Question: This is using the 2018 tax tables. Fast help on this is greatly appreciated! Note: Use the Tax Tables to calculate the answers to the

This is using the 2018 tax tables. Fast help on this is greatly appreciated!

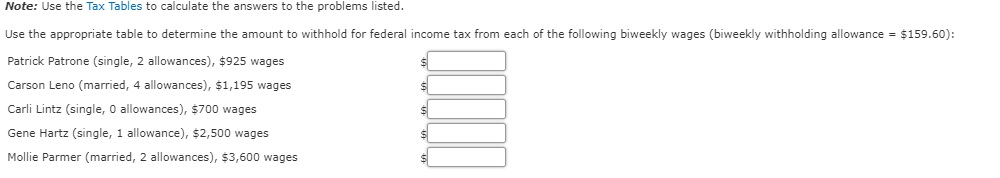

Note: Use the Tax Tables to calculate the answers to the problems listed. Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages (biweekly withholding allowance = $159.60): Patrick Patrone (single, 2 allowances), $925 wages Carson Leno (married, 4 allowances), $1,195 wages Carli Lintz (single, 0 allowances), $700 wages Gene Hartz (single, 1 allowance), $2,500 wages Mollie Parmer (married, 2 allowances), $3,600 wages Note: Use the Tax Tables to calculate the answers to the problems listed. Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages (biweekly withholding allowance = $159.60): Patrick Patrone (single, 2 allowances), $925 wages Carson Leno (married, 4 allowances), $1,195 wages Carli Lintz (single, 0 allowances), $700 wages Gene Hartz (single, 1 allowance), $2,500 wages Mollie Parmer (married, 2 allowances), $3,600 wages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts