Question: This liability is due in 6 years (the basement date is 31st December 2022). Calculate the Macaulay duration of the portfolio based on the

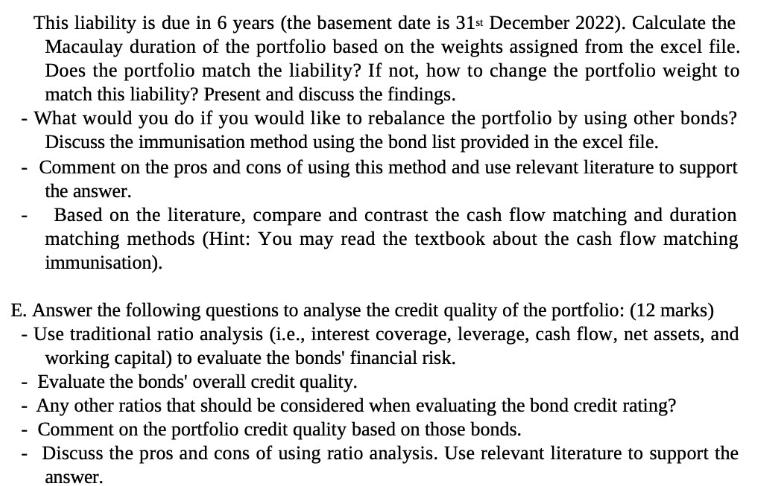

This liability is due in 6 years (the basement date is 31st December 2022). Calculate the Macaulay duration of the portfolio based on the weights assigned from the excel file. Does the portfolio match the liability? If not, how to change the portfolio weight to match this liability? Present and discuss the findings. - What would you do if you would like to rebalance the portfolio by using other bonds? Discuss the immunisation method using the bond list provided in the excel file. - Comment on the pros and cons of using this method and use relevant literature to support the answer. - Based on the literature, compare and contrast the cash flow matching and duration matching methods (Hint: You may read the textbook about the cash flow matching immunisation). E. Answer the following questions to analyse the credit quality of the portfolio: (12 marks) - Use traditional ratio analysis (i.e., interest coverage, leverage, cash flow, net assets, and working capital) to evaluate the bonds' financial risk. - Evaluate the bonds' overall credit quality. - Any other ratios that should be considered when evaluating the bond credit rating? - Comment on the portfolio credit quality based on those bonds. Discuss the pros and cons of using ratio analysis. Use relevant literature to support the answer.

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

To calculate the Macaulay duration of the portfolio we need the weights assigned from the provided Excel file ... View full answer

Get step-by-step solutions from verified subject matter experts