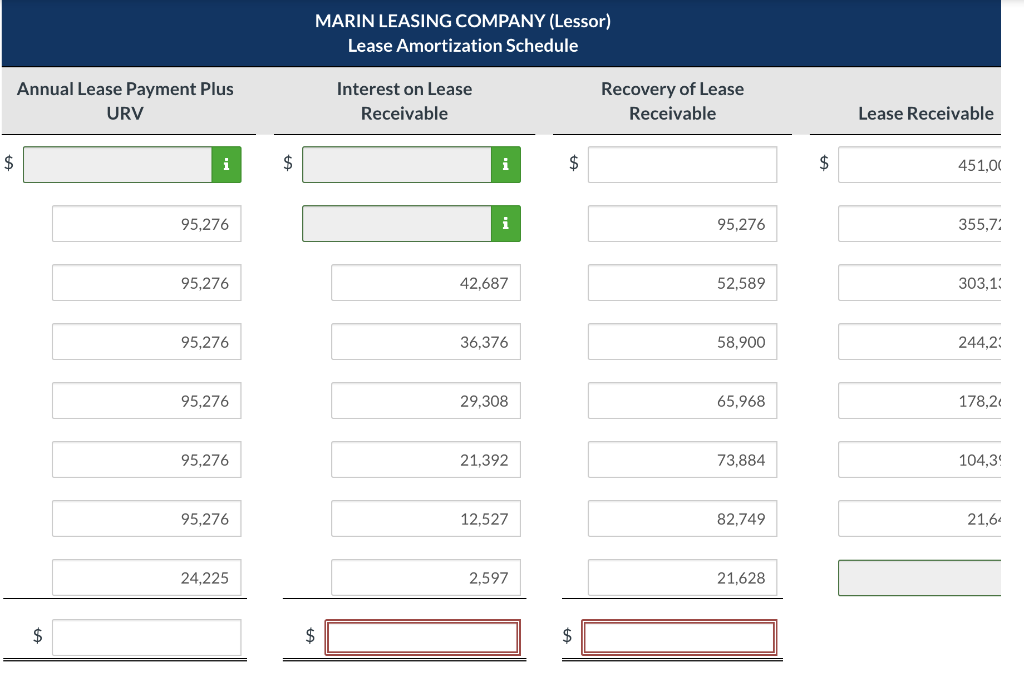

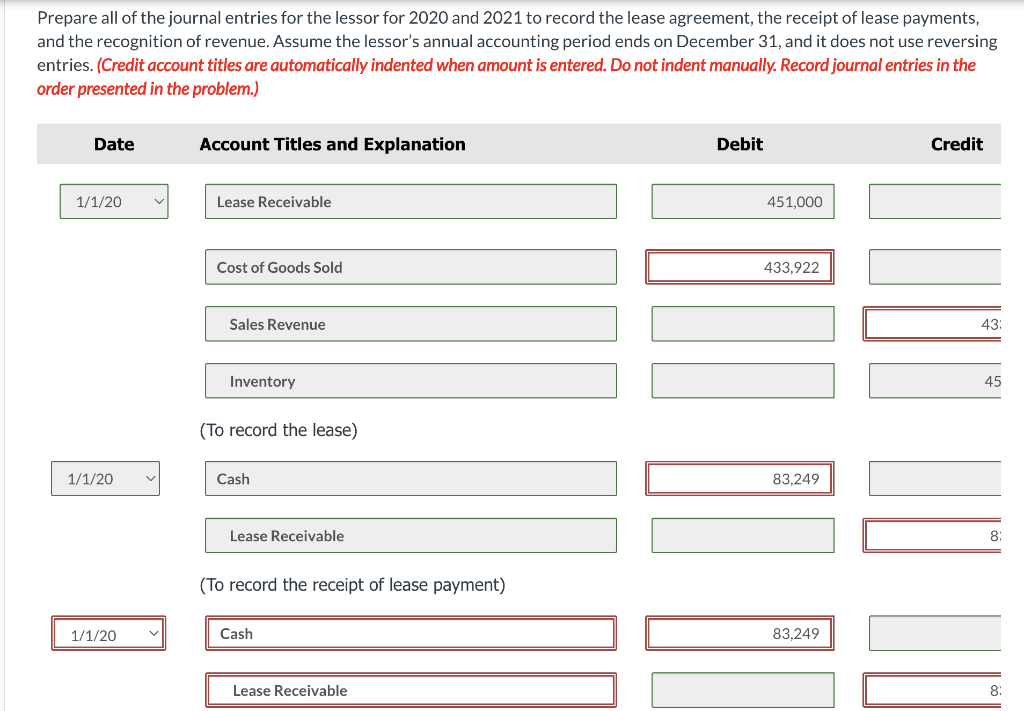

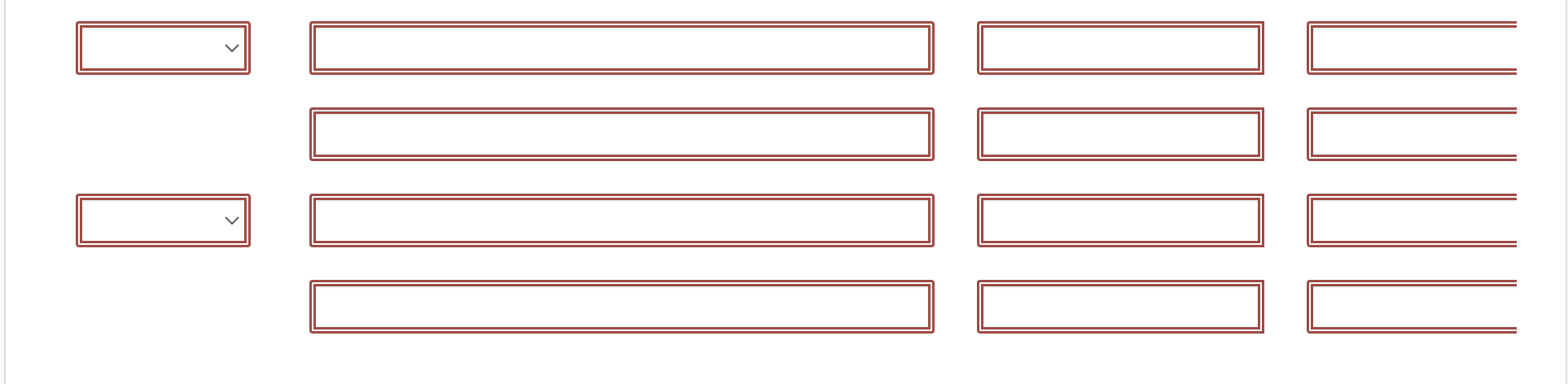

Marin Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company. The following information relates to this agreement. 1. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. 2. The cost of the asset to the lessor is $451,000. The fair value of the asset at January 1, 2020, is $451,000. 3. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $24,225, none of which is guaranteed. 4. The agreement requires equal annual rental payments, beginning on January 1, 2020. 5. Collectibility of the lease payments by Marin is probable. Click here to view factor tables. Your answer is incorrect. Assuming the lessor desires a 12% rate of return on its investment, calculate the amount of the annual rental payment required. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and the final answer to 0 decimal places e.g. 5,275.) Amount of the annual rental payment ta 95,276 e Textbook and Media List of Accounts A Date 1/1/20 1/1/20 1/1/21 1/1/22 1/1/23 1/1/24 1/1/25 12/31/25 MARIN LEASING COMPANY (Lessor) Lease Amortization Schedule Annual Lease Payment Plus URV Interest on Lease Receivable Recovery of Lease Receivable Lease Receivable $ i $ i $ $ LA 451,00 95,276 i 95,276 355,71 95,276 42,687 52,589 303,13 95,276 36,376 58,900 244,2 95,276 29,308 65,968 178,2 95,276 21,392 73,884 104,3 95,276 12,527 82,749 21,6 24,225 2,597 21,628 $ $ $ Prepare all of the journal entries for the lessor for 2020 and 2021 to record the lease agreement, the receipt of lease payments, and the recognition of revenue. Assume the lessor's annual accounting period ends on December 31, and it does not use reversing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit 1/1/20 Lease Receivable 451,000 Cost of Goods Sold 433.922 Sales Revenue 43: Inventory 45 (To record the lease) 1/1/20 Cash 83,249 Lease Receivable 8: (To record the receipt of lease payment) ALPE 1/1/20 Cash 83,249 Lease Receivable 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts