Question: this is what I have Power Solutions Ltd issues a $16,000,000, five year, 4.5% bond with semi-annual interest payments. Underwriting costs, paid up front, are

this is what I have

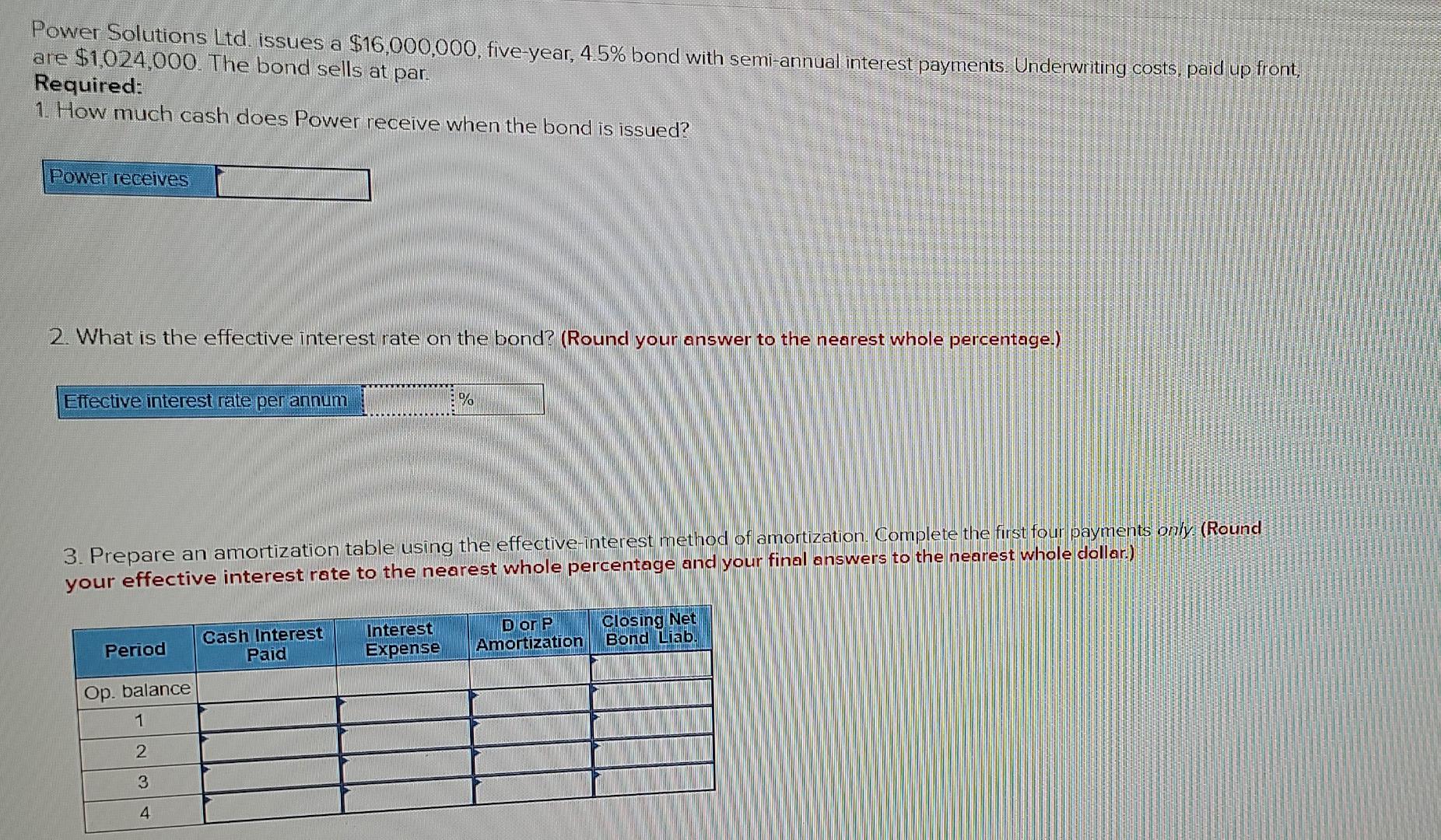

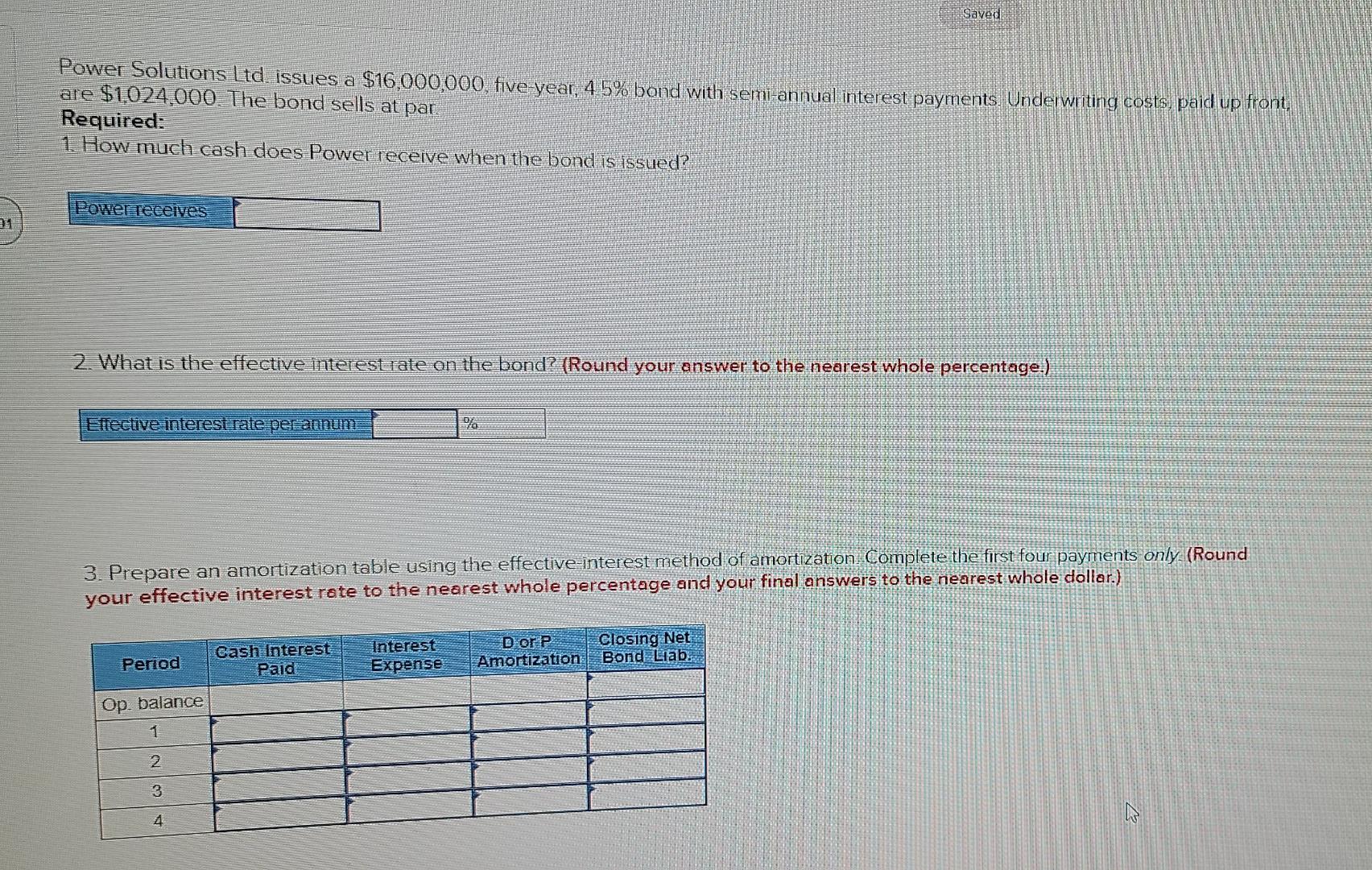

Power Solutions Ltd issues a $16,000,000, five year, 4.5% bond with semi-annual interest payments. Underwriting costs, paid up front, are $1024,000. The bond sells at par. Required: 1. How much cash does Power receive when the bond is issued? Power receives 2. What is the effective interest rate on the bond? (Round your answer to the nearest whole percentage.) Effective interest rate per annum % 3. Prepare an amortization table using the effective-interest method of amortization. Complete the first four payments only. (Round your effective interest rate to the nearest whole percentage and your final answers to the nearest whole dollar.) Interest Expense Cash Interest Paid Dor P Closing Net Amortization Bond Liab! Period Op. balance 1 2 3 4 Saved Power Solutions Ltd issues a $16,000,000, five year, 45% bond with semi-annual interest payments Underwriting costs, paid up front, are $1,024,000 The bond sells at par Required: 1. How much cash does Power receive when the bond is issued? Power receives 2. What is the effective interest rate on the bond? (Round your answer to the nearest whole percentage.) Eifective interest rate per annum 3. Prepare an amortization table using the effective interest method of amortization. Complete the first four payments only (Round your effective interest rate to the nearest whole percentage and your final answers to the nearest whole dollar.) Cash Interest Paid Interest Expense D or P Amortization Period Closing Net Bond Liab. Op. balance 1 2 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts