Question: this is what I got, please help me with the right answer. 100 000 + 10 000=110000 20 000(1-0.35)= 13000 (110 000 - 20000)/5=18000 30000-200000.35

this is what I got, please help me with the right answer.

100 000 + 10 000=110000 20 000(1-0.35)= 13000

(110 000 - 20000)/5=18000 30000-200000.35 10000 x 0.35= 3500 after tax= 30000-3500

please help me and break it down.

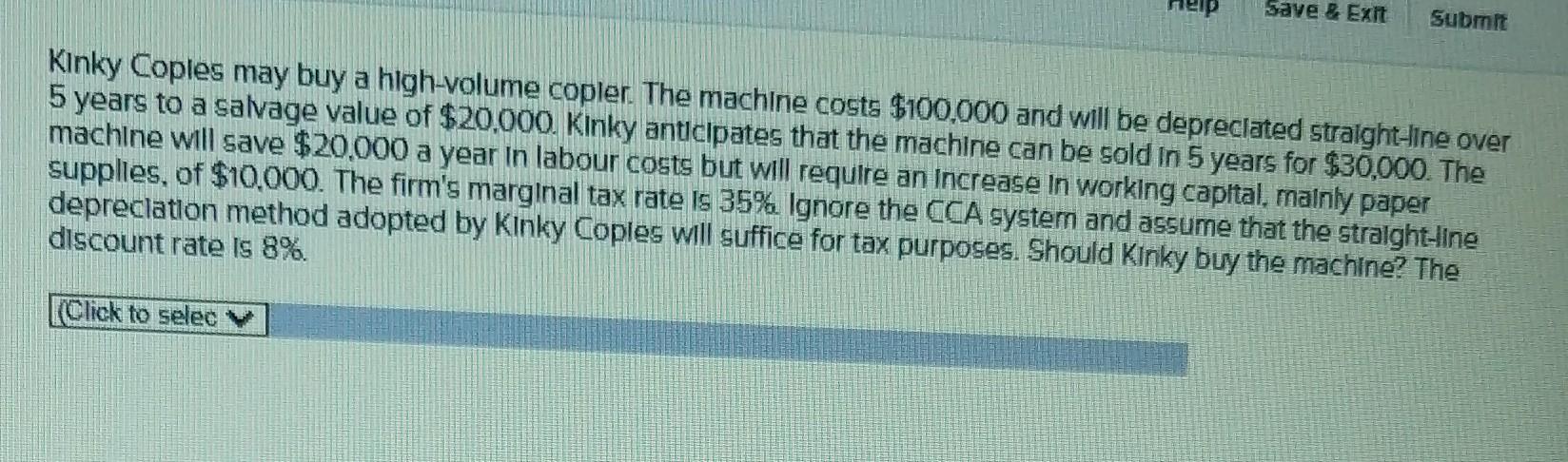

Kinky Coples may buy a high-volume copler. The machine costs $100,000 and will be depreclated straight-line over 5 years to a salvage value of $20,000. Kinky antlcipates that the machine can be sold in 5 years for $30,000. The machine will save $20.000 a year in labour costs but will require an increase in working capital, mainly paper supplies, of $10,000. The firm's marginal tax rate is 35% lgnore the CCA system and assume that the stralght-line depreclatlon method adopted by Kinky Coples will suffice for tax purposes. Should Kinky buy the machine? The discount rate is 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts