Question: this is the whole question i got Question 31 - Answer all parts Mitch Plc, a UK-based smart phone manufacturer, is considering adding a new

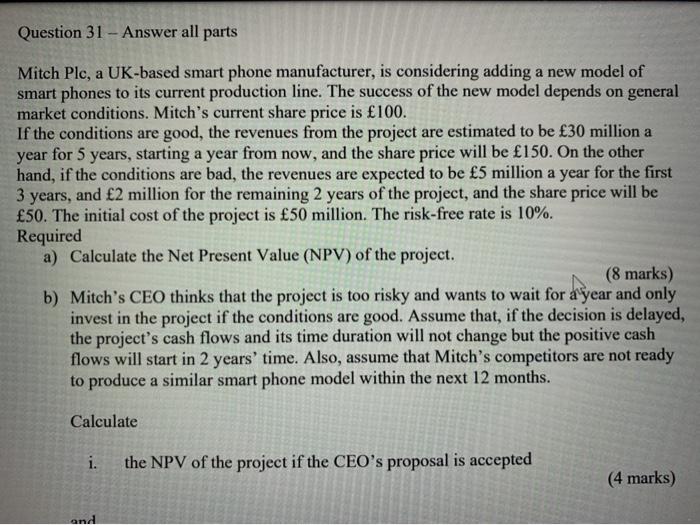

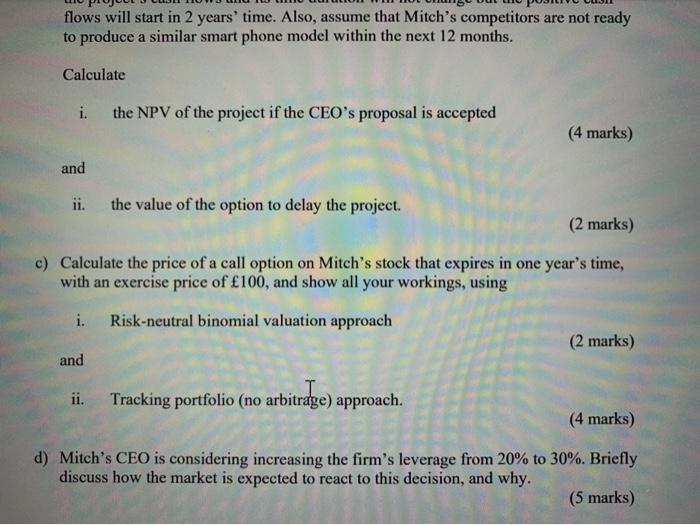

Question 31 - Answer all parts Mitch Plc, a UK-based smart phone manufacturer, is considering adding a new model of smart phones to its current production line. The success of the new model depends on general market conditions. Mitch's current share price is 100. If the conditions are good, the revenues from the project are estimated to be 30 million a year for 5 years, starting a year from now, and the share price will be 150. On the other hand, if the conditions are bad, the revenues are expected to be 5 million a year for the first 3 years, and 2 million for the remaining 2 years of the project, and the share price will be 50. The initial cost of the project is 50 million. The risk-free rate is 10%. Required a) Calculate the Net Present Value (NPV) of the project. (8 marks) b) Mitch's CEO thinks that the project is too risky and wants to wait for a year and only invest in the project if the conditions are good. Assume that, if the decision is delayed, the project's cash flows and its time duration will not change but the positive cash flows will start in 2 years' time. Also, assume that Mitch's competitors are not ready to produce a similar smart phone model within the next 12 months. Calculate i. the NPV of the project if the CEO's proposal is accepted (4 marks) and flows will start in 2 years' time. Also, assume that Mitch's competitors are not ready to produce a similar smart phone model within the next 12 months. Calculate i. the NPV of the project if the CEO's proposal is accepted (4 marks) and ii. the value of the option to delay the project. (2 marks) c) Calculate the price of a call option on Mitch's stock that expires in one year's time, with an exercise price of 100, and show all your workings, using i. Risk-neutral binomial valuation approach (2 marks) and ii. Tracking portfolio (no arbitrage) approach. . (4 marks) d) Mitch's CEO is considering increasing the firm's leverage from 20% to 30%. Briefly discuss how the market is expected to react to this decision, and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts