Question: This module is called taxation ,please write step by step Section C Estate Duty 28 Marks Study the scenario and complete the question that follows:

This module is called taxation ,please write step by step

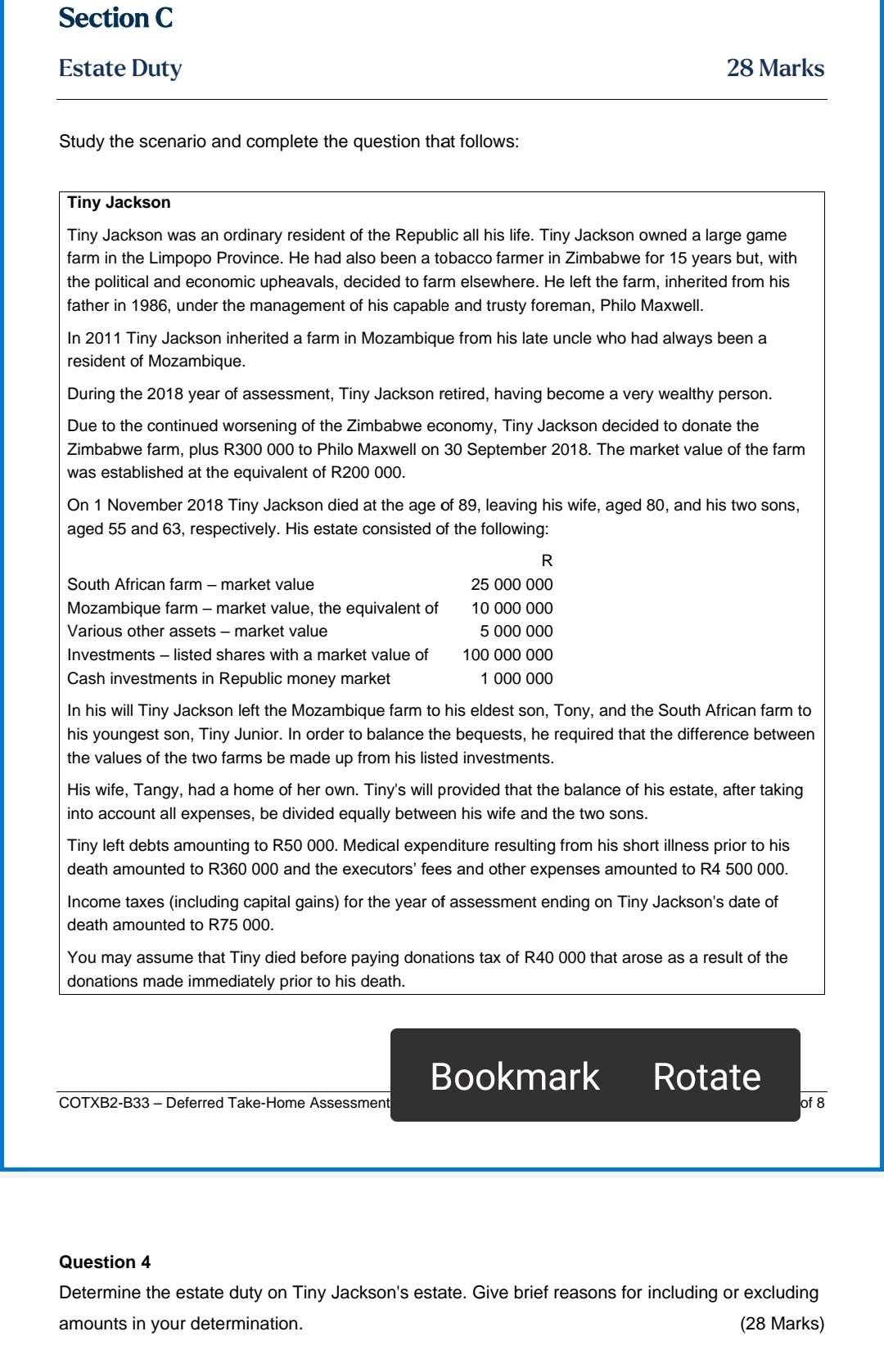

Section C Estate Duty 28 Marks Study the scenario and complete the question that follows: Tiny Jackson Tiny Jackson was an ordinary resident of the Republic all his life. Tiny Jackson owned a large game farm in the Limpopo Province. He had also been a tobacco farmer in Zimbabwe for 15 years but, with the political and economic upheavals, decided to farm elsewhere. He left the farm, inherited from his father in 1986, under the management of his capable and trusty foreman, Philo Maxwell. In 2011 Tiny Jackson inherited a farm in Mozambique from his late uncle who had always been a resident of Mozambique. During the 2018 year of assessment, Tiny Jackson retired, having become a very wealthy person. Due to the continued worsening of the Zimbabwe economy, Tiny Jackson decided to donate the Zimbabwe farm, plus R300 000 to Philo Maxwell on 30 September 2018. The market value of the farm was established at the equivalent of R200 000. On 1 November 2018 Tiny Jackson died at the age of 89, leaving his wife, aged 80, and his two sons, aged 55 and 63, respectively. His estate consisted of the following: R South African farm - market value 25 000 000 Mozambique farm - market value, the equivalent of 10 000 000 Various other assets - market value 5 000 000 Investments - listed shares with a market value of 100 000 000 Cash investments in Republic money market 1 000 000 In his will Tiny Jackson left the Mozambique farm to his eldest son, Tony, and the South African farm to his youngest son, Tiny Junior. In order to balance the bequests, he required that the difference between the values of the two farms be made up from his listed investments. His wife, Tangy, had a home of her own. Tiny's will provided that the balance of his estate, after taking into account all expenses, be divided equally between his wife and the two sons. Tiny left debts amounting to R50 000. Medical expenditure resulting from his short illness prior to his death amounted to R360 000 and the executors' fees and other expenses amounted to R4 500 000. Income taxes (including capital gains) for the year of assessment ending on Tiny Jackson's date of death amounted to R75 000. You may assume that Tiny died before paying donations tax of R40 000 that arose as a result of the donations made immediately prior to his death. Bookmark Rotate COTXB2-B33-Deferred Take-Home Assessment of 8 Question 4 Determine the estate duty on Tiny Jackson's estate. Give brief reasons for including or excluding amounts in your determination. (28 Marks) Section C Estate Duty 28 Marks Study the scenario and complete the question that follows: Tiny Jackson Tiny Jackson was an ordinary resident of the Republic all his life. Tiny Jackson owned a large game farm in the Limpopo Province. He had also been a tobacco farmer in Zimbabwe for 15 years but, with the political and economic upheavals, decided to farm elsewhere. He left the farm, inherited from his father in 1986, under the management of his capable and trusty foreman, Philo Maxwell. In 2011 Tiny Jackson inherited a farm in Mozambique from his late uncle who had always been a resident of Mozambique. During the 2018 year of assessment, Tiny Jackson retired, having become a very wealthy person. Due to the continued worsening of the Zimbabwe economy, Tiny Jackson decided to donate the Zimbabwe farm, plus R300 000 to Philo Maxwell on 30 September 2018. The market value of the farm was established at the equivalent of R200 000. On 1 November 2018 Tiny Jackson died at the age of 89, leaving his wife, aged 80, and his two sons, aged 55 and 63, respectively. His estate consisted of the following: R South African farm - market value 25 000 000 Mozambique farm - market value, the equivalent of 10 000 000 Various other assets - market value 5 000 000 Investments - listed shares with a market value of 100 000 000 Cash investments in Republic money market 1 000 000 In his will Tiny Jackson left the Mozambique farm to his eldest son, Tony, and the South African farm to his youngest son, Tiny Junior. In order to balance the bequests, he required that the difference between the values of the two farms be made up from his listed investments. His wife, Tangy, had a home of her own. Tiny's will provided that the balance of his estate, after taking into account all expenses, be divided equally between his wife and the two sons. Tiny left debts amounting to R50 000. Medical expenditure resulting from his short illness prior to his death amounted to R360 000 and the executors' fees and other expenses amounted to R4 500 000. Income taxes (including capital gains) for the year of assessment ending on Tiny Jackson's date of death amounted to R75 000. You may assume that Tiny died before paying donations tax of R40 000 that arose as a result of the donations made immediately prior to his death. Bookmark Rotate COTXB2-B33-Deferred Take-Home Assessment of 8 Question 4 Determine the estate duty on Tiny Jackson's estate. Give brief reasons for including or excluding amounts in your determination. (28 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts