Question: this is wrong, please help 3 12.5/14.28 points awarded Scored Problem 3-9 External Funds Needed Dahlia Colby, CFO of Charming Florist Ltd., has created the

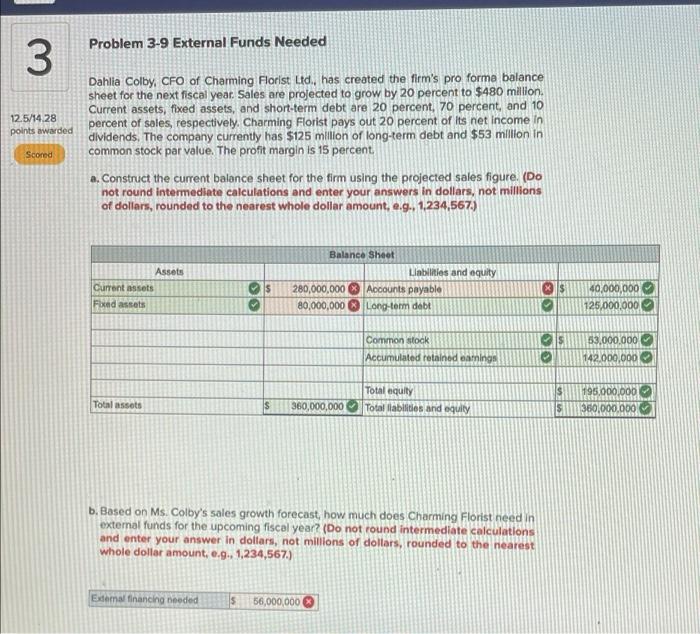

3 12.5/14.28 points awarded Scored Problem 3-9 External Funds Needed Dahlia Colby, CFO of Charming Florist Ltd., has created the firm's pro forma balance sheet for the next fiscal year. Sales are projected to grow by 20 percent to $480 million. Current assets, fixed assets, and short-term debt are 20 percent, 70 percent, and 10 percent of sales, respectively. Charming Florist pays out 20 percent of its net income in dividends. The company currently has $125 million of long-term debt and $53 million in common stock par value. The profit margin is 15 percent. a. Construct the current balance sheet for the firm using the projected sales figure. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e.g., 1,234,567.) Balance Sheet Assets Liabilities and equity S IS Accounts payable Current assets Fixed assets 280,000,000 80,000,000 Long-term debt Common stock Accumulated retained eamings Total equity Total assets $ 360,000,000 i Total liabilities and equity $ b. Based on Ms. Colby's sales growth forecast, how much does Charming Florist need in external funds for the upcoming fiscal year? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole dollar amount, e.g., 1,234,567.) External financing needed 56,000,000 40,000,000 125,000,000 53,000,000 142,000,000 195,000,000 1 360,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts