Question: This model is known as the currency arbitrage model. Please see the attached image for the details of the problem.I need help creating a linear

This model is known as the currency arbitrage model. Please see the attached image for the details of the problem.I need help creating a linear programming model that maximizes the dollar holdings of the company in the problem using Excel solver subject to the constraints listed.

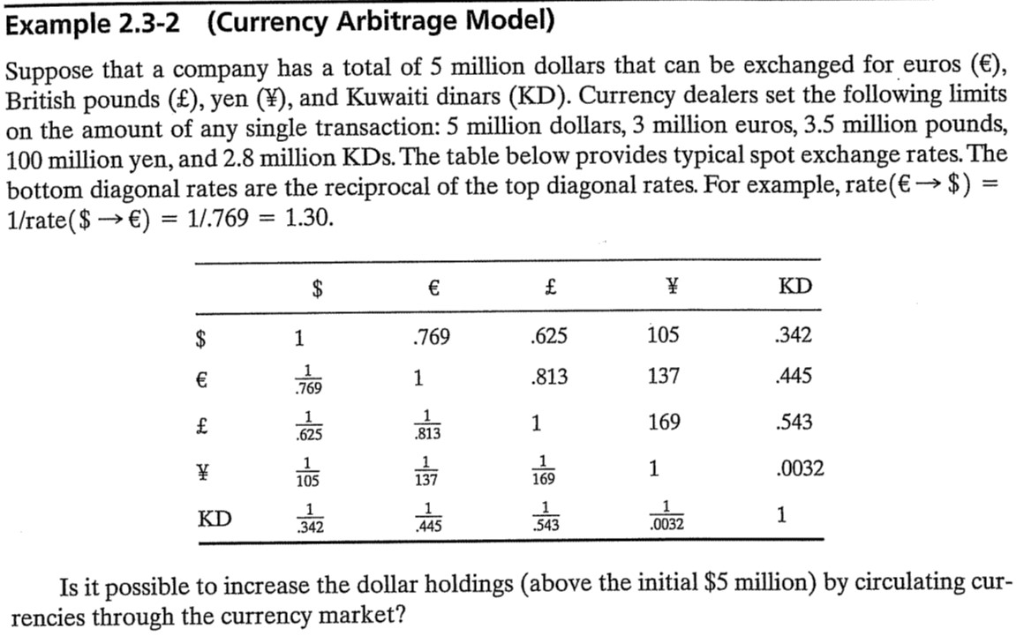

Example 2.3-2 (Currency Arbitrage Model) Suppose that a company has a total of 5 million dollars that can be exchanged for euros (e) British pounds (E), yen (), and Kuwaiti dinars (KD). Currency dealers set the following limits on the amount of any single transaction: 5 million dollars, 3 million euros, 3.5 million pounds, 100 million yen, and 2.8 million KDs. The table below provides typical spot exchange rates. The bottom diagonal rates are the reciprocal of the top diagonal rates. For example, rate(E-$) - 1/rate($- ) 1/.769 1.30. 105 137 169 KD 342 445 543 0032 769 625 769 .813 105 137 169 KD 543 0032 342 Is it possible to increase the dollar holdings (above the initial $5 million) by circulating cur- rencies through the currency market? Example 2.3-2 (Currency Arbitrage Model) Suppose that a company has a total of 5 million dollars that can be exchanged for euros (e) British pounds (E), yen (), and Kuwaiti dinars (KD). Currency dealers set the following limits on the amount of any single transaction: 5 million dollars, 3 million euros, 3.5 million pounds, 100 million yen, and 2.8 million KDs. The table below provides typical spot exchange rates. The bottom diagonal rates are the reciprocal of the top diagonal rates. For example, rate(E-$) - 1/rate($- ) 1/.769 1.30. 105 137 169 KD 342 445 543 0032 769 625 769 .813 105 137 169 KD 543 0032 342 Is it possible to increase the dollar holdings (above the initial $5 million) by circulating cur- rencies through the currency market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts